AIMA Hong Kong Alternatives Report 2022: 44 Billion Dollar Hedge Funds, 431 Hedge Funds, 606 Private Equity & Venture Capital, 58% of APAC Billionaires in China & Hong Kong

10th September 2022 | Hong Kong

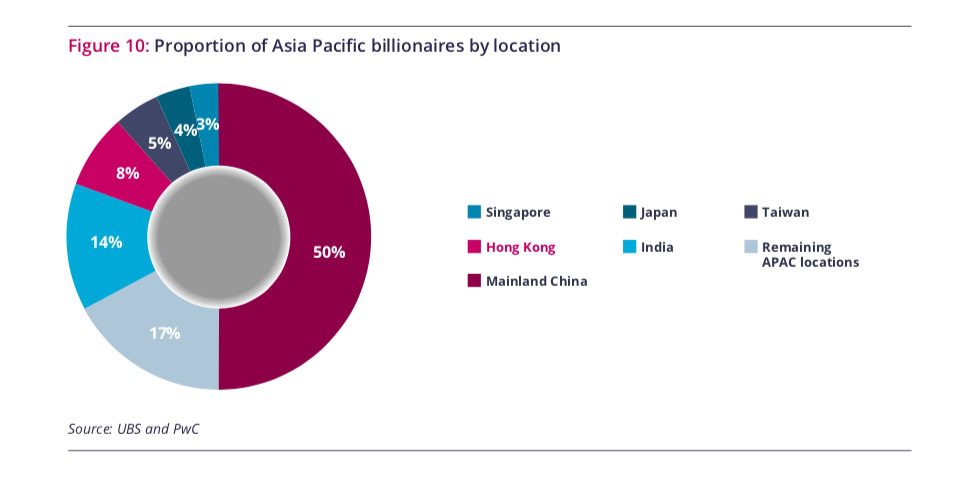

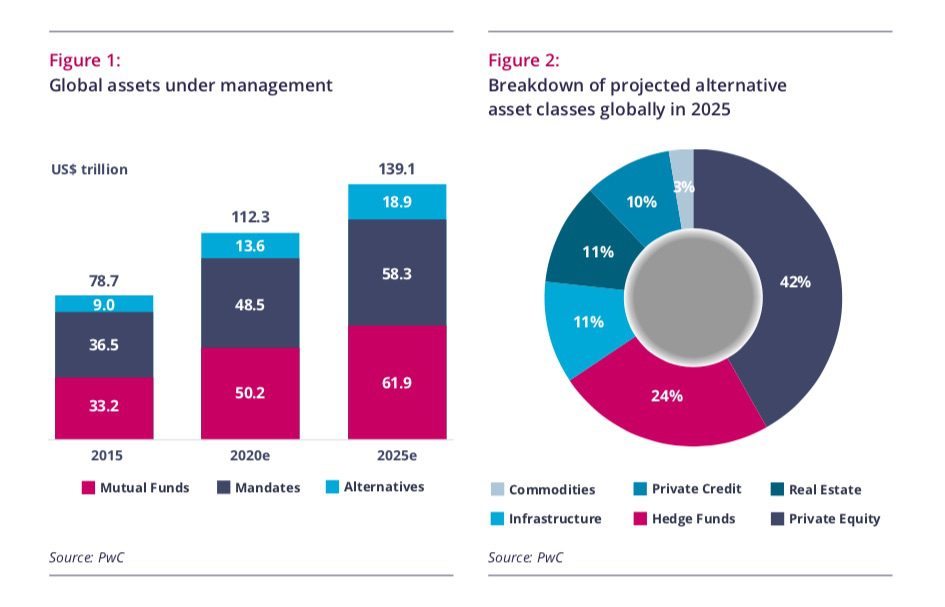

The Alternative Investment Management Association (AIMA) & PwC has released the AIMA Hong Kong Alternatives Report 2022, providing key insights into Hong Kong Alternative Asset Management industry. Key findings include global alternative asset is expected to grow to $18.9 trillion in 2025 (13.5% of global assets ($139.1 trillion). Hong Kong is the regional HQ to 43% of the major hedge funds located in Asia-Pacific, with 431 of 989 Hedge Funds based in Hong Kong (2020: 408), 606 Private Equity & Venture Capital firms (2020: 581) and the Hong Kong asset management industry employing 48,000 people (Total financial sector: 273,000). Hong Kong is home to the largest billionaire dollar hedge funds with 44 – New York metropolitan (228), London (101), Hong Kong (44), Singapore (13) and Paris (13). Asia Pacific is home to 38% of billionaires globally ($3.3 trillion), with 50% of Asia-Pacific billionaires based in Mainland China and 8% in Hong Kong and a potential 115,000 UHNWIs in Asia-Pacific to set up family investment management offices in Hong Kong. See below for key highlights and summary of the AIMA Hong Kong Alternative Asset Management Report 2022, and the growth of alternative assets. View Full Report

” 44 Billion Dollar Hedge Funds, 431 Hedge Funds, 606 Private Equity & Venture Capital, 48,000 Asset Management Jobs, 58% of APAC Billionaires in China & Hong Kong “

AIMA Hong Kong Alternatives Report 2022

Key Findings:

- Global Alternative Asset: $18.9 trillion in 2025, 13.5% of global assets ($139.1 trillion)

- Largest alternative asset classes: Private Equity (42%) and Hedge Funds (24%)

- Hong Kong: Home to 43% of the major hedge funds located in Asia-Pacific (431 of 989)

- Singapore: Home to 16% of the major hedge funds located in Asia-Pacific (162 of 989)

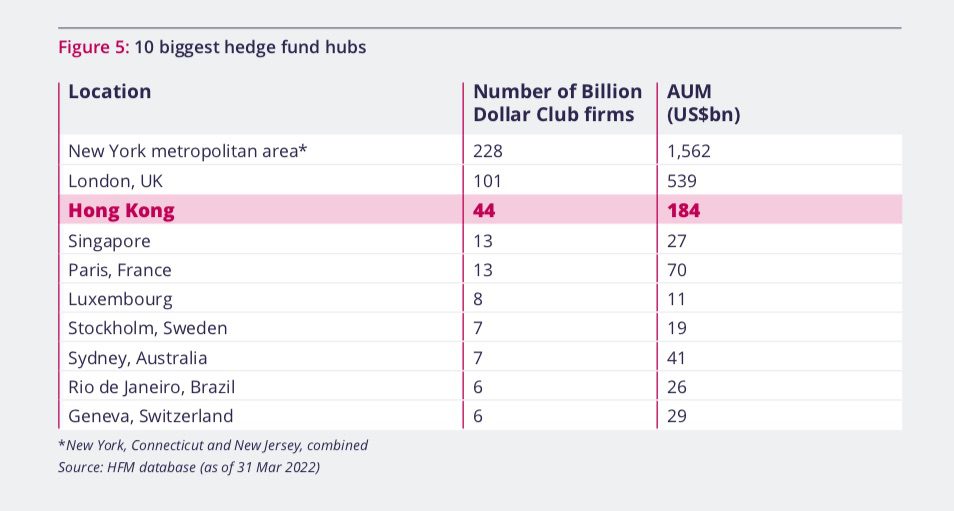

- AUM > $1 billion: ‘Billion Dollar Club’ funds collectively manage $220 billion

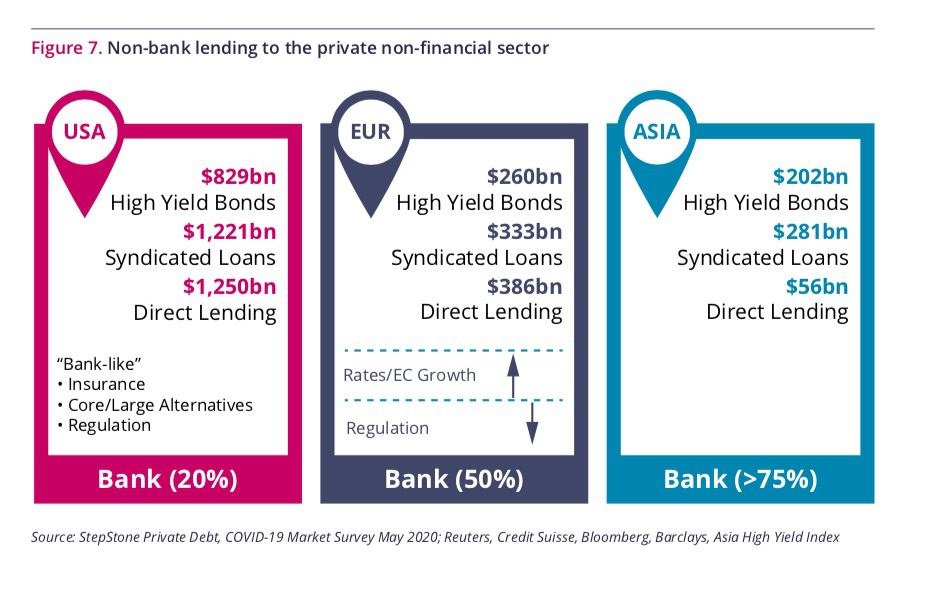

- Private credit $1 trillion global asset class, expect to double to $2 trillion in 2025

- No. licensed corporations in asset management activities: Doubled to 1,979 (2021) over 10 years

- Hong Kong financial sector employment: 273,000 jobs

- Hong Kong Asset Management employment: 48,000 jobs

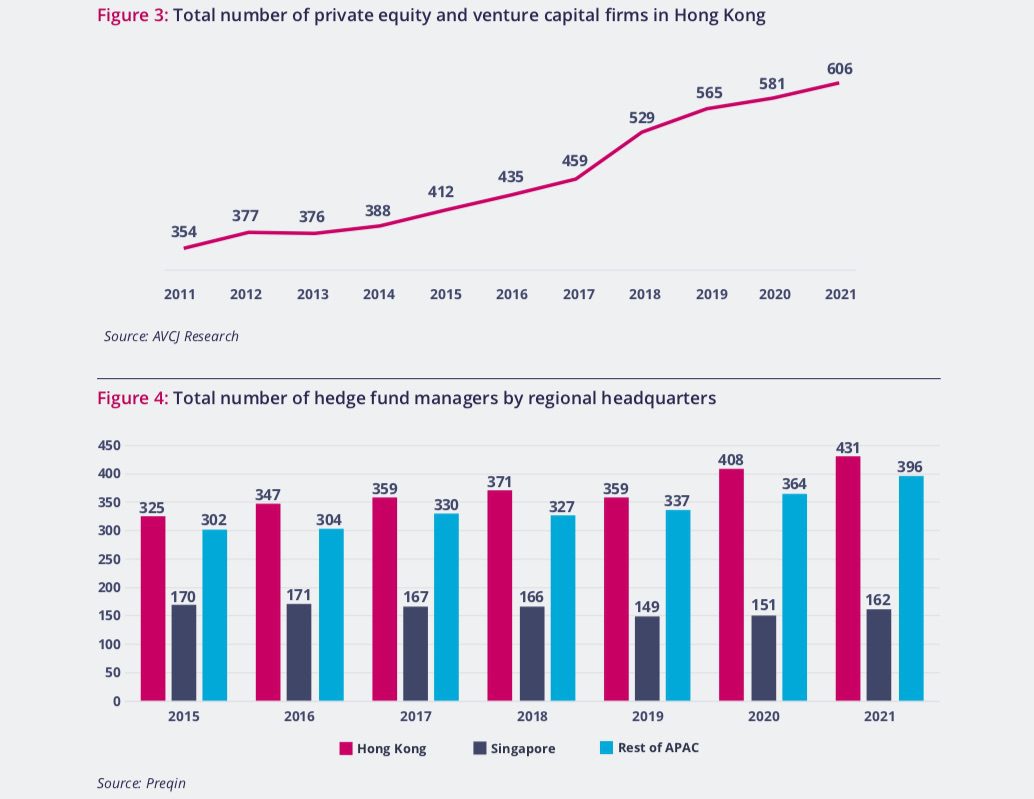

- Hong Kong No. of Private Equity & Venture Capital: 606 (2020: 581)

- Hong Kong No. of Hedge Funds: 431 (2020: 408)

- Billion Dollar Hedge Fund Hubs: New York metropolitan (228), London (101), Hong Kong (44), Singapore (13), Paris (13)

- 6 Pillars that set Hong Kong apart: Rule of law, Tax system, Regulatory environment, Talent pool, Capital markets, Proximity to Mainland China

- Hong Kong as a hub for private credit in Asia: Private credit $1 trillion global asset class, expect to double to $2 trillion in 2025.

- Non-bank lending to the private non-financial sector: United States (80%), Europe (50%), Asia (25%)

- 3 Growth Potential of Mainland China’s Pension System: State Pension (Government) with RMB 8.1 trillion (960 million participants), Corporate Annuity (Insurers) with RMB 2.0 trillion, Commercial Pension (Insurers, banks & asset managers) with 50,000 participants in tax-deferred pension

UHNWs & Billionaires Findings:

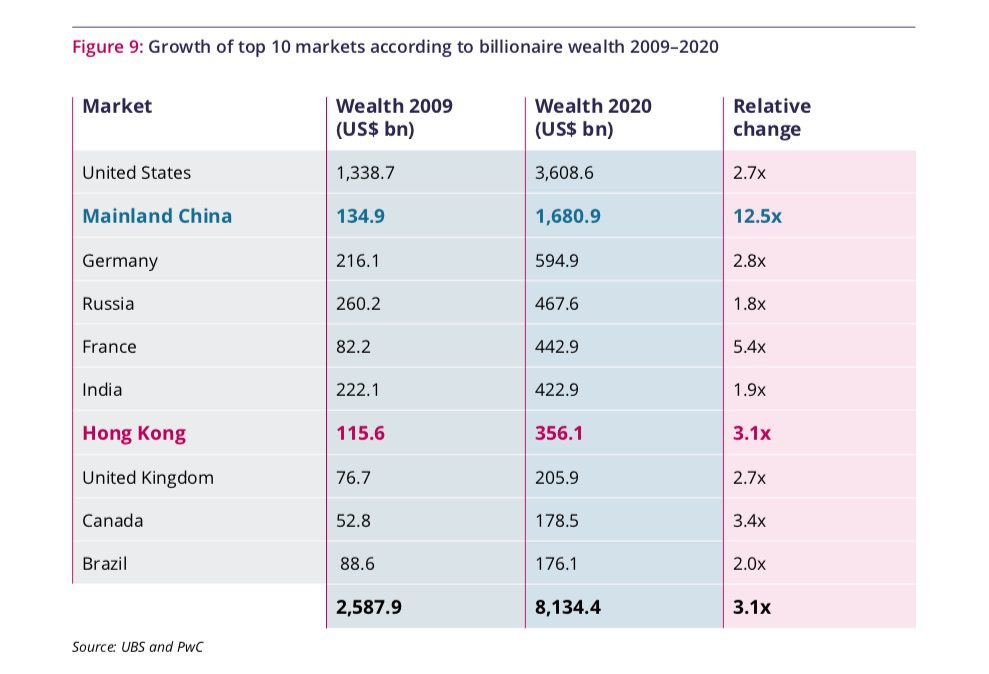

- Top 10 Markets Billionaires Wealth (2020): United States, Mainland China, Germany, Russia, France, India, Hong Kong, United Kingdom, Canada, Brazil

- Billionaires Location in Asia-Pacific: Mainland China (50%), India (14%), Hong Kong (8%), Taiwan (5%), Japan (4%), Singapore (3%), Rest of APAC (17%)

- Asia Pacific is home to 38% of billionaires globally ($3.3 trillion)

- 50% of Asia-Pacific billionaires are based in Mainland China & 8% in Hong Kong

- Potential 115,000 UHNWIs in Asia Pacific to set up family investment management offices in Hong Kong

Growth of Alternative Assets

Hong Kong is a significant global centre for the management of alternative assets, which

is a broad category that includes private equity, hedge funds, real estate, private credit, commodities, infrastructure, and digital assets. For institutions and high-net-worth (HNW) individuals and families, these asset classes are ‘alternative’ to listed equities and fixed income investments. Recognised as an attractive and prudent way to diversify investments and enhance returns.

1) Estimated AUM – Year 2025, % of Global Assets (AUM in 2015, 2020):

- Global Assets: $139.1 trillion, 100% ($78.7 trillion, $112.3 trillion)

- Mutual Funds: $61.9 trillion, 44.5% ($33.2 trillion, $50.2 trillion)

- Mandates: $58.3 trillion, 41.9% ($36.5 trillion, $48.5 trillion)

- Alternatives: $18.9 trillion, 13.5% ($9 trillion, $13.6 trillion)

2) Breakdown of Alternative Asset Classes in 2015

- Private Equity: 42%

- Hedge Funds: 24%

- Infrastructure: 11%

- Real Estate: 11%

- Private Credit: 10%

- Commodities: 3%

3) Hong Kong:

- Hong Kong: Home of 50% of the major hedge funds located in Asia-Pacific

- AUM > $1 billion: ‘Billion Dollar Club’ funds collectively manage $220 billion

- importance of potential investment targets in Asia – especially in Mainland China

- themes such as digital and technological innovation, sustainability and climate protection, urbanisation, healthcare and pharmaceuticals, growth of the Asian middle class, consumer spending and e-commerce across the region.

- Private credit $1 trillion global asset class, expect to double to $2 trillion in 2025

- Asian private credit sector is a nascent (early potential) segment of the global market, but the region is quickly maturing and emerging.

- No. licensed corporations in asset management activities (Type 9 Regulated Activity): Doubled to 1,979 (2021) over 10 years

- Hong Kong financial sector employment: 273,000 jobs

- Hong Kong Asset employment: 48,000 jobs

- No. of Private Equity & Venture Capital: 606 (2020: 581)

- No. of Hedge Funds: 431 (2020: 408)

Hedge Funds

1) Hedge Fund Managers by Regional HQ in 2021:

- Hong Kong: 431

- Singapore: 162

- Rest of APAC: 396

- Total: 989

2) 10 Biggest Billion Dollar Hedge Fund Hubs (AUM):

- New York metropolitan area*: 228 ($1.56 trillion)

- London, UK: 101 ($539 billion)

- Hong Kong: 44 ($184 billion)

- Singapore: 13 ($27 billion)

- Paris, France: 13 ($70 billion)

- Luxembourg: 8 ($11 billion)

- Stockholm, Sweden: 7 ($19 billion)

- Sydney, Australia: 7 ($41 billion)

- Rio de Janeiro, Brazil: 6 ($26 billion)

- Geneva, Switzerland: 6 ($29 billion)

- *New York, Connecticut and New Jersey, combined

Hong Kong Competitive Advantage

AIMA: “Hong Kong’s successful development has been driven by the city’s effective legal system, competitive tax regime, balanced regulatory environment and sophisticated capital markets, deep and. diverse talent pools, and close relationship with Mainland China, whilst also connecting with the other regional markets.”

1) 6 Pillars that set Hong Kong apart:

- Rule of law (Judicial independence; Common law heritage; Dispute resolution)

- Tax system (Low & simple taxation; Tax neutrality; Effective tax treaties)

- Regulatory environment (Flexible, independent, transparent & commercial; Investor protection; Rising regulatory tech)

Talent pool (Professional support; Acquisition and retention; Tech-savvy population) - Capital markets (Equity & debt markets ; Resilient financial system ; Listing & fundraising )

- Proximity to Mainland China (Gateway to Chinese wealth ; Greater Bay Area; Market access channels)

2) Hong Kong Gateway to & from Mainland China: Opportunities for Chinese investors to invest overseas

- 2006: Qualified Domestic Institutional Investor (QDII) – Equities and Bonds

- 2012: Qualified Domestic Limited Partnership (QDLP) – Traditional & alternative investments

- 2014: Shanghai-Hong Kong Stock Connect (Southbound) – Equities

- 2015: Mutual Recognition of Funds (MRF) – Mutual funds

- 2016: Shenzhen-Hong Kong Stock Connect (Southbound) – Equities

- 2016: China Interbank Bond Market Direct Scheme – Bonds

- 2021: Wealth Management Connect – Bank deposits & low-risk mutual funds

- 2021: Bond Connect (Southbound) – Bonds

3) Hong Kong as a hub for private credit in Asia

Private credit $1 trillion global asset class, expect to double to $2 trillion in 2025. Asian private credit sector is a nascent (early potential) segment of the global market, but the region is quickly maturing and emerging.

Non-bank lending to the private non-financial sector:

- United States: 80%

- Europe: 50%

- Asia: 25%

UHNW & Billionaires:

- Asia Pacific is home to 38% of billionaires globally ($3.3 trillion)

- 50% of Asia-Pacific billionaires are based in Mainland China and 8% in Hong Kong

- 115,000 UHNWIs in Asia Pacific who could each be candidates to set up family investment management offices in Hong Kong

Top 10 Markets Billionaires Wealth (2020):

- United States: $3.6 trillion

- Mainland China: $1.6 trillion

- Germany: $594 billion

- Russia: $467 billion

- France: $442 billion

- India: $422 billion

- Hong Kong: $356 billion

- United Kingdom: $205 billion

- Canada: $178 billion

- Brazil: $176 billion

- Tota: $8.13 trillion

Billionaires Location in Asia-Pacific:

- Mainland China: 50%

- India: 14%

- Hong Kong: 8%

- Taiwan: 5%

- Japan: 4%

- Singapore: 3%

- Rest of APAC: 17%

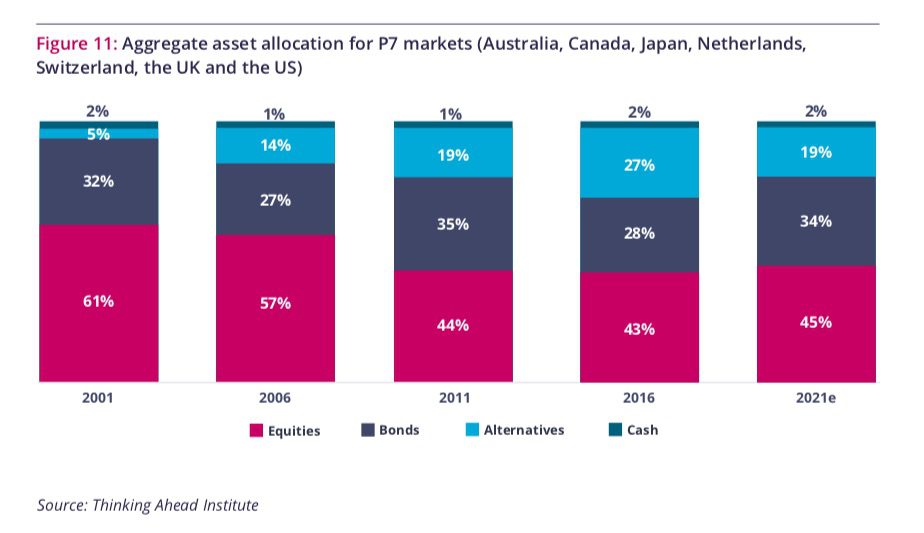

Pension Funds Allocation to Alternative Asset Classes

Large pension funds in key markets around the world have already grown their exposure to alternative asset classes as they look to meet actuarial targets for future funding.

1) 2021 Aggregate Asset Allocation for P7 markets (Australia, Canada, Japan, Netherlands, Switzerland, the UK, US)

- Equities: 45%

- Bonds: 34%

- Alternatives: 19%

- Cash: 2%

2) 3 Growth Potential of Mainland China’s Pension System: AUM

- State Pension (Government) – RMB 8.1 trillion (960 million participants, Public Pension Fund, National Council Social Security Fund )

- Corporate Annuity (Insurers) – RMB 2.0 trillion (57.57% of Enterprise Annuity covers state-owned enterprises)

- Commercial Pension (Insurers, banks & asset managers) – Negligible (50,000 participants in tax-deferred pension)

AIMA Vision for Hong Kong:

- Upholding the rule of law and judicial independence

- Maintaining a simple and competitive tax structure

- Ensuring an independent, transparent and effective regulatory framework

- Developing, retaining and attracting a high-quality international talent pool

- Capitalising on Hong Kong’s proximity to Mainland China through the GBA and other trading channels

- Promoting further depth and breadth in the capital markets system

Other Important Initiatives

- Making alternative assets more accessible

- Supporting the growth of private credit

- Establishing leadership in ESG

- Harnessing technology

About AIMA

The Alternative Investment Management Association (AIMA) is the global representative of the alternative investment industry, with around 2,100 corporate members in over 60 countries. AIMA’s fund manager members collectively manage more than US$2.5 trillion in hedge fund and private credit assets. AIMA draws upon the expertise and diversity of its membership to provide leadership in industry initiatives such as advocacy, policy and regulatory engagement, educational programmes and sound practice guides. AIMA works to raise media and public awareness of the value of the industry. AIMA set up the Alternative Credit Council (ACC) to help firms focused in the private credit and direct lending space. The ACC currently represents over 250 members that manage US$600 billion of private credit assets globally. AIMA is committed to developing skills and education standards and is a co-founder of the Chartered Alternative Investment Analyst designation (CAIA) – the first and only specialised educational standard for alternative investment specialists. AIMA. is governed by its Council (Board of Directors). For more information, please go to www. aima.org.

About PwC

PwC is the leading global professional services network, with firms in 156 countries and more than 295,000 people committed to delivering quality in assurance, tax and advisory services. PwC has around 22,675 Asset & Wealth Management (AWM) professionals globally. As a leading AWM practice, PwC is committed to playing an active role in shaping and supporting the industry for the betterment of the financial services ecosystem and broader society, in addition to spearheading the development of the burgeoning industry. This resonates with the firm’s overall purpose in building trust in society and solving important problems working with government bodies, industry associations, industry leaders and regulators.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit