The University Alumni Report 2022: 18% of UHNWs from Top 10 Universities in Harvard, Stanford, Pennsylvania, Columbia, New York, Northwestern, Cambridge, MIT, Yale & National University of Singapore

25th November 2022 | Hong Kong

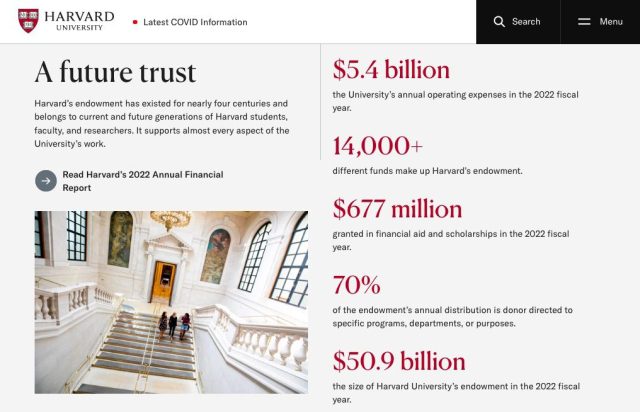

The University Alumni Report 2022 has been released, with key data & insights into the number of UHNWs (ultra high net worth with > $30 million) & senior executives (Directors & C-Suites of listed companies) from the top universities in the world in 2022. Which universities have the most UHNWs? Are they from United States, United Kingdom or Asian Universities? In 2022, the top 10 universities are Harvard, Stanford, Pennsylvania, Columbia, New York, Northwestern, Cambridge (UK), MIT, Yale, and National University of Singapore. In total, the top 10 universities have an UHNW population of 63,610, representing 18% of global UHNWs (352,000). Harvard University has the most UHNWs with 17,660, representing 5% of global UHNWs. 75% of UHNWs in the Top 50 Universities in United States are self-made and 67.4% of UHNWs in the Top 50 Universities globally (exclude United States) are self-made. The self-made UHNW population in Harvard, INSEAD, Oxford are 80.4%, 65.2%, 76% and inherited UHNW population in Harvard, INSEAD, Oxford are 5.3%, 6.7%, 4.4% respectively. The median wealth UHNW in Harvard, INSEAD, Oxford are $120 million, $130 million and $115 million. 8.3% of the Top 50 Universities in United States are female UHNWs, and 8.8% of the Top 50 Universities Globally (Exclude United States) are female UHNWs. View summary and data below.

“ 63,610 Representing 18% of UHNWs from Top 10 Universities in Harvard, Stanford, Pennsylvania, Columbia, New York, Northwestern, Cambridge, MIT, Yale & National University of Singapore “

The University Alumni Report 2022

In 2022, the top 10 universities are Harvard, Stanford, Pennsylvania, Columbia, New York, Northwestern, Cambridge (UK), MIT, Yale, and National University of Singapore. In total, the top 10 universities have an UHNW population of 63,610, representing 18% of global UHNWs (352,000). Harvard University has the most UHNWs with 17,660, representing 5% of global UHNWs.

75% of UHNWs in the Top 50 Universities in United States are self-made and 67.4% of UHNWs in the Top 50 Universities globally (exclude United States) are self-made. The self-made UHNW population in Harvard, INSEAD, Oxford are 80.4%, 65.2%, 76% and inherited UHNW population in Harvard, INSEAD, Oxford are 5.3%, 6.7%, 4.4% respectively. The median wealth UHNW in Harvard, INSEAD, Oxford are $120 million, $130 million and $115 million.

8.3% of the Top 50 Universities in United States are female UHNWs, and 8.8% of the Top 50 Universities Globally (Exclude United States) are female UHNWs. View summary and data below.

The Value of Alumni

- Alumni Networks

- Private Donations

- Corporate Donations

- Corporate Partnerships

- Brand & Reputation

Key Findings – UHNWs

- UHNWs ~ > $30 million net worth

- UHNWs Population in 2022 – 352,000 (Represents 1.2% of world’s millionaires)

- Top 10 Universities UHNWs Population in 2022 – 63,610 (18% of Global UHNWs)

- Top University with UHNWs – Harvard University with 17,660 (5% of Global UHNWs)

- Top 10 Universities with most UHNWs – Harvard, Stanford, Pennsylvania, Columbia, New York, Northwestern, Cambridge (UK), MIT, Yale, National University of Singapore

- Top 10 Universities in Globally (ex-US) with most UHNWs – Harvard, Stanford, Pennsylvania, Columbia, New York, Northwestern, MIT, Yale, University of Southern California, University of Chicago

- Top 10 Universities in United States with most UHNWs – Cambridge (UK), National University of Singapore, Oxford (UK), INSEAD (France), London School of Economics (UK), Toronto (Canada), Mumbai (India), Peking (China), Tsinghua (China), Delhi (India)

- Top 50 Universities in United States Self-Made – 75% of UHNWs

- Top 50 Universities Globally (Exclude United States) Self-Made – 67.4% of UHNWs

- Self-made UHNW population in Harvard, INSEAD, Oxford – 80.4%, 65.2%, 76%

- Inherited UHNW population in Harvard, INSEAD, Oxford – 5.3%, 6.7%, 4.4%

- The median wealth UHNW in Harvard, INSEAD, Oxford – $120 million, $130 million and $115 million

- Top 50 Universities in United States with female UHNWs – 8.3%

- Top 50 Universities Globally (Exclude United States) with female UHNWs – 8.8%

- Top 5 Female UHNWs Universities in United States – George Washington, Duke, Boston, Tufts, Southern Methodist

- Top 5 Female UHNWs Universities Globally (exclude United States) – Chulalongkorn (Thailand), Kuwait University, Monash (Australia), Geneva (Switzerland), National University of Singapore

More

- Average Age of Top 50 Universities (United States) – 62 Years Old

- Average Age of Top 50 Universities (exclude United States) – 55.6 Years Old

- Top 5 Universities in United States for Senior Executives – Harvard, Pennsylvania, Stanford, Columbia, Northwestern

- Top 5 Universities Globally (exclude United States) for Senior Executives – INSEAD, Oxford, Cambridge, London School of Economics, National University of Singapore

- Top 5 Sectors of Senior Executive Alumni – Pharmaceuticals & biotechnology, Financial services, Technology, Health, Real estate

1) UHNWs in Top Universities

Top 10 Universities – Globally

- Harvard University – 17,660

- Stanford University – 7,792

- University of Pennsylvania – 7,517

- Columbia University – 5,528

- New York University – 5,214

- Northwestern University – 4,354

- University of Cambridge (UK) – 4,149

- Massachusetts Institute of Technology (MIT) – 4,089

- Yale University – 3,654

- National University of Singapore (Singapore) – 3,653

Top 20 Universities – United States

- Harvard University – 17,660

- Stanford University – 7,792

- University of Pennsylvania – 7,517

- Columbia University – 5,528

- New York University – 5,214

- Northwestern University – 4,354

- Massachusetts Institute of Technology (MIT) – 4,089

- Yale University – 3,654

- University of Southern California – 3,594

- University of Chicago – 3,588

- University of Texas – 3,407

- Princeton University – 3,173

- Cornell University – 2,911

- University of California, Los Angeles (UCLA) – 2,881

- University of Michigan – 2,804

- University of Notre Dame – 2,568

- University of Virginia – 2,568

- Georgetown University – 2,505

- Boston University – 2,310

- University of Miami – 2,285

Top 15 Universities – Globally (Exclude United States)

- University of Cambridge (UK) – 4,149

- National University of Singapore (Singapore) – 3,653

- University of Oxford (UK) – 3,356

- INSEAD (France) – 2,625

- London School of Economics (UK) – 2,017

- University of Toronto (Canada) – 1,156

- University of Mumbai (India) – 1,131

- Peking University (China) – 1,101

- Tsinghua University (China) – 1,100

- University of Delhi (India) – 1,027

- Imperial College London (UK) – 964

- American University of Beirut (Lebanon) – 925

- McGill University (Canada) – 918

- University of New South Wales (Australia) – 780

- London Business School (UK) – 747

2) Self-Made UHNWs in Top Universities

- 75% of the Top 50 Universities in United States are Self-Made

- 67.4% of the Top 50 Universities Globally (Exclude United States) are Self-Made

Top 5 Self-Made UHNWs Universities – United States

- California Institute of Technology – 91.7% of UHNWs

- University of Maryland, College Park – 90.7%

- University of Pittsburgh – 89.1%

- Johns Hopkins University – 88.7%

- University of Chicago – 84.7%

Top 5 Self-Made UHNWs Universities – Globally (Exclude United States)

- Indian Institute of Management Ahmedabad (India) – 96.2%

- Peking University (China) – 93.6%

- Fudan University (China) – 93.6%

- University of the Witwatersrand (South Africa) – 92.3%

- Renmin University of China (China) – 92.1%

3) Female UHNWs in Top Universities

- 8.3% of the Top 50 Universities in United States are female

- 8.8% of the Top 50 Universities Globally (Exclude United States) are female

Top 5 Female UHNWs Universities – United States

- George Washington University – 16.2%

- Duke University – 12.7%

- Boston University – 12.6%

- Tufts University – 12.5%

- Southern Methodist University – 12.2%

Top 5 Female UHNWs Universities – Globally (Exclude United States)

- Chulalongkorn University (Thailand)- 22%

- Kuwait University (Kuwait) – 21.2%

- Monash University (Australia) – 16.4%

- University of Geneva (Switzerland) – 13.8%

- National University of Singapore (Singapore) – 13%

4) Demographics of UHNWs in Top Universities

Top 5 International UHNWs Universities (Different Nationalities) – United States

- Boston University – 39.7%

- University of Southern California – 30.9%

- Massachusetts Institute of Technology – 30.7%

- George Washington University – 25.8%

- Columbia University – 25%

Top 5 International UHNWs Universities (Different Nationalities) – Globally (Exclude United States)

- INSEAD (France) – 92.1%

- University of Manchester (UK) – 87.8%

- University of Edinburgh (UK) – 84.8%

- London School of Economics (UK) – 79%

- Imperial College London (UK) – 77.4%

Top 5 Youngest UHNWs Universities – United States

- University of Denver – 56.7 Years Old

- Boston College – 57.1 Years Old

- Tufts University – 57.6 Years Old

- Brown University – 57.9 Years Old

- Boston Universities – 58.1 Years Old

Average of Top 50: 62 Years Old

Top 5 Youngest UHNWs Universities – Globally (Exclude United States)

- Kuwait University (Kuwait) – 40.7 Years Old

- American University of Beirut (Lebanon) – 47.4 Years Old

- Tel Aviv University (Israel) – 49.1 Years Old

- Tsinghua University (China) – 49.3 Years Old

- Monash University (Australia) – 50 Years Old

Average of Top 50: 55.6 Years Old

5) Senior Executives in Top Universities

Top 20 Universities – United States Senior Executives

Senior Executives – Directors of publicly listed companies, the vast majority of whom are either in the C-suite or on the board (executive and non-executive directors).

- Harvard University – 3,879

- University of Pennsylvania – 2,387

- Stanford University – 2,017

- Columbia University – 1,557

- Northwestern University – 1,412

- University of Michigan – 1,323

- New York University – 1,227

- University of Chicago – 1,154

- Cornell University – 1,060

- University of California, Berkeley – 1,030

- University of Virginia – 957

- Yale University – 914

- Massachusetts Institute of Technology (MIT) – 901

- Duke University – 868

- Georgetown University – 856

- Princeton University – 756

- Dartmouth College – 690

- University of Southern California – 663

- University of Notre Dame – 633

- University of California, LosAngeles (UCLA) – 622

Top 20 Universities by Senior Executives in Global 19

- Harvard University – US

- INSEAD – France

- University of Oxford – UK

- Stanford University – US

- University of Cambridge – UK

- London School of Economics – UK

- University of Pennsylvania – US

- Columbia University – US

- Massachusetts Institute of Technology – US

- London Business School – UK

- Northwestern University – US

- New York University – US

- National University of Singapore – Singapore

- University of Delhi – India

- McGill University – Canada

19 countries across the world: Australia, Brazil, Canada, France, Germany, Hong Kong, India, Ireland, Italy, Japan, the Netherlands, Russia, Singapore, South Africa, Spain, Sweden, Switzerland, the UAE and the UK.

Top 5 Universities for Female Executives – United States

- University of California, Los Angeles – 29.3%

- University of California, Berkeley – 29.1%

- Tufts University – 29.1%

- Georgetown University – 28.9%

- Boston College – 28.3%

Top 5 Universities for Female Executives – Globally (Exclude United States)

- University of Melbourne (Australia) – 40.2%

- University of Sydney (Australia) – 36.5%

- National University of Singapore (Singapore) – 35.9%

- London School of Economics (UK) – 35.7%

- Harvard University (US) – 34.6%

Top 5 Sectors of Senior Executive Alumni

- Pharmaceuticals & biotechnology (John Hopkins, Tufts, MIT)

- Financial services (Virginia, New York, Notre Dame)

- Technology (UC Berkeley, UC Santa Barbara, MIT)

- Health (UC Santa Barbara, Florida, John Hopkins)

- Real estate (USC, New York, Virginia)

6) Harvard, INSEAD, Oxford – Alumni Analysis

Age

- Harvard University – Age 61.5

- INSEAD – Age 56.3

- University of Oxford – Age 59.5

Women

- Harvard University – 17.5% are women

- INSEAD – 18.2% are women

- University of Oxford – 17.7% are women

UHNW (Median)

- Harvard University – $120 million

- INSEAD – $130 million

- University of Oxford – $115 million

Self-made

- Harvard University – 80.4%

- INSEAD – 65.2%

- University of Oxford – 76%

Inherited

- Harvard University – 5.3%

- INSEAD – 6.7%

- University of Oxford – 4.4%

Inherited & Self-made

- Harvard University – 14.3%

- INSEAD – 28.1%

- University of Oxford – 19.6%

The University Alumni Report 2022 is released by Altrata, with data from Wealth-X & BoardEx.

Altrata’s University Alumni Report 2022

Altrata’s University Alumni Report 2022: Rankings of the Wealthy and Influential report offers unrivaled insight into the university backgrounds of the ultra wealthy and senior executives. It is essential reading for education institutions and other organizations looking to prospect for and engage with individuals in this important group. This report leverages two of Altrata’s unique products, the Wealth-X Database, the world’s most extensive collection of curated research and intelligence on the wealthy, and BoardEx’s Global Leadership Database, which covers board and non-board members, C-suite executives, senior leaders and professional advisers.

For our ultra wealthy alumni analysis, we studied the ultra wealthy across the globe, dividing our analysis into US and non-US universities. For our senior executive alumni analysis, we studied the senior executives at publicly held corporations in the US and, for our non-US analysis, at the constituent companies of the major indices across 19 countries (the Global 19). For our archetype analysis for Harvard, INSEAD and Oxford, we included all ultra wealthy and, among the senior executive alumni, those working at the constituent companies of the major indices of the Global 20 (the Global 19 and the US).

About BoardEx

BoardEx is an Altrata company and is the leading provider of executive intelligence and relationship mapping solutions. BoardEx works with premier organizations across the academic, corporate, executive search, private equity, legal, and financial and professional services industries. Founded

in 1999, organizations trust BoardEx to identify, qualify and map connection paths to 2 million organizations and the 1.6 million people who lead them, to enhance business development strategy, talent management and alumni relations efforts, as well as conduct data-driven research and analysis.

About Wealth-X

Wealth-X is an Altrata company and the global leader in wealth information and insight. Wealth-X partners with prestige brands across the financial services, luxury, nonprofit and higher-education industries to fuel strategic decision-making in sales, marketing and compliance. Wealth-X has developed the world’s largest collection of records on wealthy individuals and produces unparalleled data analysis to help organizations uncover, understand, and engage their target audience, as well as mitigate risk. Founded in 2010, with a team spanning North America, Europe and Asia, Wealth-X provides unique data, analysis, and counsel to a diverse roster of worldwide clients.

About Altrata

Altrata is a data powerhouse, built to deliver more value to our clients. We are the global leader in data-driven people intelligence on the wealthy and influential. We work at scale with businesses and nonprofits across the world from a variety of industries. We help our clients connect with confidence to the people who have the greatest impact on their business. Our products give our clients all the information they need on everyone they need to know. Our data is actionable, accurate, and comprehensive. And our global team of more than 400 researchers is committed to maintaining millions of profiles and changing data points, so our clients can effectively engage their target audience and make meaningful, lasting connections. AltrataTM is a registered trademark of the Euromoney Group, which comprises five dynamic offerings: BoardEx, Boardroom Insiders, RelSci, WealthEngine and Wealth-X.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit