HSBC Private Bank Launches Secured Chat for Clients with Private Bankers on WhatsApp & WeChat

3rd September 2021 | Hong Kong

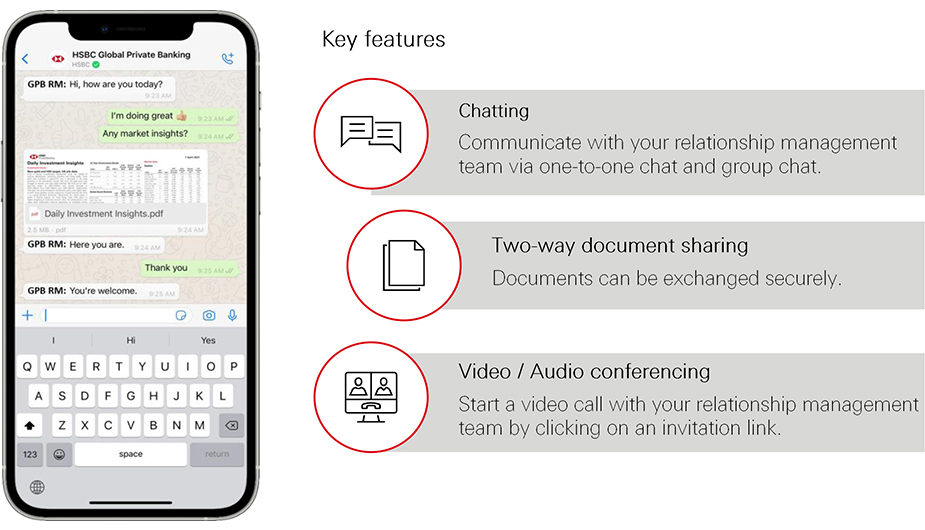

HSBC Private Bank has launched the HSBC GPB Chat, allowing secured chat between private bankers and investment counsellors through messaging platforms including WhatsApp and WeChat. The HSBC GPB Chat enables clients to communicate with their relationship management team via 1-to-1 chat, group chat, 2-way document sharing and video / audio conferencing. Over the next 2 years, HSBC Private Banking will be investing $100 million to build and innovate core banking and digital platforms to meet the fast-changing wealth and lifestyle needs of HSBC Private Banking clients. Earlier in June 2021, HSBC Private Bank had launched an online trading platform, providing trading access from their mobile phone to equities and ETFs in 10 major financial markets with 20 hours support, a high $2 million limit per trade and $10 million trading limit per day.

“ HSBC Private Bank Launches Secured Chat for Clients with Private Bankers on WhatsApp & WeChat “

HSBC Private Bank GPB Chat

The HSBC GPB Chat, allows secured chat between private bankers and investment counsellors through messaging platforms including WhatsApp and WeChat. The HSBC GPB Chat enables clients to communicate with their relationship management team via 1-to-1 chat, group chat, 2-way document sharing and video / audio conferencing.

HSBC Private Bank Launches Online Trading Platform

In June 2021, HSBC Private Bank had launched an online trading platform for all HSBC Private Banking clients booking their assets in Asia, providing trading access from their mobile phone to equities and ETFs in 10 major financial markets with 20 hours support, a high $2 million limit per trade and $10 million trading limit per day. The 10 major financial markets are Hong Kong, mainland China, Singapore, Japan, the Philippines, Australia, the UK, the US, Germany and France.

Siew Meng Tan, Regional Head of HSBC Private Banking Asia-Pacific:

“Client relationships in the wealth management world are traditionally anchored around face to face interactions. While this remains a key part of the overall client experience, clients now see the benefit of innovation in enhancing the wealth management relationship, and would like to have more flexibility in the way they interact with the Bank. This changing need is even more prominent as the world moves into the new normal.

With clients’ needs at the core of what we do, HSBC Private Banking has been investing considerably in our product, distribution and digital capabilities in the last two years to provide our clients with a significantly improved experience. The launch of the HSBC GPB Chat is another step we have taken to improve the client journey as clients’ needs evolve. It also further strengthens our position in the market as we continue to grow our portfolio of digital solutions.”

HSBC:

- HSBC Private Bank Asia AUM Reaches $193 Billion, HSBC Asia AUM at $810 Billion

- HSBC Reports Profit of $8.4 Billion in 2021 1H, Global Wealth AUM at $1.7 Trillion and Asia at $810 Billion

- HSBC Hires UBS Stefan Lecher as Regional Head of Investments & Wealth Solutions APAC

- HSBC Private Bank Appoints Jackie Mau as Head of Global Private Banking for China, Target 5 Million HNWIs in China

- HSBC Private Bank Launches Online Trading Platform to 10 Markets, 20 Hours Support, $2 Million Per Trade and $10 Million Daily

- HSBC Private Bank Expands in Asia, Appoints Chris Harwood as New Market Head of ASEAN and Australia

- HSBC Appoints David Liao & Surendra Rosha as New APAC Co-CEOs, Peter Wong Retires

- HSBC & Nielsen Survey: 82% of China GBA Mainland Investors to Invest in Wealth Management Connect

- HSBC Wealth Business Grows in Asia to $800 Billion, Hires 1000 in 2021

- HSBC Private Bank Gives Family Office in Asia Access to Investment Bank and Private Deals

- HSBC, Citi and Standard Chartered to Add 6,600 Wealth & Private Banking Jobs in Asia

- HSBC Appoints Annabel Spring as Chief Executive of Global Private Banking

About HSBC

The Hongkong and Shanghai Banking Corporation Limited is the founding member of the HSBC Group. HSBC serves customers worldwide from offices in 64 countries and territories in its geographical regions: Europe, Asia, North America, Latin America, and Middle East and North Africa. With assets of $2.97 trillion (30/6/21), HSBC is one of the world’s largest banking and financial services organisations.

HSBC Private Banking

As part of the HSBC Group, one of the world’s largest banking and financial services organisations, HSBC Private Banking seeks to be the leading international private bank for business owners and their families. It provides clients with wealth, business and family succession solutions in the largest and fastest growing markets around the world. HSBC Private Banking is the marketing name for the private banking business conducted by the principal private banking subsidiaries of the HSBC Group.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- July 2024 - Hong Kong

- July 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Oct 2024 - Hong Kong

- Nov 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit