Japan Insurer Sompo Sued by Heirs for $1.44 Billion for Wrongful Ownership of Van Gogh Sunflowers Painting Bought in 1987 Christie’s Auction in London, Jewish Paul von Mendelssohn-Bartholdy Forced to Give Up Ownership of Painting in 1934 in Germany

19th January 2023 | Hong Kong

Japan insurance group Sompo had been sued by heirs of Jewish Paul von Mendelssohn-Bartholdy for $1.44 billion for wrongful ownership of Van Gogh Sunflowers painting bought in a 1987 Christie’s auction in London, filing in the lawsuit (13th Dec 2022) that the painting belongs to Jewish Paul von Mendelssohn-Bartholdy (German banker) who was forced to give up ownership of painting in 1934 in Germany (Jewish in Germany assets were seized). Sompo in 1987 was known as Yasuda Fire & Marine Insurance. The $1.44 billion filing in United States by the heirs of Jewish Paul von Mendelssohn-Bartholdy, is to demand the return of the painting, $690 million in damages and $750 million in punitive damages.

“ Japan Insurer Sompo Sued by Heirs for $1.44 Billion for Wrongful Ownership of Van Gogh Sunflowers Painting Bought in 1987 Christie’s Auction in London, Jewish Paul von Mendelssohn-Bartholdy Forced to Give Up Ownership of Painting in 1934 in Germany “

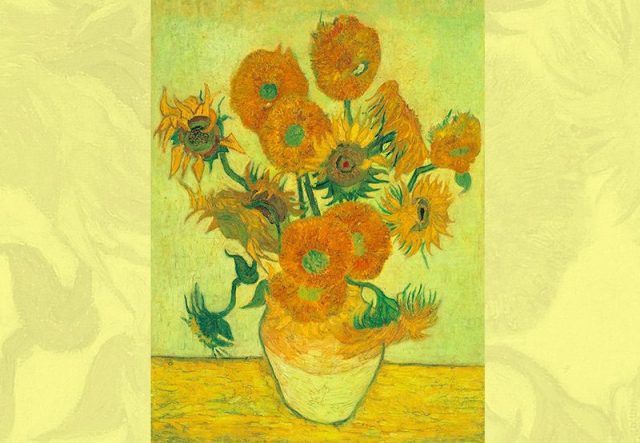

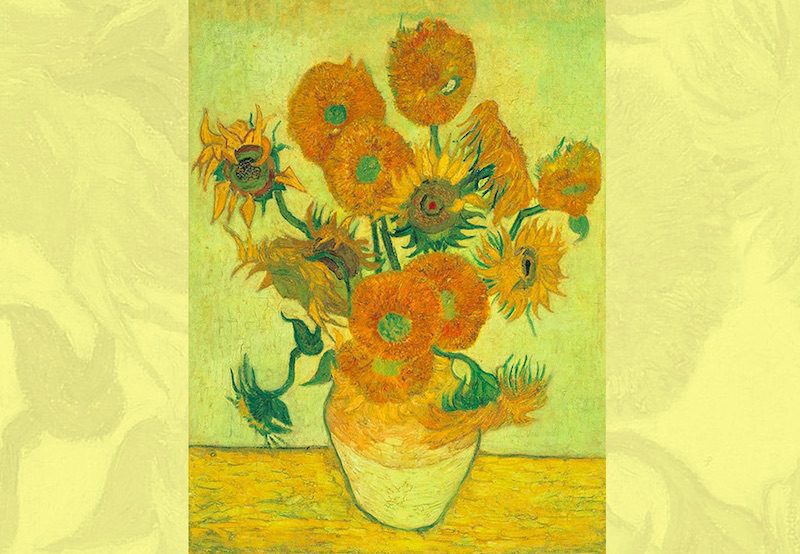

Vincent van Gogh Sunflowers (1888, oil on canvas)

Sompo Museum of Art – This is a painting that is one of the most famous works by Vincent van Gogh. On February 1888, Van Gogh departed from Paris for Arles in southern France, where he planned to live and work together with his close friend painters. He also invited a painter, Paul Gauguin, whom Van Gogh respected strongly, as a leader of this community. The Sunflowers was painted while Van Gogh was waiting Gauguin’s arrival with the purpose of decorating his room. The Sunflowers, which is now in our collection, must have been painted between late November and early December, when Van Gogh and Gauguin live together, and based on the first ‘Sunflowers on yellow background’, painted in August 1888, now in the collection of the National Gallery in London. Though the basic color and composition of the Tokyo version is the same as London’s one, brush strokes or color tones of these two paintings are slightly different. It suggests that Van Gogh worked on this painting with many considerations, rather than making a mere copy.

Vincent van Gogh(1853 – 1890)

Sompo Museum of Art – Vincent van Gogh was born a minister’s son in Holland. He decided to be a painter when he was the age of 27, and for 10 years, until his death, he created more than 2000 works, including drawings. He started his career by depicting peasant life in his early days, and after the Paris period, while he was influenced by Impressionism and Neo-Impressionism, he finally established his own style, showing dynamic brush strokes and bright color. Van Gogh is regarded as the representative painter of Post-impressionism, being equal to Paul Gauguin and Paul Cézanne, and has a major influence on the art of 20th century, such as Expressionism and Fauvism.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit