Billionaire & $18 billion Hedge Fund Founder Bill Ackman Returns $4 Billion to SPAC Investors after Failing to Acquire Suitable Company

15th July 2022 | Hong Kong

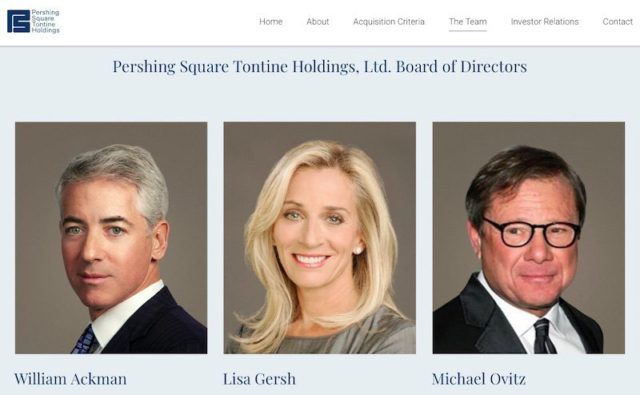

Billionaire & $18 billion hedge fund Pershing Square Capital Management founder Bill Ackman (United States) who had raised $4 billion via a SPAC listing (Pershing Square Tontine Holdings, Special Purpose Acquisition Company) in July 2020 (Hedge Fund Baupost Group, Pension Fund Ontario Teachers, T. Rowe Price), will be returning the $4 billion to investors after failing to find a suitable target company. CEO Bill Ackman: “Despite these unfavorable market conditions for PSTH, we were fortunate in quickly identifying and engaging with a highly attractive target, Universal Music Group, that met all of our investment criteria. The circumstances of UMG’s public listing and the requirements of the company’s controlling shareholder, Vivendi, made PSTH an ideal transaction partner, as our scale, structure, and sponsorship addressed our counterparties’ unique requirements. Unfortunately, Vivendi’s structural and legal requirements dictated a transaction structure that was somewhat unconventional for SPACs, and ultimately, one that could not be consummated given concerns raised by the SEC. As a result, the board terminated the transaction and assigned its obligation to acquire UMG to the Pershing Square Funds.” See full letter below. (In 2021, Bill Ackman Pershing Square fund generated 26.9% returns, 70.2% in 2020, 58.1% in 2019, -0.7% in 2018, -4% in 2017, -13.5% in 2016, -20.5% in 2015 and 40.4% in 2014.)

“ Billionaire & $18 billion Hedge Fund Founder Bill Ackman Returns $4 Billion to SPAC Investors after Failing to Acquire Suitable Company “

Pershing Square Tontine Holdings, Ltd. Releases Letter to Shareholders

CEO Bill Ackman today issued the following letter:

Dear Pershing Square Tontine Holdings, Ltd. Shareholder,

On July 22, 2020, Pershing Square Tontine Holdings, Ltd. completed a $4 billion IPO on the New York Stock Exchange. We designed PSTH to be the most investor and merger-friendly SPAC at a time when we believed the COVID-19 pandemic would continue to disrupt capital markets providing PSTH with an opportunity to merge with and take public a large capitalization private company that met our investment criteria for business quality, durable growth, and an attractive valuation.

Two years later, we are returning our $4 billion of capital in trust to shareholders as we have been unable to consummate a transaction that both meets our investment criteria and is executable. When we completed the IPO of PSTH, we expected our scale and efficient capital structure would create bespoke opportunities for high-quality, large capitalization companies seeking an efficient and highly certain path to go public. We launched PSTH in the depths of the pandemic because we believed that the capital markets would likely be impaired from the economic uncertainty created by the pandemic. The rapid recovery of the capital markets and our economy were good for America but unfortunate for PSTH, as it made the conventional IPO market a strong competitor and a preferred alternative for high-quality businesses seeking to go public.

Despite these unfavorable market conditions for PSTH, we were fortunate in quickly identifying and engaging with a highly attractive target, Universal Music Group, that met all of our investment criteria. The circumstances of UMG’s public listing and the requirements of the company’s controlling shareholder, Vivendi, made PSTH an ideal transaction partner, as our scale, structure, and sponsorship addressed our counterparties’ unique requirements.

Unfortunately, Vivendi’s structural and legal requirements dictated a transaction structure that was somewhat unconventional for SPACs, and ultimately, one that could not be consummated given concerns raised by the SEC. As a result, the board terminated the transaction and assigned its obligation to acquire UMG to the Pershing Square Funds. The Funds in turn assumed the UMG transaction costs and the related Vivendi indemnity obligations so that PSTH would be returned to its original position to enable it to immediately pursue a new transaction, albeit with one year remaining to do a deal. We thereafter immediately went back to work to find a replacement transaction.

We have been unsuccessful in consummating a deal over the last year largely due to the adverse market for SPAC merger transactions which has been driven by: (1) the extremely poor performance of SPACs that have completed deals during the last two years which has damaged market perceptions of going public by merging with a SPAC, (2) the high redemption rates of SPACs which has reduced the capital available for the newly merged company, increased the dilution from the shareholder warrants that remain outstanding, and heightened transaction uncertainty, and (3) risk and uncertainty created by the Investment Company Act litigation brought against PSTH, particularly when coupled with new SPAC rules proposed by the SEC on March 30, 2022.

High quality and profitable durable growth companies can generally postpone their timing to go public until market conditions are more favorable, which limited the universe of high-quality possible deals for PSTH, particularly during the last 12 months. While there were transactions that were potentially actionable for PSTH during the past year, none of them met our investment criteria.

With the SPAC and IPO market effectively shut today, now is a highly opportunistic investment environment for a public acquisition vehicle which does not suffer from the negative reputation of SPACs. With this in mind, as we have previously explained, we are working diligently to launch Pershing Square SPARC Holdings, Ltd., a privately funded acquisition vehicle which intends to issue publicly traded, long-term warrants called SPARs, which will offer SPAR owners the opportunity to acquire common stock in the newly merged company, the outcome of a business combination between SPARC and a private company. The SPARC structure has many favorable attributes compared with conventional SPACs that should increase the probability a transaction can be executed on favorable terms.

We intend to distribute SPARs to PSTH security holders who own either Class A Common Stock (ticker: PSTH) or warrants (ticker: PSTH.WS) as of the close of business on July 25, 2022 (the last date such instruments are redeemed or cancelled): 1⁄2 of a SPAR for each share of common stock and one SPAR for each warrant. The timing of the SPAR distribution will be determined by reference to the date SPARC’s registration statement becomes effective, which we would not expect to occur until Fall 2022.

SPARC filed a revised registration statement with the SEC on June 16th containing detailed information, risk factors, and other disclosures about SPARC which can be found at www.sec.gov. SPARC’s registration must become effective in order for SPARs to be issued, and there is no certainty that this will occur. You can be assured that we are working extremely diligently to achieve this important objective for all of PSTH’s shareholders and warrant holders.

We are disappointed that we did not achieve our initial objective of consummating a high-quality transaction for PSTH. We look forward to the opportunity to continue to work on your behalf once SPARC is successfully launched.

We are extremely grateful for your partnership and patience over the past two years.

Sincerely,

William A. Ackman

Chief Executive Officer

About Pershing Square Tontine Holdings, Ltd.

Pershing Square Tontine Holdings, Ltd., a Delaware corporation, is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with a private company. PSTH is sponsored by Pershing Square TH Sponsor, LLC (the “Sponsor”), an affiliate of Pershing Square Capital Management, L.P., a registered investment advisor. For additional information: www.PSTontine.com

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit