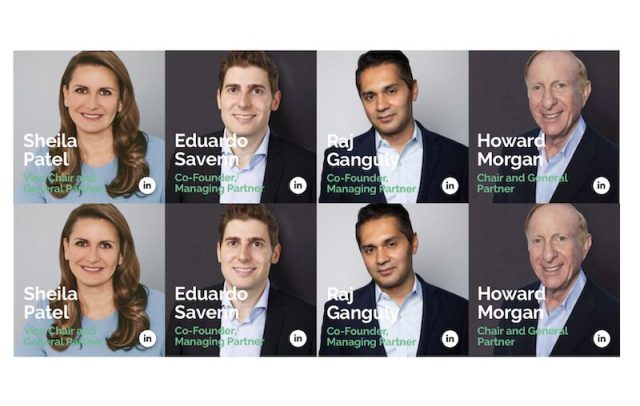

Facebook Co-Founder Eduardo Saverin B Capital Closes 3rd Fund at $2.1 Billion, Founded in 2015 and Led by Howard Morgan, Sheila Patel, Eduardo Saverin & Raj Ganguly

21st January 2023 | Hong Kong

Facebook co-founder Eduardo Saverin private equity firm B Capital has closed its 3rd fund at $2.1 billion,. a multi-stage global investment firm led by Howard Morgan, Sheila Patel, Eduardo Saverin & Raj Ganguly. B Capital Group is a private equity firm co-founded by converted-Singapore Citizen Eduardo Saverin, who is also one of Singapore’s richest man with around $9 billion personal fortune, and Raj Ganguly (Senior Advisor, Boston Consulting Group) in 2015. B Capital was founded in 2015 and invests in transformative technology startups during their early expansion stage (Series B, C rounds), at which time a company is prepared for rapid growth and acceleration. The firm partners with technology companies ranging from seed to late-stage growth, primarily in the enterprise, fintech and healthcare tech sectors. The firm invests between $10 million to $50 million in each portfolio company, including reserves for future growth funding. In June 2020, B Capital Group closed its 2nd fund of $820 million, with the group totalling AUM of more than $1.4 billion. In January 2023, B Capital Group closed its 3rd fund of $2.1 billion, with the group totalling AUM of around $6.3 billion. In 2022 May, B Capital cancelled its plans to raise $300 million via a SPAC listing in United States, a filing initiated in February 2021 for B Capital Technology Opportunities Corp to the United States Securities & Exchange Commission. (SPAC ~ Special Purpose Acquisition Company)

“ Facebook Co-Founder Eduardo Saverin B Capital Closes 3rd Fund at $2.1 Billion, Founded in 2015 and Led by Howard Morgan, Sheila Patel, Eduardo Saverin & Raj Ganguly “

Eduardo Saverin, B Capital Co-Founder & Managing Partner: “Since its inception, B Capital has been committed to investing in cutting-edge technology companies. Growth Fund III’s portfolio includes companies that are transforming their respective industries and generating meaningful impact. Our strategic partnership with Boston Consulting Group (BCG) and strong on-the-ground presence in key geographies enable us to provide our portfolio companies with targeted insights and expert advice. This multi-faceted, forward-thinking strategy lays a foundation for consistent portfolio company growth and firm success.”

Raj Ganguly, B Capital Co-Founder & Managing Partner: “Our emphasis on value-add investing, supported by our platform advisors and strategic partnership with BCG, enables us to accelerate business development and growth across our portfolio. This approach drives a high-performance investment model, which we will continue to apply to the Growth Fund III series.”

B Capital

B Capital is a multi-stage global investment firm that partners with extraordinary entrepreneurs to shape the future through technology. With $6.3 billion in assets under management across multiple funds, the firm focuses on seed to late-stage venture growth investments, primarily in the enterprise, financial technology and healthcare sectors. Founded in 2015, B Capital leverages an integrated team across nine locations in the US and Asia, as well as a strategic partnership with BCG, to provide the value-added support entrepreneurs need to scale fast and efficiently, expand into new markets and build exceptional companies.

B Capital was founded in 2015 and invests in transformative technology startups during their early expansion stage (Series B, C rounds), at which time a company is prepared for rapid growth and acceleration. The firm invests between $10 million to $50 million in each portfolio company, including reserves for future growth funding. In June 2020, B Capital Group closed its 2nd fund of $820 million, with the group totalling AUM of more than $1.4 billion. In January 2023, B Capital Group closed its 3rd fund of $2.1 billion, with the group totalling AUM of around $6.3 billion.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit