Hong Kong Socialite Abby Choi Age 28 Murdered in Suspected Multi-Million Dollar Property Dispute with Ex-Husband Family, Married to 2nd Husband Chris Tam Chuk Kwan Who is Son of Founder of Hong Kong Famous Yunnan Rice Noodle Restaurant TamJai Yunnan Mixian with $410 Million Market Value

4th March 2023 | Singapore

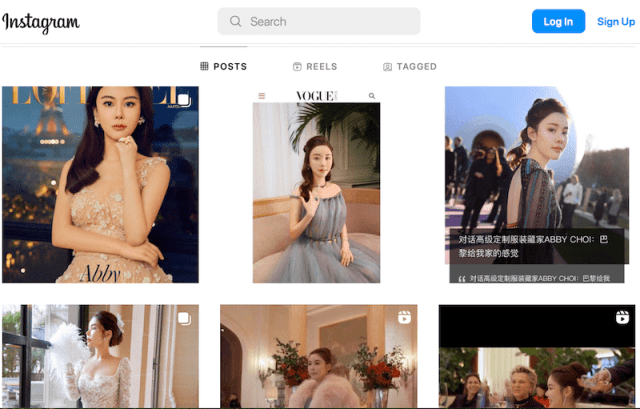

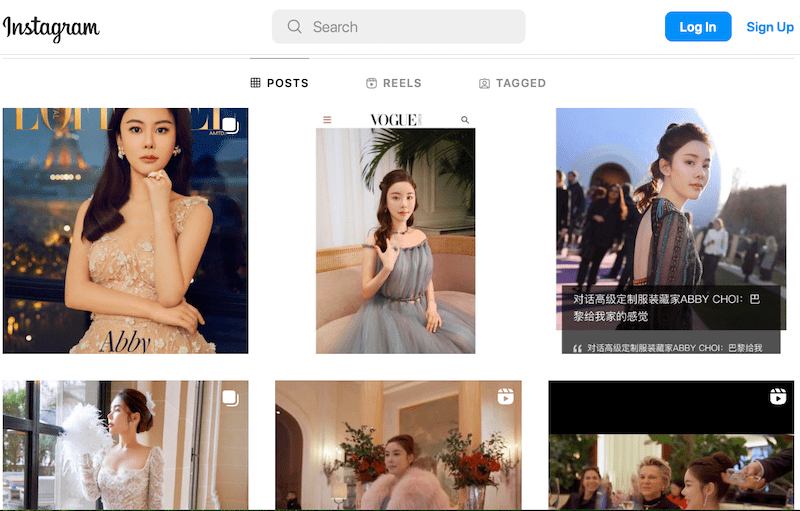

Hong Kong socialite Abby Choi (Age 28) was murdered (body dismembered, missing 21/2/23) in a suspected multi-million dollar property dispute with her ex-husband family (Age 18 to Alex Kwong, brother-in-law Anthony Kwong). Abby Choi married her 2nd husband Chris Tam Chuk Kwan in 2016 who is the son of founder (Tam Chap Kwan) of Hong Kong famous Yunnan rice noodle restaurant TamJai Yunnan Mixian. TamJai Yunnan Mixian was acquired in 2017 by parent company of Japan Marugame Seimen, TORIDOLL and listed as Tanmjai International in 2021 on Hong Kong Exchange (HKEX) with $410 million market value, . Abby Choi is a well-known social influencer in Hong Kong with around 100,000 Instagram followers. Abby Choi frequently appeared in fashion magazine, and was recently featured in the digital cover of the fashion lifestyle publication L’Officiel Monaco. Abby Choi has 4 children, 2 children with her ex-husband (Alex Kwong) and 2 children with her husband (Chris Tam Chuk Kwan).

“ Hong Kong Socialite Abby Choi Age 28 Murdered in Suspected Multi-Million Dollar Property Dispute with Ex-Husband Family, Married to 2nd Husband Chris Tam Chuk Kwan Who is Son of Founder of Hong Kong Famous Yunnan Rice Noodle Restaurant TamJai Yunnan Mixian with $410 Million Market Value “

Hong Kong Socialite Abby Choi Married to 2nd Husband Chris Tam Chuk Kwan Who is Son of Founder of Hong Kong Famous Yunnan Rice Noodle Restaurant TamJai Yunnan Mixian with $410 Million Market Value

Tam Jai International

We are a leading and renowned restaurant chain operator which operates TamJai Yunnan Mixian (譚仔雲南米線) and TamJai SamGor Mixian (譚仔三哥米線) branded fast casual restaurant chain specialising in mixian in Hong Kong with operations also in Mainland China, Singapore and Japan. The first restaurant under the Tamjai Yunnan Mixian brand in Hong Kong was opened in 1996 and the first restaurant under the TamJai SamGor Mixian brand in Hong Kong was opened in 2008.

“TamJai Yunnan Mixian” brand is a fast casual restaurant chain in Hong Kong with operations in Mainland China. Our brand has over 25 years of history and the first restaurant under the TamJai Yunnan Mixian brand in Hong Kong was opened in 1996. In 2021, we opened our first restaurant under TamJai Mixian brand in Mainland China.

“TamJai SamGor Mixian” brand is a fast casual restaurant chain in Hong Kong with operations in Singapore and Japan. Our brand has over 14 years of history and the first restaurant under the TamJai SamGor Mixian brand in Hong Kong was opened in 2008. In 2020 and 2022, we opened our first restaurant under our brand in Singapore and Japan respectively.

2021 Listing on Hong Kong Exchange

(Hong Kong, 7 October 2021) Shares of Tam Jai International Co. Limited (“TJI” or the “Company”; TJI together with its subsidiaries as the “Group”), a leading and renowned mixian specialised fast casual restaurant chain in Hong Kong, Mainland China and Singapore, commenced trading today on the Main Board of The Stock Exchange of Hong Kong Limited, under the stock code 2217.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit