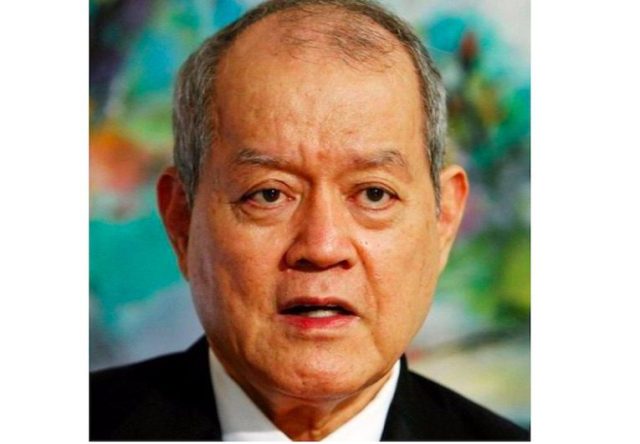

Singapore Oil Tycoon Lim Oon Kuin Court Trial Begins on 10th August 2023 for Fraud over Collapsed Hin Leong Trading with $3.5 Billion Owed to Banks Including $111.7 Million from HSBC for Invoice Financing, Children Evan Lim & Lim Huey Ching Included in Trial & Also Jointly Responsible for All Debts

11th August 2023 | Hong Kong

Singapore oil tycoon Lim Oon Kuin court trial has began on 10th August 2023 for fraud over collapsed Hin Leong Trading with $3.5 billion owed to banks including $111.7 million from HSBC for invoice financing. Lim Oon Kuin children Evan Lim (Son) and Lim Huey Ching (Daughter) are also included in the trial and are jointly responsible for all debts. The liquidators are seeking to recover the $3.5 billion to pay off the company’s debt including $90 million dividends to be returned, and the company had been “insolvent” since 2012. Lim Oon Kuin is charged for cheating HSBC and instigating an employee to forge false contract record, involving $111.7 million from HSBC. In 2020 April, Hin Leong Trading informed HSBC that it is facing liquidity issues and his 2 children Lim Huey Ching and Lim Chee Meng joined in a teleconference call with HSBC. HSBC was informed of a miscommunication for invoice financing of contracts with CAO and Unipec, but the contracts had not finalised with CAO and Unipec. In the same month in 2020 April, Commercial Affairs Department of the Singapore Police Force opened an investigation and HSBC contacted CAO and Unipec (20/4/20) but were told the transactions did not occur. The next day (21/4/20), HSBC lodged a police report for false invoice financing documents submitted. Lim Oon Kuin is currently on bail for S$4 million. Lim Oon Kuin founded Hin Leong in 1963 at age 20, and in 2020, had a net worth of around $2 billion. Lim Oon Kuin criminal trial will be in October 2023.

“ Singapore Oil Tycoon Lim Oon Kuin Court Trial Begins on 10th August 2023 for Fraud over Collapsed Hin Leong Trading with $3.5 Billion Owed to Banks Including $111.7 Million from HSBC for Invoice Financing, Children Evan Lim & Lim Huey Ching Included in Trial & Also Jointly Responsible for All Debts “

Singapore Oil Tycoon Lim Oon Kuin Court Trial Begins for Fraud over Collapsed Hin Leong Trading with $3.5 Billion Owed to Banks, Including $111.7 Million from HSBC for Invoice Financing

15th April 2023 – Singapore oil tycoon Lim Oon Kuin court trial has began for fraud over collapsed Hin Leong Trading with $3.5 billion owed to banks, including $111.7 million from HSBC for invoice financing. Lim Oon Kuin is charged for cheating HSBC and instigating an employee to forge false contract record. In 2020 April, Hin Leong Trading informed HSBC that it is facing liquidity issues and his 2 children Lim Huey Ching and Lim Chee Meng joined in a teleconference call with HSBC. HSBC was informed of a miscommunication for invoice financing of contracts with CAO and Unipec, but the contracts had not finalised with CAO and Unipec. In the same month in 2020 April, Commercial Affairs Department of the Singapore Police Force opened an investigation and HSBC contacted CAO and Unipec (20/4/20) but were told the transactions did not occur. The next day (21/4/20), HSBC lodged a police report for false invoice financing documents submitted. Lim Oon Kuin is currently on bail for S$4 million. Lim Oon Kuin founded Hin Leong in 1963 at age 20, and in 2020, had a net worth of around $2 billion.

Singapore Oil Tycoon Lim Oon Kuin Court Trial Begins for Fraud over Collapsed Hin Leong Trading with $3.5 Billion Owed to Banks, Including $111.7 Million from HSBC for Invoice Financing

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit