European Coffee Company JDE Peet’s to IPO at $16 Billion Market Value

Hong Kong | 26th May 2020

European coffee company, JDE Peet’s is set to IPO with a market capitalization range of $16 billion to $17 billion on 3rd June 2020. The indicative IPO price range is EUR 30 – 32.25, representing a total market capitalization of around EUR 14.9 billion to EUR 16 billion ($16.36 billion to $17.25 billion). The exchange rate for EUR to USD is around 1.0950, 1 EUR is equal to $1.0950.

“ JDE Peet’s to IPO at $16 – $17 billion Market Value “

About JDE Peet’s

JDE Peet’s is the world’s largest pure-play coffee and tea company by revenue, serving 130 billion cups of coffee and tea in 2019. The European coffee maker has a portfolio of more than 50 brands including Jacobs, Peet’s Coffee and Tassimo in more than 100 countries. In 2019, the company generated revenue of EUR 6.9 billion and EBIT of EUR 1.6 billion.

JDE Peet’s major shareholders include Acorn Holdings (subsidiary of JAB Holding) and Mondelez International.

- Acorn Holdings owns brands including Dr Pepper, Snapple, Schweppes, 7UP, Tully’s Coffee and Van Houtte.

- JAB Holding is an investment group owning portfolio of brands including Pret A Manager, Krispy Kreme Doughnuts, beauty group COTY, luxury brand Bally and Jimmy Choo (exited in 2017).

- Mondelez International is one of the largest snack companies in the world and own brands including Oreo, Cadbury Dairy Milk, Toblerone Chocolate, Sour Patch Kids Candy and Trident Gum.

JDE Peet’s IPO

The IPO offer period will start on 26th May 2020 and will be closing on 2nd June 2020 (Tuesday), will be listed on Euronext Amsterdam on the 3rd June 2020 (Wednesday). With the IPO, the company will raise approximately EUR 2.25 billion (New issuance: EUR 700 million; Existing Shares of Acorn and Mondelez: EUR 1.55 billion).

Cornerstone investors include Quantum Partners, Palindrome Master Fund (a fund of Soros Fund Management), FMR and JAB holdings.

Casey Keller, Chief Executive Officer of JDE Peet’s:

“Today’s announcement is another important step in our journey towards an Initial Public Offering for JDE Peet’s on Euronext Amsterdam. Our storied heritage combined with our approach to innovation lie at the heart of our commitment to serving our customers. Thanks to the amazing work of our global teams, even during these unprecedented times, we look forward to the next phase of JDE Peet’s growth as a global leader in coffee and tea”.

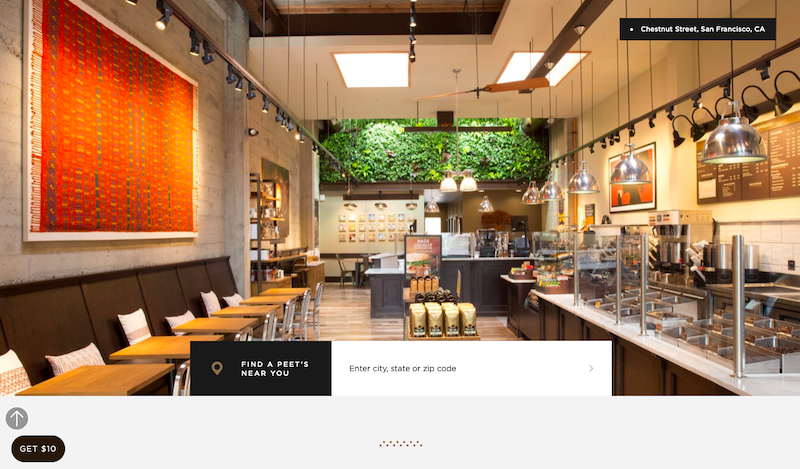

Peet’s Coffee

Modelez CEO: Snack Comeback

FT: How Mondelez Invested into Cadbury

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit