Top Private Equity Carlyle Appoints Goldman Sachs President Harvey Schwartz as CEO, Global AUM of $373 Billion with 3 Business Segments in Private Equity, Global Credit & Global Investment Solutions

10th February 2023 | Hong Kong

Top Private Equity firm Carlyle with $373 billion AUM (Assets under Management) has appointed former Goldman Sachs President & Co-COO Harvey Schwartz as the new Carlyle CEO, leading the private equity group with 3 business segments in Private Equity, Global Credit & Global Investment Solutions (15/2/23). Carlyle interim CEO Bill Conway will step down and continue his role as Co-Chairman of the Board. Carlyle: “Harvey Schwartz is the former President and Co-Chief Operating Officer of The Goldman Sachs Group, Inc. (NYSE: GS), and prior to that, served as the firm’s Chief Financial Officer, where he oversaw its most critical financial and risk management processes as well as its capital allocation strategy. He also held leadership roles across a broad range of the firm’s operations, including its Securities and Investment Banking divisions, where he was instrumental in driving the growth of a number of the firm’s client franchises. With a career spanning more than 35 years in the industry, Mr. Schwartz brings to Carlyle extensive experience leading and expanding a wide range of large, profitable businesses, as well as a deep understanding of global capital markets and the needs of clients. Importantly, he has a proven track record as a seasoned operator and a demonstrated ability to develop high-performing talent and teams in order to capitalize fully on growth opportunities, in all macroeconomic and regulatory environments. At Carlyle, Mr. Schwartz will be responsible for setting and executing a strategy that advances and accelerates the diversification plan the firm has successfully pursued, as well as identifying new investment opportunities to further grow and scale the firm, drive sustained performance for fund investors, and create significant shareholder value.” In 2022 August, Carlyle Group CEO Kewsong Lee has resigned ahead of his 5 years contract ending at the end of 2022 after contract renewal discussion failed, with Carlyle Group co-founder Bill Conway appointed as the interim CEO and a board formed to search for a new CEO. In 2021, Kewsong Lee had earned around $42 million and had requested for a pay package worth around $300 million for 5 years, in line with top private equity firms KKR & Apollo. In late 2017, Carlyle Group had named Kewsong Lee and Glenn Youngkin as co-CEOs, succeeding David Rubenstein & Conway as co-CEOs. In July 2022, Glenn Youngkin retired (Elected & won United States’ Virginia governorship 2021), with Kewsong Lee appointed as the sole CEO of Carlyle Group.

“ Top Private Equity Carlyle Appoints Goldman Sachs President Harvey Schwartz as CEO, Global AUM of $373 Billion with 3 Business Segments in Private Equity, Global Credit & Global Investment Solutions “

Carlyle Co-Chairmen Bill Conway and David Rubenstein: “Harvey is a widely respected business builder with significant leadership experience in a high-performing, highly competitive global financial institution. Given his experience, track record, and skillset, the Board was unanimous in its determination that he is the right leader to drive Carlyle forward, building upon the firm’s strong operational foundation, world-class brand, and collaborative, performance-oriented culture.”

Mr. Conway, Interim Chief Executive Officer: “I am grateful to the senior leadership team who have supported the continued execution of our plan during this transition period. I look forward to stepping back to my role on the Board as Harvey steps in to lead and run the firm with the leadership team and position Carlyle to capture the significant opportunities ahead.”

Incoming Carlyle Chief Executive Officer Harvey Schwartz: “I am thrilled to be joining Carlyle, a premier investment firm with a world-class brand and differentiated global platform supported by one of the most talented teams in the industry. I believe there is tremendous opportunity ahead to continue to transform and grow the firm, and enhance its ability to deliver on its mission of driving long-term value for its investors, shareholders and all stakeholders. I’m excited to get started and look forward to working closely with the firm’s senior leaders, along with the entire global team, as we build on Carlyle’s strong foundation to navigate and capture the opportunities in the current market environment and in the future.”

Carlyle Lead Independent Director Lawton Fitt: “I am delighted that the Search Committee of the Board’s robust and competitive process has culminated in the selection of a leader of Harvey’s caliber and depth of experience. I would like to thank Bill, on behalf of the entire Board, for stepping in as Interim CEO during this transition and for working with the leadership team to position Carlyle for further success under Harvey. As we look to the future, the Board is confident Harvey will leverage the firm’s strengths and momentum to enhance Carlyle’s position and create significant value for shareholders and all stakeholders. We look forward to working with him.”

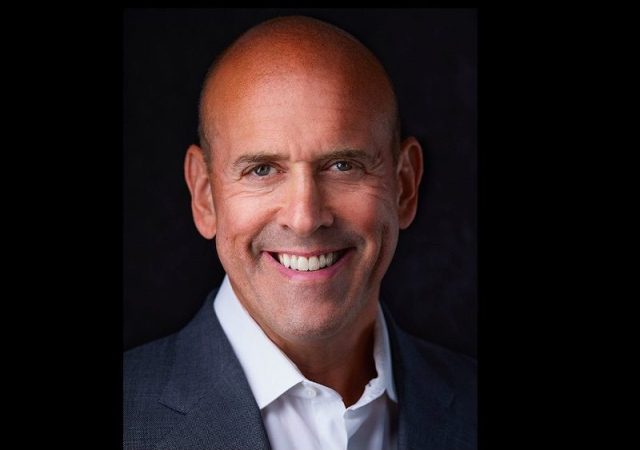

Carlyle CEO Harvey Schwartz

Harvey M. Schwartz, 58, is the former President and Co-Chief Operating Officer of The Goldman Sachs Group, Inc. Mr. Schwartz joined Goldman Sachs in 1997 and subsequently held numerous senior leadership positions including Chief Financial Officer, Global Co-Head of the Securities Division, Head of Securities Division Sales, Head of North American Sales and Co-Head of the Americas Financing Group. He additionally served as a member of the firm’s Management Committee and co-headed its Risk Committee, Steering Committee on Regulatory Reform, Capital Committee and Finance Committee. Mr. Schwartz established the firm’s Investment Policy Committee on which he also served as a member. Prior to Goldman Sachs, Mr. Schwartz spent a decade working at several financial firms, including at Citicorp, from 1990 through 1997.

As both an investor and advisor, he is currently involved in a range of investment and philanthropic endeavors. These efforts include a focus on mental health and developing future business leaders, including women and young people seeking a career in finance. He serves as the group chairperson and non-executive director of The Bank of London, a clearing and payments bank with operations in London and New York City. In addition, Mr. Schwartz serves on the board of SoFi Technologies, Inc., a San Francisco-based fintech company, and One Mind, a nonprofit that accelerates collaborative research and advocacy to enable all individuals facing brain health challenges to build healthy, productive lives. Mr. Schwartz earned his BA from Rutgers University, where he is member of the university’s Board of Governors and its Hall of Distinguished Alumni. He received his MBA from Columbia University.

$376 Billion Top Private Equity Firm Carlyle Group CEO Kewsong Lee Resigns, Co-founder Bill Conway Appointed as Interim CEO and to Search for new CEO

11th August 2022 – Top private equity firm Carlyle Group with $376 billion assets under management CEO Kewsong Lee has resigned immediately ahead of his 5 years contract ending at the end of 2022 after contract renewal discussion failed, with Carlyle Group co-founder Bill Conway appointed as the interim CEO and a board formed to search for a new CEO. In 2021, Kewsong Lee had earned around $42 million and had requested for a pay package worth around $300 million for 5 years, in line with top private equity firms KKR & Apollo. In late 2017, Carlyle Group had named Kewsong Lee and Glenn Youngkin as co-CEOs, succeeding David Rubenstein & Conway as co-CEOs. In July 2022, Glenn Youngkin retired (Elected & won United States’ Virginia governorship 2021), with Kewsong Lee appointed as the sole CEO of Carlyle Group.

The Carlyle Group Statement

Global investment firm The Carlyle Group Inc. (Nasdaq: CG) (“Carlyle” or “the Company”) today announced changes in its executive leadership team. With Chief Executive Officer Kewsong Lee’s five-year employment agreement coming to a close at the end of 2022, both the Company’s Board of Directors and Mr. Lee mutually agreed as part of their discussions that the timing is right to initiate a search for a new CEO to lead Carlyle forward in its next phase of growth. Mr. Lee will step down today as CEO and a member of the Board of Directors. He will be available as needed to assist in a transition during the months ahead. The Board has appointed William Conway, Co-Founder, current Non-Executive Co-Chairman of the Board, and former Co-CEO, to serve as Interim CEO.

A newly-formed Search Committee of the Board will drive the search for a permanent successor. The Board’s Search Committee will include Mr. Conway as well as independent directors Lawton Fitt, Anthony Welters, Linda Filler, and Derica Rice. The Board will immediately engage an executive search firm to identify and assess candidates for the permanent CEO position.

Mr. Conway said, “The Board is grateful to Kewsong for everything he has done to position Carlyle for the future. As Carlyle undertakes this process to select a new leader, we do so from a position of strength, a testament to the performance of our talented team. Today, Carlyle is a more diversified, resilient firm with the resources to continue to invest in accelerating our growth trajectory. Looking ahead, our objective remains to execute on our vision of enhancing scale, speed, and performance in order to grow and deliver sustainable results, in any investment environment.”

Mr. Lee said, “I am grateful for my time at Carlyle and thankful for the opportunity to build the firm with an incredibly talented and committed team. I feel immense pride in our many accomplishments during these complex and challenging times, especially the firm’s record financial results, strong investment performance, and continued leadership on DEI and ESG initiatives. Diversified and durable, Carlyle is now well-positioned to capitalize on many exciting areas of attractive growth. I wish my colleagues at Carlyle well as they continue to set the highest standards for integrity and value creation in the asset management industry.”

To assist Mr. Conway as he fulfills his duties as Interim CEO and assure a seamless transition once a permanent successor has been identified, an Office of the CEO has been established. Peter Clare, Chief Investment Officer for Corporate Private Equity and Chairman of Americas Private Equity, Mark Jenkins, Head of Global Credit, Ruulke Bagijn, Head of Global Investment Solutions, Curtis Buser, Chief Financial Officer, Christopher Finn, Chief Operating Officer, and Bruce Larson, Chief Human Resources Officer, will comprise the Office of the CEO and will work alongside Mr. Conway to continue driving forward Carlyle’s strategy and build on the firm’s strong momentum. To further facilitate a seamless transition, Mr. Finn has agreed to defer his previously-announced retirement at the end of this year.

Ms. Fitt, Carlyle’s Lead Independent Director, said, “On behalf of the entire Board, I would like to thank Kewsong for his contribution to the Company during his tenure. Carlyle has built on its enviable legacy while diversifying its asset base and earnings streams, driving scale, and identifying new opportunities to further drive performance. Going forward, the Company will benefit from a fresh perspective to build upon its strengths and capitalize fully on its long-term future growth opportunities, regardless of macroeconomic headwinds. As the search for a permanent CEO proceeds, we are very pleased that Bill will lead Carlyle through this transition, as the Company remains focused on continuing to enhance value for its public shareholders and limited partners.”

Consistent with its previously-reported second quarter earnings results, the Company noted that, as of June 30, 2022, total Assets Under Management was $376 billion, of which $260 billion was fee earning, and available capital for future investment was $81 billion. The Company is again reaffirming its 2022 Fee Related Earnings target of $850 million, and its prior performance revenue guidance.

About William “Bill” Conway

Mr. Conway is a co-founder and current non-executive Co-Chairman of the Board. Mr. Conway was elected to our Board of Directors effective July 18, 2011. Previously, Mr. Conway served as our Co-Chief Executive Officer and Chief Investment Officer. Prior to forming Carlyle in 1987, Mr. Conway was the Senior Vice President and Chief Financial Officer of MCI Communications Corporation (“MCI”). Mr. Conway was a Vice President and Treasurer of MCI from 1981 to 1984. Mr. Conway is Chairman of the Board of Trustees of Johns Hopkins Medicine and a member of the Board of Trustees of the Catholic University of America. He previously served as chairman and/or director of several public and private companies in which Carlyle had significant investment interests. Mr. Conway received his BA from Dartmouth College and his MBA in finance from The University of Chicago Booth School of Business.

About Carlyle

Carlyle (NASDAQ: CG) is a global investment firm with deep industry expertise that deploys private capital across three business segments: Global Private Equity, Global Credit and Global Investment Solutions. With $373 billion of assets under management as of December 31, 2022, Carlyle’s purpose is to invest wisely and create value on behalf of its investors, portfolio companies and the communities in which we live and invest. Carlyle employs more than 2,100 people in 29 offices across five continents.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit