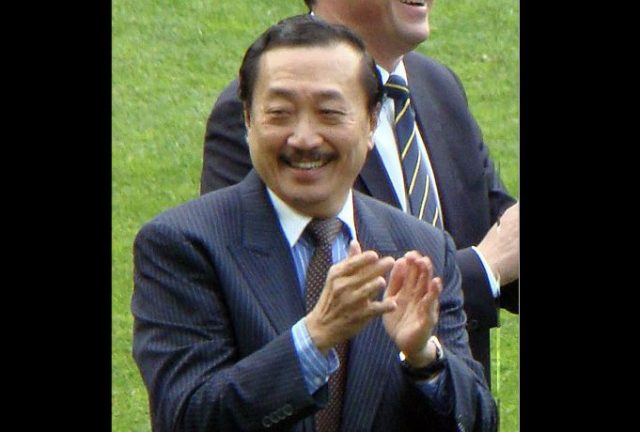

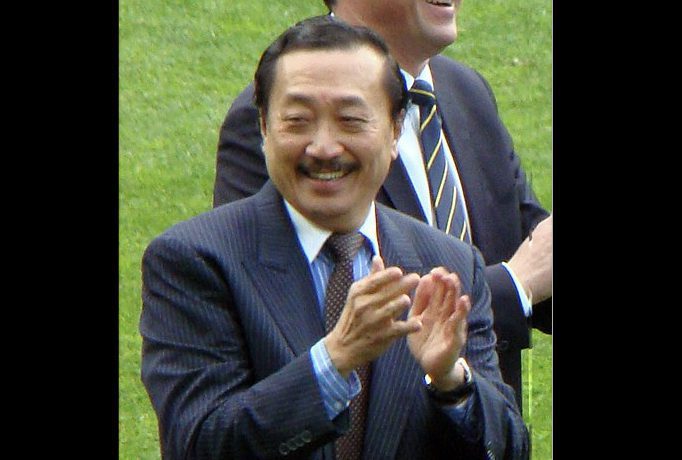

Malaysia Business Tycoon & Founder of Berjaya Corporation Vincent Tan with $900 Million Fortune Resigns as Chairman, Appoints Daughter of Johor State Sultan Tunku Tun Aminah Sultan Ibrahim Ismail as Chairman and All-Women Board Including Daughter Tan Sheik Ling

4th March 2023 | Hong Kong

Malaysia business tycoon, owner of English football club Cardiff City and founder of Berjaya Corporation Vincent Tan (Age 71) with around $900 million fortune has resigned as non-Executive Chairman, appointing daughter of Johor State Sultan Tunku Tun Aminah Sultan Ibrahim Ismail as Non-Executive Chairman and an all-women board including daughter Tan Sheik Ling. Berjaya Corporation goint-Group CEOs are Vivienne Cheng Chi Fan & Nerine Tan Sheik Ping (daughter of Vincent Tan), and are also Executive Directors. The other board directors are Norlela Baharudin & Chryseis Tan Sheik Ling, and non-Executive Directors are Dr. Jayanti Naidu G. Danasamy, Penelope Gan Paik Ling & Datuk Leong. Tan Sri Dato’ Seri Vincent Tan Chee Yioun is one of the most successful businessman in Malaysia founding Berjaya Corporation in 1984 (acquisition of Berjaya Industrial Berhad), growing the group into a conglomerate with businesses in retail, F&B, financial services, property, hotels, resorts, gaming, motor & telecommunications. His personal businesses include 7-Eleven Malaysia and English football club Cardiff City. In his early life, Vincent Tan had planned to study in New Zealand, but had joined banking as a clerk as his father business was failing. Thereafter, he sold life insurance for AIA, started businesses in trading, credit, insurance & real estate, and entered into a joint venture with Japanese insurer Tokio Marine & Fire Insurance (United Prime Insurance), and winning the McDonald’s franchise in Malaysia in 1982. In 1984, he founded Berjaya Corporation (acquisition of Berjaya Industrial Berhad).

“ Malaysia Business Tycoon & Founder of Berjaya Corporation Vincent Tan with $900 Million Fortune Resigns as Chairman, Appoints Daughter of Johor State Sultan Tunku Tun Aminah Sultan Ibrahim Ismail as Chairman and All-Women Board Including Daughter Tan Sheik Ling “

Malaysia Business Tycoon & Founder of Berjaya Corporation Vincent Tan with $900 Million Fortune Resigns as Chairman

Berjaya Corporation – The Berjaya Corporation group of companies’ history dates back to 1984 when our Founder, Tan Sri Dato’ Seri Vincent Tan Chee Yioun acquired a major controlling stake in Berjaya Industrial Berhad (originally known as Berjaya Kawat Berhad and now known as Reka Pacific Berhad) from the founders, Broken Hill Proprietary Ltd, Australia and National Iron & Steel Mills, Singapore. The shareholding change also resulted in a major change in the business, direction and the dynamic growth of a diversified conglomerate under the flagship of Berjaya Corporation Berhad (“BCorp”). In October 1988, following a major restructuring, Berjaya Group Berhad (then known as Inter-Pacific Industrial Group Berhad) became the holding company of Reka Pacific Berhad. Inter-Pacific Industrial Group Berhad (formerly known as Raleigh Berhad) was incorporated in 1967 as a bicycle manufacturer. In 1969, the Company gained official listing on Bursa Malaysia Securities Berhad (“Bursa Securities”). BCorp assumed the listing status of Berjaya Group Berhad on the Main Board of Bursa Securities upon the completion of the group restructuring exercise in October 2005 and the listing of the new shares on 3 January 2006. The Group is a diversified entity engaged in the following core businesses:

- Consumer Marketing, Direct Selling & Retail

- Financial Services

- Hotels, Resorts, Vacation Timeshare & Recreation Development

- Property Investment and Development

- Gaming & Lottery Management

- Environmental Services and Clean Technology Investment

- Motor Trading and Distribution

- Food & Beverage

- Telecommunications and Information Technology-related Services and Products

Executive Chairman, Tan Sri Dato’ Seri Vincent Tan Steps Back Into a Non-Executive Role

Berjaya Corporation Berhad (“BCorp”) Executive Chairman, Tan Sri Dato’ Seri Vincent Tan Chee Yioun announced today that he will be resigning from his position as Executive Chairman of BCorp, effective 5 April 2021. He will remain on the BCorp Board of Directors as Non-Executive Chairman. This is in line with his vision to transform the BCorp Group into an institutionalised corporation, managed by professionals. BCorp Group CEO, Abdul Jalil bin Abdul Rasheed who was appointed to the Board on 16 March 2021 has been mandated to transform the BCorp Group into a high performing organisation through streamlining the various group businesses to create and enhance shareholders’ value, optimising financial and human resources, improving synergies and efficiency as well as enhancing corporate governance and transparency.

Tan Sri Dato’ Seri Vincent Tan said, “With Jalil Rasheed on board as Group CEO, handling the strategic and operational decision-making and planning the future business direction of the BCorp Group, together with Executive Deputy Chairman, Dato’ Sri Robin Tan, I am confident that the BCorp Group is in capable hands and would be able to move forward progressively towards greater heights. It is also important to give Jalil space and freedom to run Berjaya in his own style. I can now take a step back from active day-to-day involvement in the Group’s businesses and devote more of my time and energy to promoting charitable initiatives and other interests. I have been blessed with my fortune and am thankful for the many opportunities Malaysia has given me. Now it’s time to give back.”

“I am particularly passionate about building affordably priced homes for Malaysians as housing is a basic need and essential for a person’s sense of dignity, safety and inclusion. In the last two years, the Better Malaysia Foundation has assembled a “brain trust” of like-minded professionals to help formulate innovative solutions to address the affordability gap faced by low-income Malaysians, namely the B40 households. We are launching a new social enterprise programme with one national goal, which is to assist our Government’s efforts in solving the home ownership needs for low-income Malaysians through innovative and sustainable solutions. Our Government has always been passionate about providing affordable homes for low-income Malaysians. We believe that the new social enterprise programme will be able to complement the Government’s affordable housing agenda.”

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit