India Billionaire & Richest Man Gautam Adani is World’s 3rd Richest with $143 Billion Fortune, Overtakes France Bernard Arnault with $135 Billion

1st September 2022 | Hong Kong

India billionaire & richest man Gautam Adani is now the world’s 3rd richest with an estimated $145 billion fortune, overtaking France Bernard Arnault (LVMH) with $135 billion. Gautam Adani is the founder and the Chairman of the Adani Group which ranks among the top 3 industrial conglomerates in India (Adani Group is constituted of 7 publicly listed entities with combined market capitalization in excess of with businesses spanning across Energy, Ports & Logistics, Mining & Resources, Gas, Defence & Aerospace and Airports). The top 5 richest man in the world are: Elon Musk ($245 billion), Jeff Bezos ($150 billion), Gautam Adani ($143 billion), Bernard Arnault ($135 billion), and Bill Gates ($115 billion). The top 5 richest Asians are Gautam Adani ($143 billion), Mukesh Ambani ($94 billion), Zhong Shanshan ($70 billion), Zhang Yiming ($44 billion), Zeng Yuqun ($40 billion). Jack Ma ($32 billion) is ranked 7th in Asia (36th worldwide) and Pony Ma Huateng ($36 billion) is ranked 6th in Asia (31st worldwide). Hong Kong most iconic businessman Li Ka-Shing is ranked 41st in the world with $29 billion and Singapore richest Li Xiting is ranked 100th worldwide with $15 billion.

“ India Billionaire & Richest Man Gautam Adani is World’s 3rd Richest with $143 Billion Fortune, Overtakes France Bernard Arnault with $135 Billion “

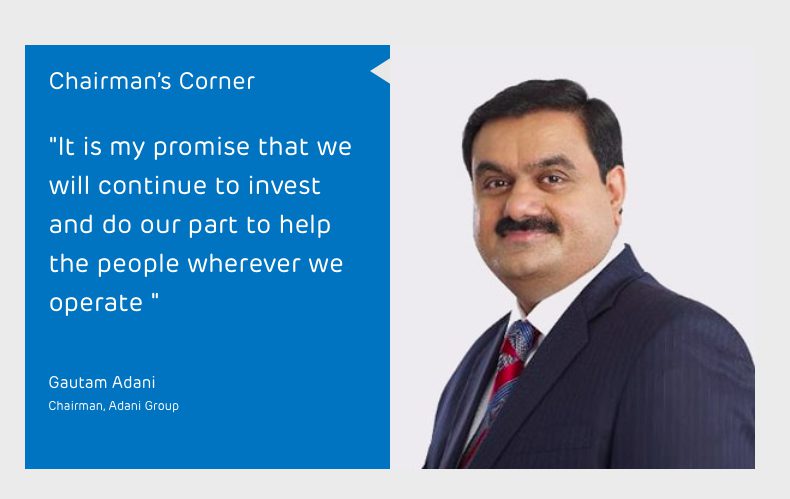

Gautam Adani, Chairman of Adani Group

Mr. Gautam Adani is the founder and the Chairman of the Adani Group which ranks among the top 3 industrial conglomerates in India. Mr. Adani, a first-generation entrepreneur, is driven by the core philosophy of infusing “Growth with Goodness” through his vision of nation-building. Each of the Group’s businesses are focused on helping build world-class infrastructure capabilities to help accelerate the growth for India. Adani Group is constituted of 7 publicly listed entities with combined market capitalization in excess of with businesses spanning across Energy, Ports & Logistics, Mining & Resources, Gas, Defence & Aerospace and Airports. In each of its business areas, the Group has established leadership position in India.

Nation-building, for Mr. Adani, means transforming the coastline of India by building a series of ports and logistics hubs, thus generating several tens of thousands of jobs. It means transforming the power scenario in India and mitigating the urban rural divide by delivering electricity to several hundreds of millions living in the hinterlands of India. It means enabling food security by building a modern agriculture supply chain empowering the farmers of our country. It means to fulfill India’s energy requirements and become one of the largest players in sustainable energy by making the largest commitment to the renewables ecosystem spanning across solar manufacturing, generation, and solar park businesses. It means playing an instrumental role in helping India become self-reliant in defence and security, and making India the hub for defence manufacturing. The Group has a strong track record of working with global leaders who want to participate in the India growth story; the global expertise of these international companies in their respective businesses, combined with the local execution and market capabilities of Adani Group has created enduring partnerships. The list of partners includes the likes of Wilmar Group, Total SA and Elbit Systems, among others.

Adani Foundation, the Group’s Corporate Social Responsibility arm is among his key interest areas. The Foundation’s pan-India initiatives across key sectors of education, healthcare, sustainable livelihoods and community infrastructure development touch more than 3.4 Million lives annually in 2315 villages across 18 Indian states.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit