Berkshire Hathaway Warren Buffett Donates $4.6 Billion of Shares to 5 Charities Including Bill & Melinda Gates Foundation, Warren Buffett Has No Debt & Remaining Berkshire Hathaway A Shares Valued at $112 Billion Representing 99% of Net Worth

29th June 2023 | Hong Kong

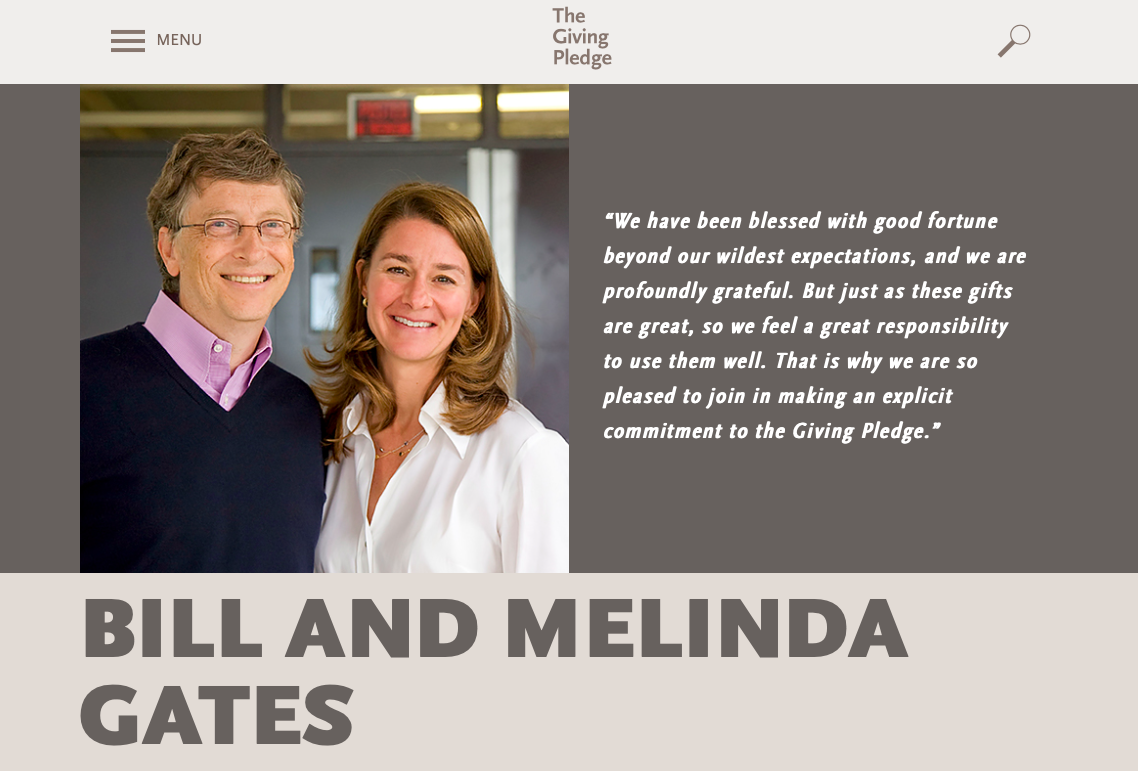

Berkshire Hathaway Chairman Warren Buffett has donated $4.6 billion of shares to 5 charities including Bill & Melinda Gates Foundation. Warren Buffett has no debt and has Berkshire Hathaway Class A Shares valued at around $112 billion representing 99% of his net worth. Warren Buffett has 218,287 Berkshire Hathaway Class A shares and 344 Class B Berkshire Hathaway shares. Warren Buffett is a founder of The Giving Pledge, a moral commitment by the world’s wealthiest to give the majority of their wealth to charitable causes. The Giving Pledge is a global philanthropic movement launched in 2010 by Microsoft chairman Bill Gates & Melinda Gates along with Berkshire Hathaway chairman Warren Buffett with a total of 40 billionaires.

“ Berkshire Hathaway Warren Buffett Donates $4.6 Billion of Shares to 5 Charities Including Bill & Melinda Gates Foundation, Warren Buffett Has No Debt & Remaining Berkshire Hathaway A Shares Valued at $112 Billion Representing 99% of Net Worth “

The Giving Pledge

Bill Gates, who founded the Giving Pledge together with Melinda French Gates and Warren Buffett: “I’ve always believed that if you’re in a position to help somebody, you should do it. It’s great to welcome this new group of philanthropists to the Giving Pledge community as we continue to learn from each other and find new ways to maximize the positive impact of our philanthropy.”

Melinda French Gates:“I’m inspired to see how the Giving Pledge has grown into a movement of over 230 philanthropists from around the world who are committed to giving away the vast majority of their wealth to address some of the most pressing issues in our society.”

The Giving Pledge is a global philanthropic movement launched in 2010 by Microsoft chairman Bill Gates and Melinda Gates along with Berkshire Hathaway chairman Warren Buffett with a total of 40 billionaires. The Giving Pledge is a moral commitment by the world’s wealthiest to give the majority of their wealth to charitable causes.

Notable names are:

- Facebook founder Mark Zuckerberg and Priscilla Chan ($103 billion)

- Tesla founder Elon Musk ($162 billion)

- Oracle founder Larry Ellison ($90 billon)

- Virgin Group founder Richard Branson and Joan Branson. ($5 billion)

- Linkedin founder Reid Hoffman and Michelle Yee ($2 billion)

- David Rockefeller, deceased 2017 (3.8 billion)

Notable names from finance are:

- Bridgewater Associates founder Ray Dalio & Barbara Dalio ($20 billion)

- Blackstone founder Stephen Schwarzman ($23 billion)

- Carlyle Group founder David Rubeinstein ($4 billion)

- Bloomberg founder Michael Bloomberg ($59 billion)

- Icahn Enterprises founder Carl Icahn ($15 billion)

- Tudor Investment founder Paul Tudor Jones and Sonia ($7 billion)

(2021 net worth)

Signers of the Giving Pledge

Signers of the Giving Pledge commit to give the majority of their wealth to philanthropy, either during their lifetimes or in their wills.

To Join the Giving Pledge

To join the Giving Pledge, billionaires will need to have at least $1 billion in personal net worth and and are ready to make a public pledge to donate the majority of their personal wealth to philanthropy. Visit: The Giving Pledge

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit