United States Appeal Court Rejects $430 Billion Johnson & Johnson Chapter 11 Bankruptcy Filing in 2021 for Talc Company to Avoid $3.5 Billion Liabilities for 38,000 Legal Claims Related to Talc Baby Powder Product Cancer Claims, Improperly Filed for Bankruptcy with No Financial Distress

4th February 2023 | Hong Kong

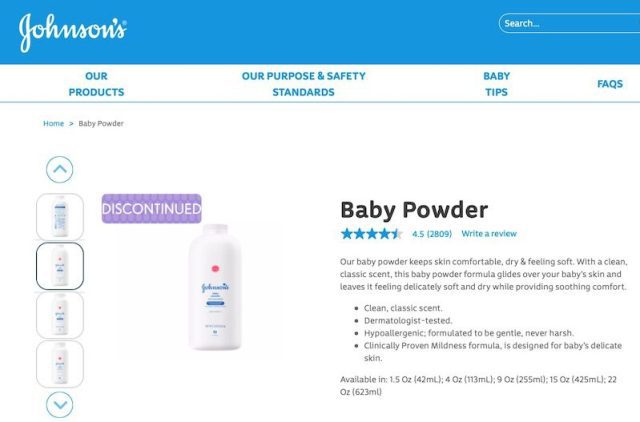

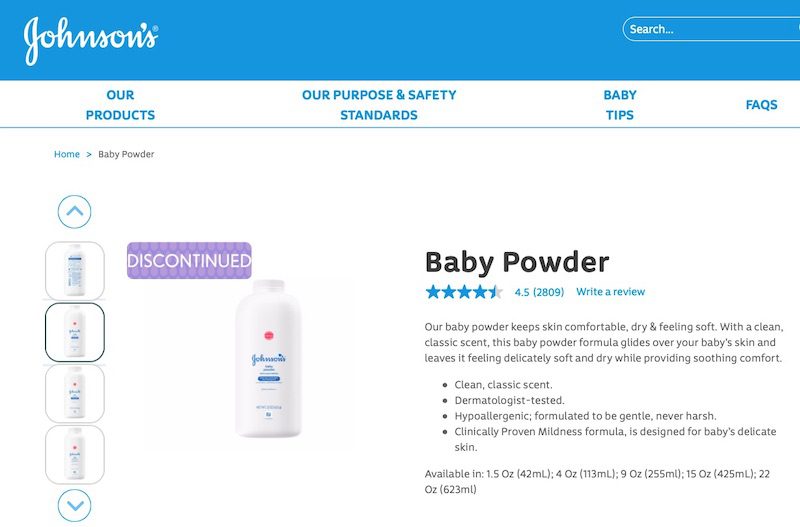

The United States appeal court has rejected $430 billion Johnson & Johnson Chapter 11 Bankruptcy filing in 2021 for its Talc company (LTL Management) to avoid $3.5 billion in liabilities for 38,000 of legal claims related to its Talc baby powder product cancer claims, ruling the company for improperly filing for bankruptcy despite no financial distress. Before the bankruptcy filing, Johnson & Johnson had $3.5 billion in settlements, including one $2 billion judgement for 22 women. In 2022, Johnson & Johnson announced that it will stop selling talc-based baby powder globally in 2023. Johnson & Johnson had faced 38,000 lawsuits from consumers & survivors (Claims: Talc products caused cancer due to contamination with asbestos, a known human carcinogen).

“ United States Appeal Court Rejects $430 Billion Johnson & Johnson Chapter 11 Bankruptcy Filing in 2021 for Talc Company to Avoid $3.5 Billion Liabilities for 38,000 Legal Claims Related to Talc Baby Powder Product Cancer Claims, Improperly Filed for Bankruptcy with No Financial Distress “

Johnson & Johnson – 5 Important Facts About the Safety of Talc

- JOHNSON’S® Baby Powder, made from cosmetic talc, has been a staple of baby care rituals and adult skin care and makeup routines worldwide for over a century.

- The most common cosmetic applications for talc are face, body and baby powders, but it’s also used as an ingredient in color cosmetics, soap, toothpaste, antiperspirant, chewing gum and drug tablets.

- Following decades of studies conducted by medical experts across the globe, it has been demonstrated through science, research and clinical evidence that few ingredients have the same performance, mildness and safety profile as cosmetic talc.

- Talc, also known as talcum powder, is a naturally occurring mineral that is highly stable, chemically inert and odorless. The grade of talc used in cosmetics is of high purity—comparable to that used for pharmaceutical applications—and it’s only mined from select deposits in certified locations before being milled into relatively large, non-respirable-sized particles.

- Today, talc is accepted as safe for use in cosmetic and personal care products throughout the world.

At Johnson & Johnson, we believe good health is the foundation of vibrant lives, thriving communities and forward progress. That’s why for more than 135 years, we have aimed to keep people well at every age and every stage of life. Today, as the world’s largest and most broadly-based health care company, we are committed to using our reach and size for good. We strive to improve access and affordability, create healthier communities, and put a healthy mind, body and environment within reach of everyone, everywhere. We are blending our heart, science and ingenuity to profoundly change the trajectory of health for humanity.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit