Singapore Water Company Hyflux Former CEO Olivia Lum Received 3 More Charges for Breaching Duties as Director, Charged in 2022 Alongside CFO & 4 Independent Directors for Securities Disclosure Offences with DBS Investigated for Role in 2011 Hyflux 6% Preference Share Issuance

5th May 2023 | Hong Kong

Singapore “Water Company of the Year in 2006” Hyflux former CEO Olivia Lum has received 3 more charges for breaching duties as director. In 2022 November, Olivia Lum, former CFO & 4 independent directors were charged for securities disclosure offences in Singapore court, with Singapore largest bank DBS Bank investigated for its role in the offering of 2011 Hyflux 6% Preference Share. More info below.

“ Singapore Water Company Hyflux Former CEO Olivia Lum Received 3 More Charges for Breaching Duties as Director, Charged in 2022 Alongside CFO & 4 Independent Directors for Securities Disclosure Offences with DBS Investigated for Role in 2011 Hyflux 6% Preference Share Issuance “

Singapore Water Company Hyflux CEO Olivia Lum, CFO & 4 Independent Directors Charged for Securities Disclosure Offences, DBS Investigated for Role in 2011 Hyflux 6% Preference Share Issuance

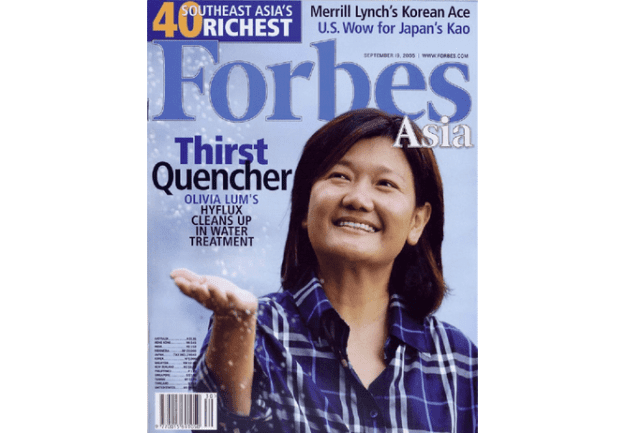

17th November 2022 – Singapore “Water Company of the Year in 2006” Hyflux former CEO, CFO & 4 independent directors had been charged for securities disclosure offences in Singapore court, with Singapore largest bank DBS Bank investigated for its role in the offering of 2011 Hyflux 6% Preference Share. The individuals charged include Hyflux former CEO Olivia Lum Ooi Lin under the Securities & Futures Act (SFA) and Companies Act (CA), for agreeing not to release information of Singapore Tuaspring integrated water & power project (disclosures required under the listing rules of the Singapore Exchange, SGX), not releasing the same information in the offering of 2011 Hyflux 6% Preference Share, and failing to ensure accounting standards for its financial statements for the FY2017. Former CFO Cho Wee Peng, and the 4 independent directors (Teo Kiang Kok, Gay Chee Chong, Murugasu Christopher & Rajskar Kuppuswami Mitta) are also charged for failing to disclose information on Tuaspring. Hyflux was founded as Hydrochem in 1989 by Olivia Lum Ooi Lin, who was one of Singapore’s most successful woman entrepreneur, with only S$20,000 in capital. Olivia Lum grew Hyflux into a billion-dollar company (market capitalisation), had net worth of more than $200 million, and was named EY World Entrepreneur of the Year in 2011 (Singapore). In 2018, Hyflux filed for bankruptcy with a total debt of S$1.17 billion.

Hyflux Investigation

Hyflux was founded as Hydrochem in 1989 by Olivia Lum Ooi Lin, who was one of Singapore’s most successful woman entrepreneur, with only S$20,000. Olivia grew the company into a billion company (market capitalisation), had net worth of more than $200 million, and was named EY World Entrepreneur of the Year in 2011 (Singapore). In 2018, Hyflux filed for bankruptcy with a total debt of S$1.17 billion.

The investigations were conducted by Commercial Affairs Department (CAD) of the Singapore Police Force (SPF), the Monetary Authority of Singapore (MAS) and the Accounting and Corporate Regulatory Authority (ACRA).

If convicted, they face imprisonment of up to seven years, a fine not exceeding $250,000, or both on each charge under the SFA section 203; imprisonment of up to two years, a maximum fine of $150,000 or both on each section 253 SFA charge, and a maximum fine of $50,000 on the charge under the Companies Act.

Joint Singapore News Release: SPF, MAS, ACRA

- Singapore Police Force (SPF)

- Monetary Authority of Singapore (MAS)

- Accounting and Corporate Regulatory Authority (ACRA)

Singapore, 17 November 2022… The former Chief Executive Officer of Hyflux Ltd (Hyflux), Ms Lum Ooi Lin, its former Chief Financial Officer, Mr Cho Wee Peng, and four independent directors of Hyflux at the material time were charged in court today for disclosure-related offences under the Securities and Futures Act (SFA). Ms Lum was further charged with an offence under the Companies Act (CA) for her failure in ensuring Hyflux’s compliance with accounting standards.

2. The charges followed joint investigations carried out by the Commercial Affairs Department of the Singapore Police Force, the Monetary Authority of Singapore and the Accounting and Corporate Regulatory Authority (ACRA) (collectively, the Authorities). They are as follows:

Against Lum Ooi Lin:

(a) One count of section 203(2) read with section 331(1) SFA, for consenting to Hyflux’s intentional failure to disclose information relating to the Tuaspring Integrated Water and Power Project (Tuaspring), when such disclosure was required under the Singapore Exchange Listing Rules (Listing Rules);

(b) One count of section 253(1)(b) read with sections 253(4)(b)(i) and 277(3) SFA for Hyflux’s omission to state the same information relating to Tuaspring in the 2011 Offer Information Statement (2011 OIS). The 2011 OIS was issued for the offer of S$200 million, 6% preference shares on 13 April 2011; and

(c) One count of section 201(5) read with section 204(1) CA for failing to ensure that Hyflux made disclosures required under the accounting standards for its financial statements for the financial year ended 31 December 2017. This included the failure to disclose the breach of a subsidiary’s loan agreement that permitted its lenders to demand accelerated repayment.

Against Cho Wee Peng:

(a) One count of section 203(2) read with section 331(1) SFA for conniving in Hyflux’s intentional failure to disclose information relating to Tuaspring, when such disclosure was required under the Listing Rules.

Against four Independent Directors of Hyflux, namely Teo Kiang Kok, Gay Chee Chong, Murugasu Christopher and Rajskar Kuppuswami Mitta:

(a) One count each of section 203(2) read with section 331(1) SFA, for their neglect in connection with Hyflux’s intentional failure to disclose information relating to Tuaspring, when such disclosure was required under the Listing Rules; and

(b) One count each of section 253(1)(b) read with sections 253(4)(b)(i) and 277(3) SFA, for Hyflux’s omission to state the same information in the 2011 OIS.

3. If convicted, the accused persons face:

(a) imprisonment of up to seven years, a fine not exceeding $250,000, or both, on each section 203 SFA charge;

(b) imprisonment of up to two years, a fine of not exceeding $150,000, or both, on each section 253 SFA charge; and

(c) a fine not exceeding $50,000, on the CA charge.

4. The Authorities have also, in relation to the 2011 OIS, investigated DBS Bank Ltd under section 253(4)(d) of the SFA for its role as issue manager in the offer, and no further action will be taken after reviewing the evidence obtained.

5. The outcome of ACRA’s inspectionon the audits conducted by KPMG, the auditors of Hyflux, will be finalised in due course.

Additional Information:

Securities and Futures Act (Cap 289, 2006 Rev Ed) (SFA)

Section 203(2) SFA

Section 203(2) SFA provides that an entity, the securities of which are listed for quotation on a securities exchange, shall not intentionally, recklessly or negligently fail to notify the securities exchange of such information as is required to be disclosed by the securities exchange under the listing rules or any other requirement of the securities exchange, if the person is required by the securities exchange under the listing rules or any other requirement of the securities exchange to notify the securities exchange of information on specified events or matters as they occur or arise for the purpose of the securities exchange making that information available to a securities market operated by the securities exchange.

Rule 703(1)(a) of the SGX Listing Rules provides that an issuer must announce any information known to the issuer concerning it or any of its subsidiaries or associated companies which is necessary to avoid the establishment of a false market in the issuer’s securities.

Section 253 SFA

Section 253(1)(b) read with 253(4)(b)(i) SFA provides that in the case of an offer made by an entity, each director or equivalent person of the entity shall be guilty of an offence, where an offer of securities is made in or accompanied by a prospectus, and there is an omission to state any information required to be included in the prospectus under section 243 or there is an omission to state any information required to be included in the profile statement under section 246, as the case may be.

Section 331(1) SFA

Section 331(1) SFA provides that where an offence under this Act committed by a body corporate is proved to have been committed with the consent or connivance of, or to be attributable to any neglect on the part of an officer of the body corporate, the officer as well as the body corporate shall be guilty of that offence and shall be liable to be proceeded against and punished accordingly.

Companies Act (Cap 50, 2006 Rev Ed) (CA)

Section 201(5) CA

Section 201(5) CA provides that directors of a company are responsible for laying before the company, at its annual general meeting, consolidated financial statements that comply with the requirements of the prescribed accounting standards in Singapore, and give a true and fair view of the financial position and performance of the company.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit