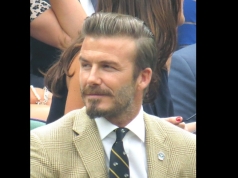

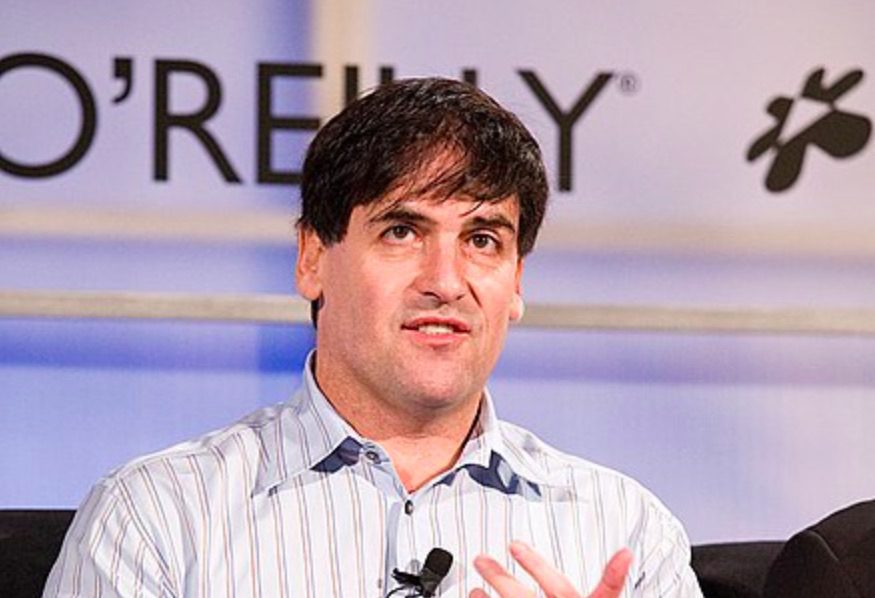

Dallas Mavericks Owner & Billionaire Mark Cuban to Sell Majority Stake in NBA Team Dallas Mavericks at $3.5 Billion Valuation to Las Vegas Sands Casino Owner Miriam Adelson Family, Las Vegas Sands Owns Marina Bay Sands in Singapore & Venetian Macao, Mark Cuban Bought Dallas Mavericks in 2000 for $285 Million

1st December 2023 | Hong Kong

Dallas Mavericks owner & billionaire Mark Cuban has entered into an agreement to sell his majority stake in NBA team Dallas Mavericks at $3.5 billion valuation range to Las Vegas Sands casino owner Miriam Adelson family (Late husband Sheldon Adelson ~ Founder of Las Vegas Sands). In 2000, Mark Cuban had bought Dallas Mavericks for $285 million. The Miriam Adelson family (through Las Vegas Sands Corp) owns Marina Bay Sands in Singapore and Venetian Macao. In late November 2023, Miriam Adelson & Miriam Adelson Trust had announced to sell $2 billion of shares in Las Vegas Sands (30/11/23: $35 billion market value) to buy a sports team. After the transaction, Mark Cuban will continue to manage the operations of NBA team Dallas Mavericks. Billionaire Mark Cuban has a personal fortune of around $6.2 billion. In the late 1980s, Mark Cuban co-founded MicroSolutions and sold the business for $6 million in 1990, and received $2 million. In 1995, Mark Cuban joined Audionet and rename to Broadcast.com in 1998. In 1999, Broadcast.com was acquired by Yahoo for $5.7 billion stocks. In 1999, Mark Cuban bought a $40 million private jet online. He bought the $40 million Gulfstream V private jet on the internet. The purchase was recorded as the 1999 Guinness Record of “the largest single e-commerce transaction”. In 2000, Mark Cuban bought Dallas Mavericks for $285 million.

“ Dallas Mavericks Owner & Billionaire Mark Cuban to Sell Majority Stake in NBA Team Dallas Mavericks at $3.5 Billion Valuation to Las Vegas Sands Casino Owner Family Miriam Adelson, Las Vegas Sands Owns Marina Bay Sands in Singapore & Venetian Macao, Mark Cuban Bought Dallas Mavericks in 2000 for $285 Million “

Billionaire Mark Cuban Named in Class Action Lawsuit for Promoting Crypto Currency Platform Voyager Digital, Announced 5-Year Sponsorship of Dallas Mavericks in 2021 & Filed for Bankruptcy in July 2022

18th August 2022 – Billionaire & NBA team Dallas Mavericks owner Mark Cuban had been named in a class action lawsuit for promoting cryptocurrency platform Voyager Digital, which had announced a 5-year sponsorship of Dallas Mavericks in 2021 and filed for bankruptcy on 6th July 2022. Mark Cuban was a client of Voyager Digital, trading on the platform itself. His comments include: “As close to risk-free as you’re gonna get in the crypto.” In the class action lawsuit, the investors alleged the Voyager Digital was a “Ponzi scheme”.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit