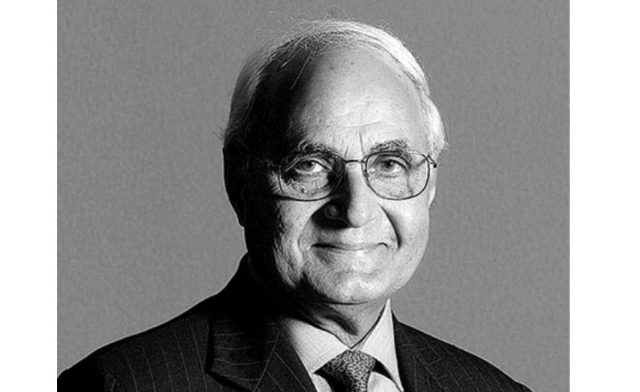

India Property Billionaire & DLF Chairman & CEO Kushal Pal Singh Fortune Increased to $15 Billion, DLF Limited is India Largest Public-Listed Real Estate Company Founded by Father-in-Law Chaudhary Raghvender Singh in 1946

25th November 2023 | Hong Kong

India property billionaire & DLF Chairman & CEO Kushal Pal Singh (KP Singh) fortune has increased to $15 billion. DLF Limited is India largest public-listed real estate company, founded by Kushal Pal Singh’s father-in-law Chaudhary Raghvender Singh in 1946. DFL: “Founded in 1946 by Chaudhary Raghvendra Singh, DLF started with the creation of 22 urban colonies in Delhi. In 1985, the company expanded into the then-unknown region of Gurugram, creating exceptional living and working spaces for the new Indian global professionals. Today, DLF is the largest publicly listed real estate company in India, with residential, commercial, and retail properties in 15 states and 24 cities.”

” India Property Billionaire & DLF Chairman & CEO Kushal Pal Singh Fortune Increased to $15 Billion, DLF Limited is India Largest Public-Listed Real Estate Company Founded by Father-in-Law Chaudhary Raghvender Singh in 1946 “

DLF

Founded in 1946 by Chaudhary Raghvendra Singh, DLF started with the creation of 22 urban colonies in Delhi. In 1985, the company expanded into the then-unknown region of Gurugram, creating exceptional living and working spaces for the new Indian global professionals. Today, DLF is the largest publicly listed real estate company in India, with residential, commercial, and retail properties in 15 states and 24 cities.

Our diverse verticals reflect our dedication to developing ecosystems for India’s changing needs. But our foundation has always been our employees, our customers, our stakeholders, and our shareholders. We invest in spearheading innovation through empowerment and optimism, in order to build the foundation of India’s future on the legacy of our past.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit