The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

Investment / Alternatives Summit - March / Oct / Nov

Investment Day - March / July / Sept / Oct / Nov

Private Wealth Summit - April / Oct / Nov

Family Office Summit - April / Oct / Nov

View Events | Register

This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $30 billion.

Citi Private Bank Hires Credit Suisse Lillian Liao as China Global Market Manager, Lead Private Bankers to Focus on China Entrepreneurs

3rd August 2021 | Singapore

Citi Private Bank, managing more than $550 billion of AUM and serving more than 13,000 UHNW clients & 25% of the world’s billionaires, has hired Credit Suisse Managing Director & Senior Client Partner for China Lillian Liao as Citi Private Bank China Global Market Manager, leading a team of Private Bankers to focus on China Entrepreneurs. Lillian Liao will grow Citi Private Bank’s offerings for Mainland Chinese entrepreneurs, supporting them in their investing, financing, strategic advisory, estate planning and banking needs. Based in Singapore, Lillian as Citi Private Bank China Global Market Manager will report to Rudolf Hitsch, who is Citi Private Bank North Asia Head and Lee Lung-Nien who is Citi Private Bank Chairman & South Asia Head. (AUM ~ Assets under Management)

“ Citi Private Bank Hires Credit Suisse Lillian Liao as China Global Market Manager “

Caproasia Access | Events | Summits | Register Events | The Financial Centre

The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

Basic Member: $5 Monthly | $60 Yearly

Newsletter Daily 2 pm (Promo): $20 Monthly | $180 Yearly (FP: $680)

Hong Kong | Singapore

March / July / Sept / Oct / Nov

Private Equity, Hedge Funds, Boutique Funds, Private Markets & more. Join 20+ CIOs & Senior investment team, with > 60% single family offices with $300 million AUM. Taking place in Hong Kong and in Singapore. Every March, July, Sept, Oct & Nov.

Visit | Register here

10th April & 16th Oct Hong Kong Ritz Carlton | 24th April & 6th Nov Singapore Amara Sanctuary Resort

Join 80 single family offices & family office professionals in Hong Kong & Singapore

Links: 2025 Family Office Summit | Register here

March / Oct / Nov in Hong Kong & Singapore

Join leading asset managers, hedge funds, boutique funds, private equity, venture capital & real estate firms in Hong Kong, Singapore & Asia-Pacific at the Investment / Alternatives Summit. Join as delegate, speaker, presenter, partner & sponsor.

Visit | Register here

April / Oct / Nov in Hong Kong & Singapore

Join CEOs, CIOs, Head of Private Banking, Head of Family Offices & Product Heads at The Private Wealth Summit. Join as delegate, speaker, presenter, partner & sponsor.

Visit | Register here

Lillian Liao Citi Private Bank China Global Market Manager

Lillian Liao joins Citi Private Bank as China Global Market Manager from Credit Suisse, where she held the role of Managing Director & Senior Client Partner for China. She has 20 years of experience including Credit Suisse, UBS, HSBC and Deutsche Bank.

Based in Singapore, Lillian will lead a team of Private Bankers to focus on Chinese entrepreneurs, supporting them in their investing, financing, strategic advisory, estate planning and banking needs. She will report to Rudolf Hitsch (Citi Private Bank North Asia Head) and Lee Lung-Nien (Citi Private Bank Chairman & South Asia Head).

Citi expects China’s economic growth that has nurtured many outstanding entrepreneurs who has successfully export their products, services and ideas globally, to continue to grow. Citi, being the most globally connected bank, offers a unique position to support the international growth of Chinese entrepreneurs’ companies and personal investments.

Private bankers typically manages $100 million to $300 million of assets, with the most senior and top private bankers managing assets of $300 million to $1 billion and top UHNW private bankers can manage book size of $500 million to $2 billion.

Rudolf Hitsch, Citi Private Bank North Asia Head:

“As we continue to expand our offering for entrepreneurs from China in Singapore, this required a strengthening of our local leadership.

Since starting our Offshore Mainland China team in 2010, our philosophy has been to focus on understanding clients’ needs and strive to become the bank most capable of assisting them meeting their goals outside of China. Thus, mutual trust develops and symbiotic relationships which are meaningful to both parties and are focused on the long term form.”

Lee Lung-Nien, Citi Private Bank Chairman & South Asia Head:

“Our China team’s success shows that our patient approach is appreciated by many large entrepreneurs and their families there.

We have what it takes to be a China entrepreneur’s main bank outside of China, and Lillian’s joining us sends a strong signal of this intent to better serve our clients and grow this business.”

Citi:

- Citi Global Wealth APAC Gained $15 Billion Net Asset in 2021 1H, To Hire 1100 Private Bankers & Relationship Managers by 2025

- Citi Appoints Chan San-San as Head of Private Bank HNW APAC, Kelvin Goh as Head of FI Group for Investment Banking

- Citi Private Bank Appoints Seamus Yin as Global Market Manager China South & West, 10 Years with China Top Entrepreneurs

- HSBC, Citi and Standard Chartered to Add 6,600 Wealth & Private Banking Jobs in Asia

- Citi Appoints Ida Liu as New Global Head of Private Banking, Exit 13 Markets

- Citi Creates Citi Global Wealth to Manage all Global Wealth Units, Including Citi Private Bank

- Citi Gained $20 Billion Net Inflow into APAC Wealth Management Business

- Citi Private Bank Forms Citi Private Capital Group to Provide Institutional Service to Family Offices, Private Funds and Private Companies

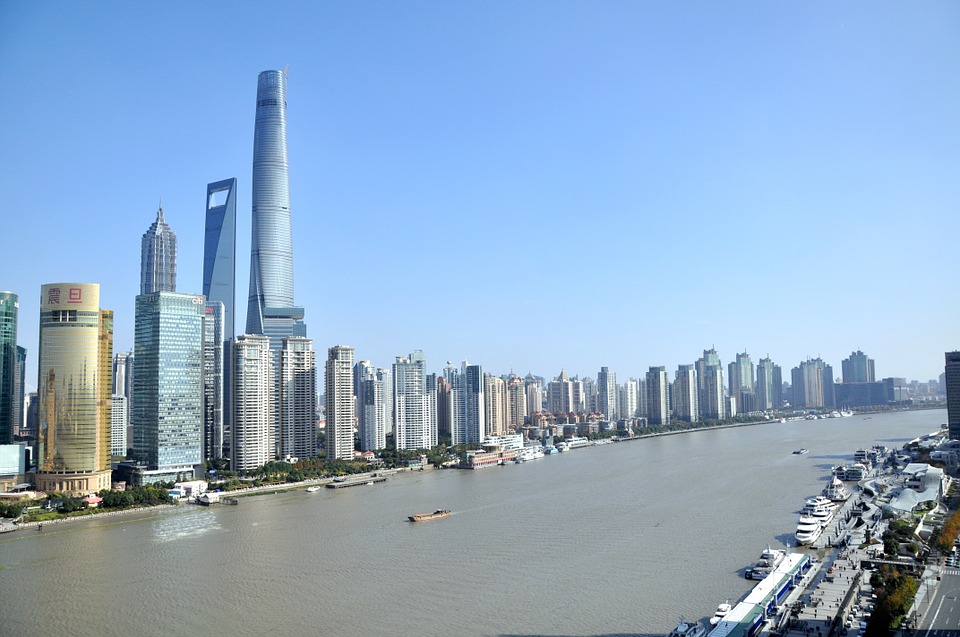

China, $14.3 trillion Economy

China is the fastest growing economy in the world and home to the fastest growing companies, billionaires, UHNWs & HNWs. China is the 2nd largest economy in the world with GDP of $14.3 trillion in 2020, representing 16.34% of global GDP ($87.7 trillion). China also has the largest population in the world with 1.39 billion, representing 18.21% of global population (7.67 billion).

China also have 3 of the world’s largest stock exchange – Shanghai Stock Exchange, Hong Kong Exchange and Shenzhen Stock Exchange. In the 2021 Global Financial Centres Index 29 Report, 4 of China’s cities are in the top 10 ranking – Shanghai, Hong Kong, Beijing, Shenzhen.

Citi Private Bank, Citi Global Wealth

Over the last 1 year, Citi has been making numerous key changes. In March 2021, Citi appointed Jane Fraser as the new CEO and in January 2021, created a single business unit – Citi Global Wealth, to manage all global wealth units, including Citi Private Bank. In June 2020, Citi had also created Citi Private Capital Group to provide institutional service to private investment companies and family offices.

- March 2021 – Appointment of new CEO Jane Fraser

- January 2021 – Citi Global Wealth, merging Citi Private Bank

- June 2020 – Created Citi Private Capital Group

In April 2021, Citi appointed Ida Liu as the new Global Head of Private Banking (Citi Private Bank), with Steven Lo and Fabio Fontainha as the new co-Heads of Citi Global Wealth in Asia-Pacific.

Citi also announced plans to exit 13 markets for Citi’s consumer businesses across Asia, Europe, Middle East and Africa (EMEA) and to focus on 4 key main hubs – London, UAE, Hong Kong and Singapore.

Citi Private Bank

Citi’s Private Bank serves the world’s wealthiest individuals, families and law firms. Citi Private Bank has around $550 billion AUM (Assets under Management), serving more than 13,000 UHNW clients, including 25% of the world’s billionaires and more than 1,400 family offices across 50 cities in over 100 countries.

Citi Private Bank focuses on clients who have an average net worth above $100 million, with clients gaining access to a highly customized experience and a comprehensive range of products and services including investments, banking, lending, custody, wealth planning, real estate, art, aircraft finance and lending, personalized advice, competitive pricing and efficient execution.

Citigold, Citigold Private Client and Citi Priority

Citi Global Consumer Bank, with Citigold, Citigold Private Client and Citi Priority, provides institutional grade, personalized wealth management services to clients, which includes dedicated Wealth teams, fund access and a range of exclusive privileges, preferred pricing and benefits to clients around the globe.

Citi’s Global Consumer Bank has approximately $200 billion in AUM (Assets under Management) globally and serves clients in the United States, Europe, the Middle East, Asia and Mexico.

In Asia-Pacific: Citi CEO APAC Peter Babej

In 2019, Citi appointed Peter Babej, who was Citi’s Global Head of Financial Institution Group, as CEO of Citi Asia-Pacific. In 2019, Citi’s APAC business contributed around 20% of revenue and nearly 1/3 of Citi’s net income.

Citi’s wealth management senior leadership team in Asia-Pacific includes Fabio Fontainha who is the Head of Retail Banking for Asia-Pacific and Europe, Middle East and Africa (EMEA), Steven Lo who is the Regional Head of Citi Private Bank APAC, Lee Lung Nien who is the Chairman of South Asia Citi Private Bank and Chan San San who is Citi Private Bank High Net Worth Head of Asia-Pacific.

Citi APAC Wealth Management Leadership Team

- Peter Babej, CEO of Citi Asia-Pacific

- Fabio Fontainha, Head of Retail Banking for APAC and EMEA

- Steven Lo, Regional Head of Citi Private Bank APAC

- Lee Lung Nien, Chairman of South Asia Citi Private Bank

- Chan San San, Citi Private Bank High Net Worth Head Asia-Pacific

Citi:

- Citi Global Wealth APAC Gained $15 Billion Net Asset in 2021 1H, To Hire 1100 Private Bankers & Relationship Managers by 2025

- Citi Appoints Chan San-San as Head of Private Bank HNW APAC, Kelvin Goh as Head of FI Group for Investment Banking

- Citi Private Bank Appoints Seamus Yin as Global Market Manager China South & West, 10 Years with China Top Entrepreneurs

- HSBC, Citi and Standard Chartered to Add 6,600 Wealth & Private Banking Jobs in Asia

- Citi Appoints Ida Liu as New Global Head of Private Banking, Exit 13 Markets

- Citi Creates Citi Global Wealth to Manage all Global Wealth Units, Including Citi Private Bank

- Citi Gained $20 Billion Net Inflow into APAC Wealth Management Business

- Citi Private Bank Forms Citi Private Capital Group to Provide Institutional Service to Family Offices, Private Funds and Private Companies

List of Private Banks:

- 2020 List of International Private Banks in Hong Kong

- 2020 List of Boutique Private Banks in Hong Kong

- 2020 List of International Private Banks in Singapore

- 2020 List of Boutique Private Banks in Singapore

Related:

- 2020 Top 10 Largest Family Office in the World

- 2020 Top 10 Largest Multi-Family Offices in the World

- Top Research Reports in 2020

- Top Global Wealth Reports in 2020

- Top Family Office Reports in 2020

Citigroup

Founded in 1812, Citigroup is one of the world’s largest bank with more than 200 million customer accounts and around 200,000 employees in more than 160 countries and jurisdictions. It is listed on the New York Stock Exchange (NYSE) and has a market capitalization of $124.2 billion (15/12/20). In 2019, Citigroup reported total revenue of $74.2 billion and net profit of $19.4 billion.

For Investment Managers, Hedge Funds, Boutique Funds, Private Equity, Venture Capital, Professional Investors, Family Offices, Private Bankers & Advisors, sign up today. Subscribe to Caproasia and receive the latest news, data, insights & reports, events & programs daily at 2 pm.

Join Events & Find Services

Join Investments, Private Wealth, Family Office events in Hong Kong, Singapore, Asia-wide. Find hard-to-find $3 million to $300 million financial & investment services at The Financial Centre | TFC. Find financial, investment, private wealth, family office, real estate, luxury investments, citizenship, law firms & more. List hard-to-find financial & private wealth services.

Have a product launch? Promote a product or service? List your service at The Financial Centre | TFC. Join interviews & editorial and be featured on Caproasia.com or join Investments, Private Wealth, Family Office events. Contact us at angel@caproasia.com or mail@caproasia.com

Caproasia.com | The leading source of data, research, information & resource for financial professionals, investment managers, professional investors, family offices & advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets?

The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

2020 List of Private Banks in Hong Kong

2020 List of Private Banks in Singapore

2020 Top 10 Largest Family Office

2020 Top 10 Largest Multi-Family Offices

2020 Report: Hong Kong Private Banks & Asset Mgmt - $4.49 Trillion

2020 Report: Singapore Asset Mgmt - $3.48 Trillion AUM

For Investors | Professionals | Executives

Latest data, reports, insights, news, events & programs

Everyday at 2 pm

Direct to your inbox

Save 2 to 8 hours per week. Organised for success

Register Below

Get Ahead in 60 Seconds. Join 10,000 +

Save 2 to 8 hours weekly. Organised for Success.

Sign Up / Register

Please click on desktop.

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit

Contact Us

For Enquiries, Membershipmail@caproasia.com, angel@caproasia.com

For Listing, Subscription

mail@caproasia.com, claire@caproasia.com

For Press Release, send to:

press@caproasia.com

For Events & Webinars

events@caproasia.com

For Media Kit, Advertising, Sponsorships, Partnerships

angel@caproasia.com

For Research, Data, Surveys, Reports

research@caproasia.com

For General Enquiries

mail@caproasia.com

a financial information technology co.

since 2014