$40 Billion Estee Lauder Family Pledged $200 Million to Non-Profit Alzheimer’s Drug Discovery Foundation to Support Research to Find a Cure, Estee Lauder Suffered from Alzheimer Disease

8th April 2023 | Hong Kong

The late Estee Lauder family with a family fortune of around $40 billion, has announced to pledge $200 million to non-profit Alzheimer’s Drug Discovery Foundation (ADDF) to support Alzheimer research to find a cure for the disease. The late Estee Lauder (1908 to 2004) & family members had suffered from Alzheimer disease. Estée Lauder was founded officially in 1946 by American Estée Lauder (Josephine Esther Mentzer) and her husband Joseph Lauder, selling a Super Rich All-Purpose Cream for skincare. In 1953, Estée Lauder started selling Youth-Dew, both a bath oil and perfume. Estée Lauder & Joseph Lauder married in 1930 (Estée Lauder died in 2004 at age 97, Joseph Lauder died in 1983 at age 80). Today, the Estée Lauder Companies is one of the world’s largest cosmetic group in the world, owning brands including Estée Lauder, Aramis, Clinique, Lab Series, Origins, M·A·C, La Mer, Bobbi Brown, Aveda, Jo Malone London, Bumble and bumble, Darphin Paris, TOM FORD BEAUTY, Smashbox, AERIN Beauty, Le Labo, and Editions de Parfums. United States Centers for Disease Control & Prevention – Alzheimer’s disease is the most common type of dementia. It is a progressive disease beginning with mild memory loss and possibly leading to loss of the ability to carry on a conversation and respond to the environment. Alzheimer’s disease involves parts of the brain that control thought, memory, and language. Founded in 1998 by co-chairmen Leonard Lauder and Ronald Lauder, the Alzheimer’s Drug Discovery Foundation (ADDF) is the only charity solely focused on finding drugs for Alzheimer’s. Alzheimer’s Drug Discovery Foundation (ADDF) CEO Mark Roithmayr: “Leonard and Ronald Lauder founded the organization in 1998 in honor of their mother, who had Alzheimer’s as did other members of her family.” See below for more info.

“ $40 Billion Estee Lauder Family Pledged $200 Million to Non-Profit Alzheimer’s Drug Discovery Foundation to Support Research to Find a Cure, Estee Lauder Suffered from Alzheimer Disease “

$40 Billion Estee Lauder Family Pledged $200 Million to Non-Profit Alzheimer’s Drug Discovery Foundation to Support Research to Find a Cure, Estee Lauder Suffered from Alzheimer Disease

Lauder family donates $200 million to Alzheimer’s drug discovery foundation for development of novel methods to prevent, diagnose, treat, and cure Alzheimer’s disease. Investment comes at critical time for Alzheimer’s field as biomarkers and clinical trials aimed at novel targets bring a new era of research

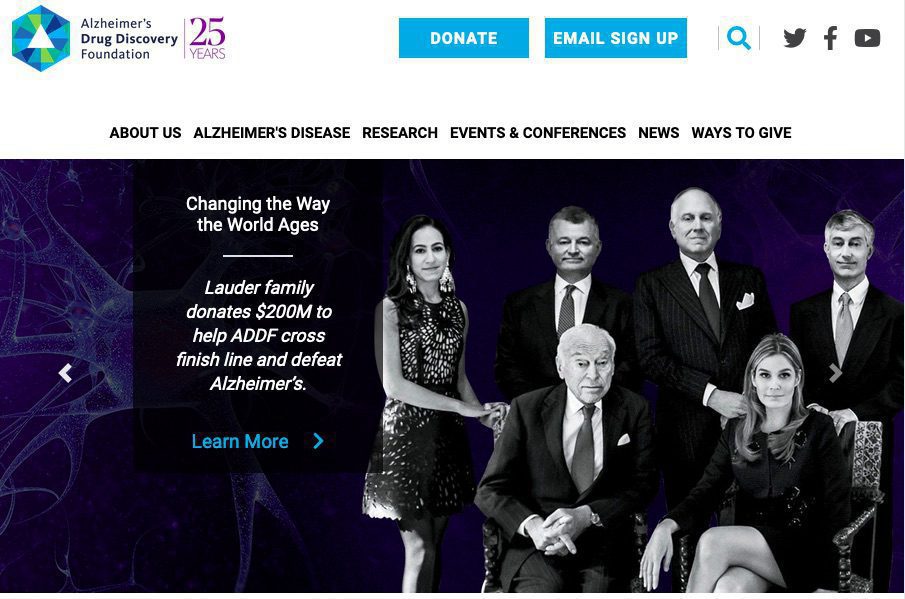

4th April 2023 – The Alzheimer’s Drug Discovery Foundation (ADDF) today announced that Leonard A. Lauder and Ronald S. Lauder, along with the entire third generation of their family, William Lauder, Gary Lauder, Aerin Lauder Zinterhofer, and Jane Lauder, have committed $200 million to accelerate the discovery and development of drugs to prevent and treat Alzheimer’s disease. This is the largest gift ever given to the ADDF – underscoring the Lauder family’s dedication to curing Alzheimer’s.

“With this extraordinary gift, the Lauders will continue what they began 25 years ago, when they founded the ADDF in honor of their mother, Mrs. Estée Lauder,” said Mark Roithmayr, Chief Executive Officer of the ADDF.

The members of the Lauder family have been at the forefront of philanthropic support for Alzheimer’s research and have become the nation’s leaders in private giving to combat the disease.

“Alzheimer’s disease doesn’t affect just one person, it impacts entire families,” said Leonard A. Lauder, Co-Chairman and Co-Founder of the ADDF. “That is why this family gift sets the stage for the next generation to tackle and ultimately end this devastating disease. We are seeing important progress, and we feel confident that this gift will build on the current momentum to cure Alzheimer’s disease.”

The gift comes at a critical time for the over six million Americans and their families currently living with Alzheimer’s as new breakthroughs emerge with the approval of several anti-amyloid therapies. These advances were made possible through new diagnostic tools, such as the Amyvid PET scan, that have revolutionized Alzheimer’s research, making clinical trials more accurate and efficient. The ADDF provided early funding for the scan, which played a critical role in getting these drugs across the finish line by tracking their ability to clear amyloid.

“When my brother and I began this project 25 years ago, there was little hope on the horizon for Alzheimer’s disease,” said Ronald S. Lauder, Co-Chairman and Co-Founder of the ADDF. “We are proud of the undeniable impact the ADDF has made over the past two decades and we are more confident than ever for the future. As this research continues to progress, we will have prevention programs to slow this disease before it begins, diagnostic tools to tell us what each person’s disease looks like, and effective treatments to eradicate it for future generations.”

The next step for the ADDF is to help bring to market a new generation of drugs that are based on an understanding of the biology of aging that can be used in combination with anti-amyloid therapies to stop Alzheimer’s in its tracks. This work is already well under way, with 75% of the clinical trials in today’s robust and diverse drug pipeline aimed at novel targets. The Lauder family gift will fuel the ADDF to advance this next generation of drugs more quickly by allowing the organization to explore the full potential of the current pipeline and move the most promising research forward.

Novel biomarkers will be key to developing personalized approaches that tailor drug combinations to each patient’s unique disease pathology, improving clinical trial designs and allowing researchers to identify which patients will benefit most from which drugs.

“This is an incredibly exciting time for the field, and we would not be here without the vision and outstanding commitment and leadership of the Lauder family,” said Dr. Howard Fillit, Co-Founder and Chief Science Officer of the ADDF. “Many of the most promising treatments being studied right now are based on our understanding of the biology of aging, an approach long supported by the ADDF, which focuses on the many processes that go wrong in the aging brain to cause Alzheimer’s. We believe we will conquer this disease using precision medicine approaches that have been successful in preventing and treating other diseases of chronic aging, such as cancer. The biomarkers being developed by the ADDF’s Diagnostics Accelerator will play a key role, allowing us to pinpoint the best drugs to target the specific causes of each patient’s Alzheimer’s.”

Established in honor of Mrs. Estée Lauder in 1998, the ADDF was founded on a venture philanthropy model, positioning it to address a critical gap in Alzheimer’s research through funding innovative and promising science while investing all returns directly back into the pipeline. The ADDF’s model has garnered the attention and support of many of the world’s leading philanthropists, including Bill Gates, Jeff Bezos, and MacKenzie Scott, as well as industry leaders Biogen and Eli Lilly and Company. With this new gift from the Lauder family, the ADDF expects to inspire further collaboration among leaders in philanthropy, industry, academia, and government.

“This extraordinary gift from the Lauder family will change the way the world ages,” said Mark Roithmayr. “This disease cannot be solved in a vacuum, and the Lauder family understands no one goes through Alzheimer’s alone. This gift enables the ADDF to continue convening the world’s best and brightest minds to solve this disease while reinvesting every penny back into the science and innovating the drug pipeline.”

Founded in 1998 by co-chairmen Leonard A. and Ronald S. Lauder, the Alzheimer’s Drug Discovery Foundation (ADDF) is the only charity solely focused on finding drugs for Alzheimer’s.

OUR FUNDING MODEL

We follow a venture philanthropy model, funding breakthrough research in academia and the biotech industry. Through the tremendous support of our donors, the ADDF has awarded nearly $250 million to fund over 720 Alzheimer’s drug discovery programs, biomarker programs and clinical trials in 19 countries. Twenty percent of the drugs in clinical development for Alzheimer’s disease received support from the ADDF.

OUR STRATEGY

The ADDF focuses on translating the knowledge we have gained about the causes of Alzheimer’s disease into drugs to conquer it. We support an underfunded area—preclinical drug discovery and early-stage clinical trials of potential drug targets—that is often called the “valley of death” because it’s where good ideas go to die. These projects hold great promise, but also great risk. And most are not far enough along in the drug development pipeline to attract financial support from the pharmaceutical industry, federal funders, or other major partners. By assuming the risk and bridging this critical gap in funding, the ADDF enables leading scientists to pursue pioneering ideas to cure Alzheimer’s disease that would otherwise go unexplored.

OUR FUTURE

Today, Alzheimer’s disease affects more than 50 million people and is the only top 10 cause of death that cannot be prevented, cured or slowed. But we have the power to stop this devastating disease in its tracks. By advancing the most promising research across the globe, we will conquer Alzheimer’s disease.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit