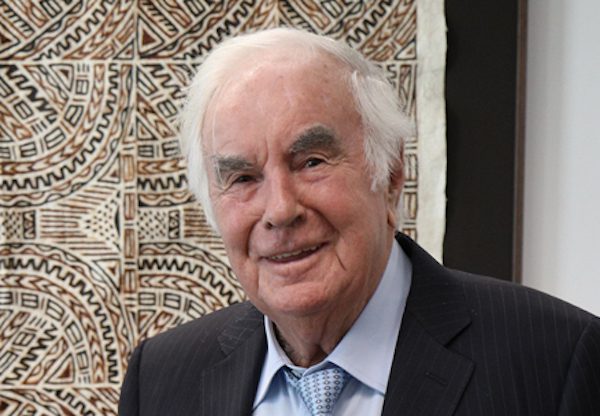

French Billionaire with $15 Billion Fortune Pierre Castel & Founder of World 3rd Largest Wine Trader Castel Group Ordered by Switzerland to Pay $416 Million in Taxes, Hide Real Identity & Have Companies in Switzerland & Liechtenstein, Trust in Singapore

13th October 2022 | Hong Kong

French billionaire Pierre Castel (Age 95) & founder of the world’s 3rd largest wine trader Castel Group has been ordered by a Switzerland federal court to pay $416 million in taxes for hiding his real identity, with investigation revealing him as the true owner of Castel Group (Pierre Castel had filed taxes under a different first name, not using Pierre). Switzerland authorities had began investigating in tax filing of Pierre Castel in 2017, suspecting that Castel, is the founder of multi-billion empire Castel Group. Castel Group is founded in 1949, and has companies in Switzerland & Gibraltar, a foundation in Liechtenstein and a trust in Singapore. In 1981, Pierre Castel had switched his residency from France to Switzerland. Castel is the largest French wine producer and owns the biggest French and foreign wine brands distributed in France.

“ French Billionaire with $15 Billion Fortune Pierre Castel & Founder of World 3rd Largest Wine Trader Castel Group Ordered by Switzerland to Pay $416 Million in Taxes, Hide Real Identity & Have Companies in Switzerland & Liechtenstein, Trust in Singapore “

Castel Group

As much a family company as a family of companies, reunited under the same name but essentially independent, CASTEL has become a global reference in the wine industry: as winemakers, wine traders, and wine merchants/distributors. In each of our companies and products, and in every country, we are driven by the same spirit and united in pursuit of the same goal: to open up the world of wine.

Winemaker – CASTEL manages 1,400 hectares of vineyards: in Bordeaux, Provence, the Loire and Languedoc. CASTEL is constantly developing its expertise, working with the utmost respect for terroir and the wider French viticultural landscape. Each of its properties shares an enduring commitment to sustainable winemaking, developing working methods while taking into account people and the environment. This approach enables us to showcase the individuality of each property, offering unique, quality wines.

Wine trader – This is a core activity, helping to raise the profile of French wines across the globe, and is effectively carried out at CASTEL’s facilities based in each of France’s major winegrowing regions, by 9 Maisons de Vin, and their independent, mutually complementary partners. Together they offer an unrivalled range covering all distribution channels in France and abroad, with wines from a vast spectrum of terroirs. Over the years, this wine trading expertise has enriched, and been enriched by, that of recognised French wine houses.

Wine merchant/distributor – CASTEL’s wine retail chains share the same mission: to make it easier for customers to find the wine that is right for them, without compromising on quality or customer service. In this way, CASTEL maintains a direct link to its customers, an essential means of staying in touch with the market. All are true professionals, with an expert knowledge of the wines they sell and the intricacies of food pairing. Their mission is to share French wine expertise, helping customers discover and enjoy the very best products, and to guide them in their choices.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit