China Oil Giant CNOOC Rises 27% on Shanghai Exchange Day 1 Trading, Delisted from NYSE Due to US Sanctions

22nd April 2022 | Hong Kong

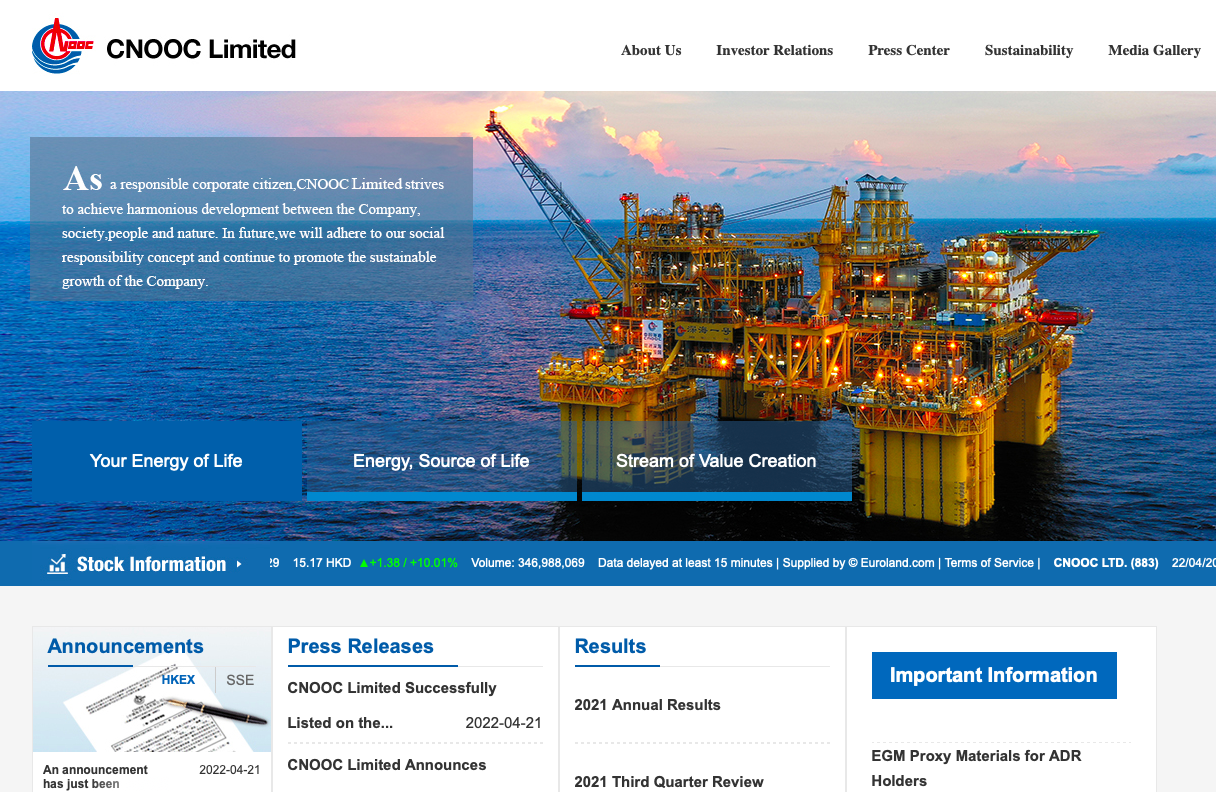

China oil giant CNOOC A-Share price increased 27% on Shanghai Stock Exchange (SSE) on day 1 of trading (21/4/22 Thursday), raising $4.4 billion (CNY 28.08 billion) in the issue after being forced to delist from New York Stock Exchange (NYSE) due to United States’ sanctions. CNOOC A-Share price had also increased to 44% on day 1 (21/4/22 Thursday) of trading, triggering a 30 minute trading halt. Chairman Wang Dongjin CNOOC: ”The A-share listing is an important milestone in the history of the Company. We will take this opportunity to make full use of domestic and overseas financing channels to promote the high-quality and sustainable development of the Company. In addition, we will continue to emphasize the returns to shareholders, actively share the fruits of the Company’s development with the shareholders, and strive to become an outstanding listed company with long-term investment value in the A-share market.”

” China Oil Giant CNOOC Rises 27% on Shanghai Exchange Day 1 Trading, Delisted from NYSE Due to US Sanctions “

CNOOC

CNOOC Limited was incorporated in Hong Kong in 1999 and was listed on The Stock Exchange of Hong Kong Limited in 2001. It is the largest producer of offshore crude oil and natural gas in China and one of the largest independent oil and gas exploration and production companies in the world. It mainly engages in the exploration, development, production and sale of crude oil and natural gas. The Company focuses on oil and gas exploration and development in offshore China and has become a major contributor of crude oil production growth in China. It has developed Bohai oilfields into the largest crude oil production base in China. The Company actively expands its overseas presence and holds interests in a number of world-class oil and gas projects, with assets in more than 20 countries and regions around the globe.

Since its listing in Hong Kong, CNOOC Limited has made a total of over 300 commercial discoveries and owns over 240 existing oil and gas fields. The Company’s net proven reserves reached 5.73 billion BOE by the end of 2021, and the reserve life remained above 10 years in the last three years. Along with the rapid growth in reserves, the Company’s net oil and gas production grew from 88 million BOE in 2000 to a record high of 573 million BOE in 2021. While focusing on business development and growth, the Company has maintained an excellent financial position. By adhering to strict cost control measures, the Company keeps a competitive cost advantage over its domestic and international peers. In 2021, the Company achieved a net profit of approximately RMB70.3 billion, a record high in its history.

In line with the trend of the global energy industry, CNOOC Limited is facilitating the transition to low carbon development. The Company puts great efforts into increasing the proportion of natural gas in its production mix, promoting the implementation of onshore power projects and strengthening the application of new technologies for energy-saving and carbon-reduction. In addition, leveraging on its strengths in the development of marine resources, the Company actively explores new energy business opportunities, promotes the large-scale and efficient development of offshore wind power projects, and accelerates the construction of offshore carbon dioxide storage demonstration projects.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit