Billionaire Couple & Founders Chairman Pan Shiyi & CEO Zhang Xin of China Property Group SOHO China to Step Down & Focus on Arts & Philanthropy

8th September 2022 | Hong Kong

Billionaire couple & founders of China property group SOHO China Chairman Pan Shiyi & CEO Zhang Xin have stepped down from their executive roles to focus on Arts & Philanthropy. SOHO China is founded in 1995 by Mr. Pan Shiyi and Ms. Zhang Xin, focusing on developing and holding high-profile branded commercial properties in Beijing and Shanghai. In 2007, SOHO China became listed on the Stock Exchange of Hong Kong (Stock Code: 410), raising proceeds of USD 1.9 billion. SOHO China currently has a market capitalization of around $1 billion (8/9/22). With founders Chairman Pan Shiyi & CEO Zhang Xin stepping down, SOHO China has appointed Huang Jingsheng (independent non-executive director) as non-executive chairman with immediate effective (8/9/22), with senior executives Xu Jin and Qian Ting becoming co-CEOs.

“ Billionaire Couple & Founders Chairman Pan Shiyi & CEO Zhang Xin of China Property Group SOHO China to Step Down & Focus on Arts & Philanthropy “

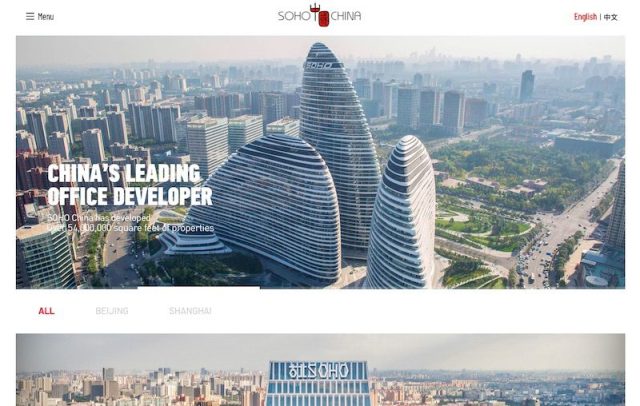

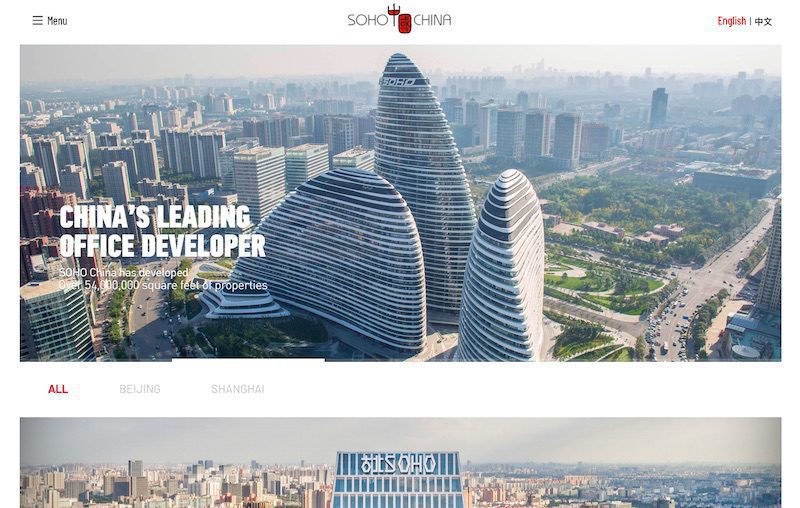

SOHO China

Founded in 1995 by Mr. Pan Shiyi and Ms. Zhang Xin, SOHO China focuses on developing and holding high-profile branded commercial properties in Beijing and Shanghai. The Company rolled out high-quality, innovative products in prime locations and translated the innovative designs into iconic real estate which possesses strong appeal to property investors and the local businesses and customer bases. SOHO China’s properties have already become landmark buildings in the city’s modern skyline. As the largest prime office developer in Beijing and Shanghai, SOHO China developed commercial property of 54 million square feet. On October 8, 2007, SOHO China was successfully listed on the Stock Exchange of Hong Kong (Stock Code: 410), raising proceeds of USD 1.9 billion. It has the distinction of being Asia’s largest commercial real estate IPO as of today. The Company was also named as one of the “Most Admired Companies” in China by FORTUNE (China edition) Magazine for six times since 2006.

Mr. Pan Shiyi

is an executive Director. Since the 1980s, SOHO China Chairman Pan Shiyi has been deeply engaged in the real estate industry and is recognized for his role in shaping China’s industry landscape. Pan’s entrepreneurial acumen and flair for marketing led to an innovative business model that quickly propelled SOHO China, the Company he co-founded with his wife Ms. Zhang Xin in 1995, to become one of the largest prime office developers in China. SOHO China developments, featuring the avant-garde architecture of internationally acclaimed architects have transformed the skylines of Beijing and Shanghai. In the eyes of many Chinese, Pan Shiyi’s life journey, from his humble rural beginning to his victorious entrepreneurial success, is a quintessential modern China rags to riches story. Pan has been an especially impactful online influencer and currently has over 18 million followers on Sina Weibo, the Chinese version of Twitter. Pan’s influence extends well beyond property development and urbanization. He is a close observer and regular commentator on environmental issues, and he was instrumental in raising public awareness for PM 2.5 pollution in China via his social media profile. In 2015, Mr. Pan and Ms. Zhang joined the Breakthrough Energy Coalition led by Mr. Bill Gates to fund development of clean energy technology. Owing his business success to China’s economic reform and opening, Pan is strongly committed to giving back to the society through philanthropy. In 2005, he and Ms. Zhang set up the SOHO China Foundation to support underprivileged families through various education initiatives. In 2014, the Foundation launched the SOHO China Scholarships, a fund providing financial aid for Chinese students at leading international universities. Gift agreements have been signed with Harvard University, Yale University and University of Chicago. Mr. Pan has served as visiting fellow at the Harvard Kennedy School, and also is a member of the Special Olympics Senior Advisors Committee for the East Asia region.

Executive Director Mrs. Pan Zhang Xin Marita

is an executive Director of the Company. Ms. Zhang Xin is one of China’s most celebrated women entrepreneurs. Since co-founding SOHO China in 1995, she has led the company to become one of country’s largest developers of prime office property with 54 million square feet of projects in Beijing and Shanghai. Acclaimed as the“ woman who built Beijing”, Xin is renowned for her daring and iconic collaborations with international architects that have transformed Chinese skylines. Born in Beijing in 1965, Xin moved to Hong Kong at age 14, where she labored as a factory girl for five years. At 19, Xin ventured to the UK where she earned a Bachelor’s degree in Economics from the University of Sussex and a Master’s degree in Development Economics from Cambridge University. Education served as a springboard to launch a career in investment banking with Goldman Sachs and Travelers Group. Xin’s rags-to-riches story embodies the rise of China’s entrepreneurship, making her a celebrity CEO at home and a sought after Chinese voice on the international stage. Active on Weibo, China’s“ twitter”, Xin frequently shares her views on business, entrepreneurship and fitness with over 10 million followers. In 2002, she was awarded a special prize at the 8th la Biennale di Venezia for Commune by the Great Wall, a private collection of architecture featuring the works of 12 Asian architects. Xin serves as Trustee of MoMA, and a Trustee of the Asia Business Council. She is also a Member of World Economic Forum, Davos, and Member of the Harvard Global Advisory Council. Xin holds an honorary Doctor of Laws from the University of Sussex and has served as visiting fellow at the Harvard Kennedy School. Recognized for their commitment to sustainability, Xin and Pan Shiyi are members of the Breakthrough Energy Coalition spearheaded by Bill Gates to fund technology developments that will enable a zero-emissions energy future. In 2005, Xin and her husband Pan Shiyi established the SOHO China Foundation and launched the SOHO China Scholarships, a initiative providing financial aid to Chinese students at leading international universities in 2014. Gift agreements totaling USD 35 million have been signed with Harvard University, Yale University, and the University of Chicago.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit