Former Citigroup CEO Mike Corbat & Investors Buy Jackson Hole Mountain Resort from Kemmerers Family after 31 Years of Ownership & $300 Million in Investments

11th August 2023 | Hong Kong

Former Citigroup CEO Mike Corbat and investors have bought Jackson Hole Mountain Resort from the Kemmerers family after 31 years of ownership & $300 million in investments into Jackson Hole Mountain Resort. Jackson Hole Mountain Resort: “After 31 years of ownership, the Kemmerer family today announced its intent to sell Jackson Hole Mountain Resort (JHMR). The Kemmerer family bought JHMR in 1992, and their passion, dedication and commitment turned the Resort into a world-class destination. As the Kemmerers watched the consolidation of the ski industry, their highest priority was maintaining JHMR’s status as an independent, family-owned Resort. Owners Jay, Connie and Betty Kemmerer found the perfect buyers: Teton County residents, close Kemmerer family friends and JHMR Board Members Eric Macy, Mike Corbat, their families and a small, select group of co-investors.” See below for full statement:

“ Former Citigroup CEO Mike Corbat & Investors Buy Jackson Hole Mountain Resort from Kemmerers Family after 31 Years of Ownership & $300 Million in Investments “

Former Citigroup CEO Mike Corbat & Investors Buy Jackson Hole Mountain Resort from Kemmerers Family after 31 Years of Ownership & $300 Million in Investments

- Jackson Hole Mountain Resort Plans to Sell to Local Families

8th August 2023 – After 31 years of ownership, the Kemmerer family today announced its intent to sell Jackson Hole Mountain Resort (JHMR). The Kemmerer family bought JHMR in 1992, and their passion, dedication and commitment turned the Resort into a world-class destination. As the Kemmerers watched the consolidation of the ski industry, their highest priority was maintaining JHMR’s status as an independent, family-owned Resort. Owners Jay, Connie and Betty Kemmerer found the perfect buyers: Teton County residents, close Kemmerer family friends and JHMR Board Members Eric Macy, Mike Corbat, their families and a small, select group of co-investors.

“The time has come to transition ownership of Jackson Hole Mountain Resort. We take great pride in what JHMR has become and what it represents to the Jackson Hole community and the state of Wyoming,” said Jay Kemmerer. “It is of utmost importance to me that the next ownership maintains the integrity and character of the mountain that we have worked so hard to build over the past three decades. There is no better fit for this ownership transition than Eric and Mike and their families, who share the same vision for the future of JHMR and its importance to our great community. I’m excited and proud to pass along this iconic, family-run ski resort to these two strong Jackson Hole families.”

Reflecting on the Kemmerers’ Legacy

During over three decades of ownership, the Kemmerers reached many proud milestones and are grateful for all the help they have received along the way. Jay Kemmerer shared some of his family’s thanks: “My family and I would like to thank Paul McCollister for providing us with an incredible platform to work with, Jerry Blann for 23 years of partnering with us in growing the Resort with accomplishments such as the Resort Master Plan and the Teton Village Master Plan, Mary Kate Buckley for five years of wonderful strategic leadership including expertly guiding our Resort through the COVID-19 pandemic and all our amazing former and current JHMR employees.”

Under Jay’s leadership as chairman, the Kemmerers have invested over $300 million in capital improvements, and their efforts to improve the Resort and the experience at JHMR for employees, guests and the community will have an everlasting impact. Jay’s vision to make JHMR a world-class resort led to many important milestones, including:

- Replaced or built new every lift at JHMR, with Sublette being the final lift to be replaced in 2024

- Constructed a new $31 million Aerial Tram in 2008 during the financial crisis

- Built the Bridger Gondola and the Bridger Center in the winter of 1997/1998

- Helped with the creation of the Teton Village Master Plan, which was approved in 1998

- Supported Jerry Blann in the formation of the Teton Village Association, followed by the Teton Village Resort District several years later

- Encouraged the establishment of Jackson Hole Air to support direct flights to Jackson, now available from 13 destinations

- Purchased the Stilson property and subdivided it into Stilson Residences and the Stilson Transit Center

- Built Sweetwater Gondola in 2017 to service Solitude Station, which was built in 2018/2019 and is regarded as the premiere learning center in the West for the Mountain Sports School

- Championed Resort leadership in the development of the new Mountain Master Plan in 1996

- In 2019, switched to 100% green energy, making it the largest resort in North America to run on green power

- Consistently invested in employee housing throughout Teton County

- In 2021, began managing capacity at JHMR to elevate the guest and employee experience, with many ski areas subsequently following JHMR’s lead

Beyond driving the successful evolution of JHMR, the Kemmerer family has a long history of steadfast support in the local Jackson community and the state of Wyoming at large. They have made significant, ongoing contributions to entities such as St. John’s Health, Teton County Search and Rescue, the Community Foundation of Jackson Hole, Friends of Pathways, Grand Teton National Park Foundation, Teton Science School and the University of Wyoming — among many others.

Eric Macy: Cultivating the JHMR Legacy

“Mike and I are honored to have the opportunity to carry on the legacy of this world-class ski resort,” said JHMR Board Member and new owner Eric Macy. “We want to thank everyone at JHMR in advance for their support as we begin this next stage and are committed to our ownership for decades. We appreciate all the hardworking employees and members of the Jackson Hole community who have played an integral part in building JHMR into the ski mountain we know and love today. It is our privilege to continue cultivating an authentic resort experience that is treasured by locals and visitors alike. We look forward to many amazing winter and summer seasons to come.”

Eric Macy joined the JHMR board of directors in 2014. His career spans more than 35 years with experience in financing, restructuring, stabilization and growth of private and public companies in myriad industries. Eric’s unique background includes experience in institutional finance and corporate operations. Eric began his career at New York investment bank Donaldson, Lufkin & Jenrette in 1986, holding multiple roles there until 1991. He then moved to Jefferies & Co., an internationally recognized investment banking firm also headquartered in New York, where he held various positions until 2006. A full-time resident of Jackson, Eric has founded and operated multiple successful companies since 2007. Married for 33 years, Eric and Dana Macy and their three children proudly call Jackson their home.

Mike Corbat: Building on Tradition

“Jackson Hole Mountain Resort’s legendary runs, couloirs and iconic features have provided the quintessential ski mountain experience for decades. Coupled with an enthusiastic skier base and a dedicated community, JHMR defines what it means to be a best-in-class ski resort. We will work hard to preserve the cherished aspects of the ski mountain and continue building on the mountain’s storied tradition,” said JHMR Board Member and new owner Mike Corbat. “We are excited to partner with the mountain’s exceptional team to continue developing JHMR’s best-in-class guest experience and unique brand.”

Mike Corbat joined the JHMR board of directors in October 2021 after retiring from Citigroup after 38 years where he led as CEO from 2012 to 2021. Mike leveraged Citi’s unique global network to serve its institutional and consumer banking clients with an emphasis on strong execution and exceptional client experience. In the process, Mike made Citi a simpler, smaller, safer and stronger institution and significantly improved the quality and consistency of Citi’s earnings. Mike is a longtime Jackson resident and an enthusiastic fly fisherman, golfer and downhill skier. He and his wife, Donna, reside in Wilson and have two married children and three grandchildren.

What Comes Next — Continuing a World-Class Legacy

Following the transition, Jay will remain actively involved in JHMR as a part of the new ownership group and as a board and executive committee member, providing his expertise and insight and helping to guide the strategic direction of the Resort.

Mike and Eric do not anticipate any changes to current business operations. Having served alongside Jay and Connie as board members, Eric and Mike have had key input into and approval of all of JHMR’s current operating and financial plans. They endorse these plans and do not foresee change. They look forward to continuing to invest in JHMR improvements, employees and the community while maintaining JHMR’s world-class reputation. Mike and Eric and their families take great pride in the long-term stewardship of JHMR and look forward to decades of continued success.

The transaction is subject to customary closing conditions and approvals and is anticipated to close by end-of-year 2023. Financial details of the private transaction will not be disclosed.

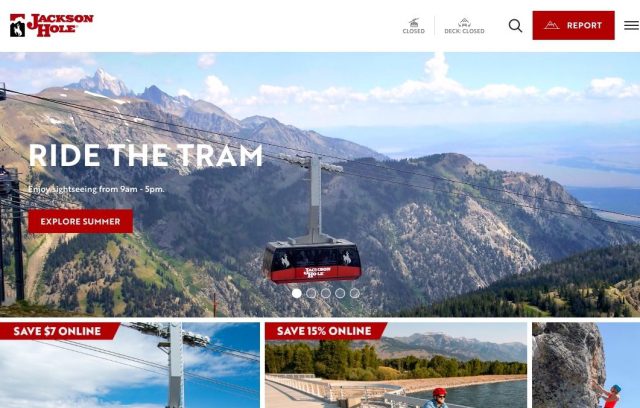

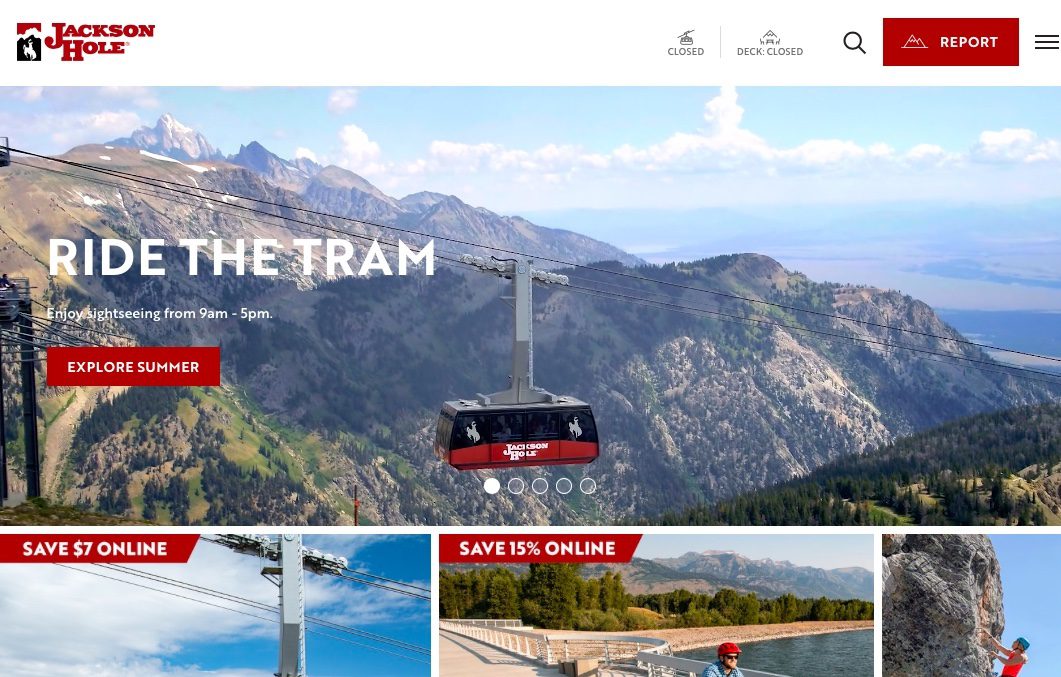

About Jackson Hole Mountain Resort

Jackson Hole Mountain Resort (JHMR), located in Teton Village, Wyoming, is a values-led, family-owned, iconic mountain destination with a purpose of enriching the lives of its guests, employees and community through authentic and memorable big mountain experiences only found in the Tetons. Jackson Hole famously delivers the finest powder snow with 4,139 continuous vertical feet of legendary terrain and 2,500 acres of the best beginner, intermediate and expert terrain. The neighboring Grand Teton and Yellowstone National Parks, and operating in the Bridger-Teton National Forest, make Jackson Hole an exceptional and unique global destination. With an enduring commitment to the surrounding landscape, wildlife and authentic community character, JHMR strives to live by its values to reduce environmental impact. In doing so, it runs 100% of its operations on green power.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit