$26 Billion Supermicro Founder & CEO Taiwanese Charles Liang Becomes Billionaire with $3.3 Billion Fortune, Founded Supermicro with Wife Sara Liu in 1993 in United States, Supermicro Provides Total IT Solutions for Enterprise, Cloud, AI, 5G Telco & Edge IT Infrastructure

25th January 2024 | Hong Kong

Supermicro (24/1/24: $26 billion market value) founder & CEO Taiwanese Charles Liang has become a billionaire with $3.3 billion fortune, founding Supermicro with his wife Sara Liu in 1993 in the United States. Supermicro provides Total IT Solutions for Enterprise, Cloud, AI, 5G Telco & Edge IT Infrastructure. Charles Liang Profile – Charles Liang founded Supermicro in 1993 and has been President, Chief Executive Officer, and Chairman of the Board. Mr. Liang, a Silicon Valley entrepreneur, has been developing server system architectures and technologies for over three decades. With a passion for Green IT and protecting the environment, Mr. Liang has been the driving force behind Supermicro’s transformation into a Total IT Solutions provider for Enterprise, Cloud, AI, and 5G/Edge markets. Under Mr. Liang’s guidance, Supermicro has evolved from a motherboard and subsystem company to a multi-billion-dollar business optimizing complete rack and data center-level solutions customers can deploy and bring online within hours. In addition, the Company has expanded globally well beyond its San Jose, California headquarters to encompass significant manufacturing and operations campuses in Asia and Europe with over 4,000 employees globally. Mr. Liang has been granted many server technology patents. Mr. Liang holds an M.S. in Electrical Engineering from the University of Texas at Arlington and a B.S. in Electrical Engineering from the National Taiwan University of Science & Technology in Taiwan. More info below:

” $26 Billion Supermicro Founder & CEO Taiwanese Charles Liang Becomes Billionaire with $3.3 Billion Fortune, Founded Supermicro with Wife Sara Liu in 1993 in United States, Supermicro Provides Total IT Solutions for Enterprise, Cloud, AI, 5G Telco & Edge IT Infrastructure “

$26 Billion Supermicro Founder & CEO Taiwanese Charles Liang Becomes Billionaire with $3.3 Billion Fortune

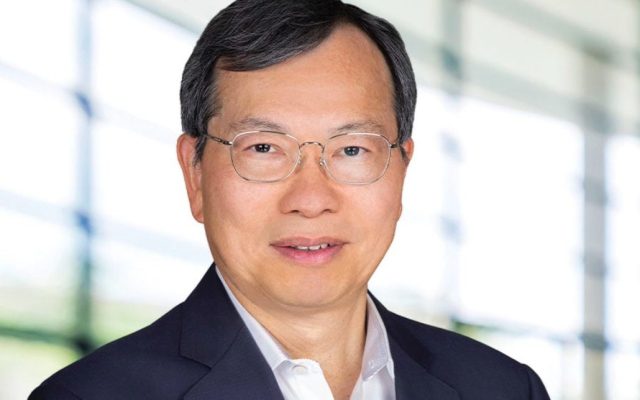

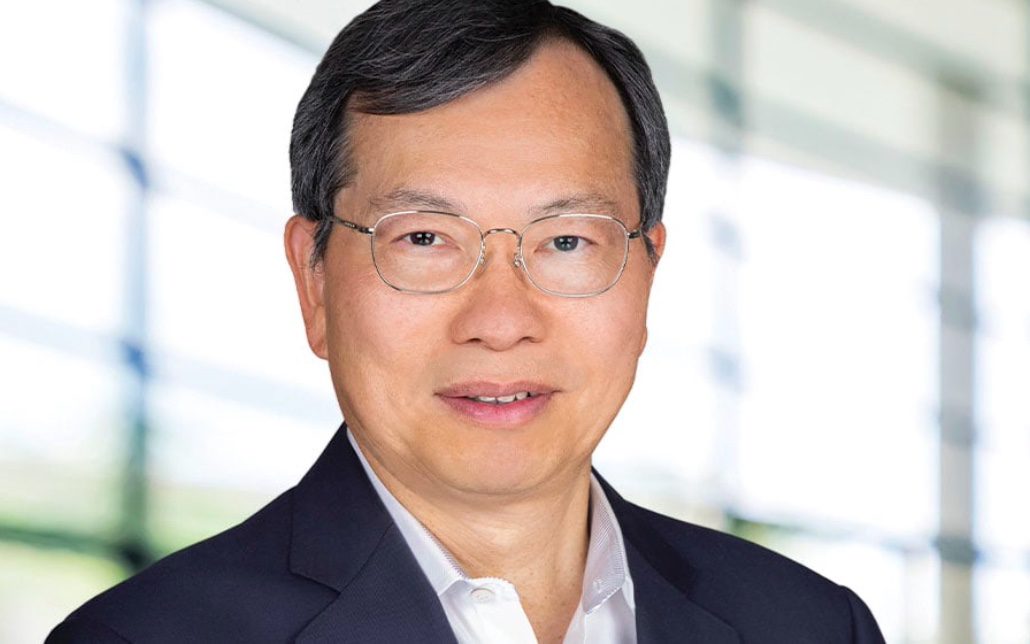

Charles Liang, President, Chief Executive Officer & Chairman of the Board, Supermicro

Charles Liang founded Supermicro in 1993 and has been President, Chief Executive Officer, and Chairman of the Board. Mr. Liang, a Silicon Valley entrepreneur, has been developing server system architectures and technologies for over three decades. With a passion for Green IT and protecting the environment, Mr. Liang has been the driving force behind Supermicro’s transformation into a Total IT Solutions provider for Enterprise, Cloud, AI, and 5G/Edge markets. Under Mr. Liang’s guidance, Supermicro has evolved from a motherboard and subsystem company to a multi-billion-dollar business optimizing complete rack and data center-level solutions customers can deploy and bring online within hours. In addition, the Company has expanded globally well beyond its San Jose, California headquarters to encompass significant manufacturing and operations campuses in Asia and Europe with over 4,000 employees globally. Mr. Liang has been granted many server technology patents. Mr. Liang holds an M.S. in Electrical Engineering from the University of Texas at Arlington and a B.S. in Electrical Engineering from the National Taiwan University of Science & Technology in Taiwan.

About Super Micro Computer, Inc.

Supermicro (NASDAQ: SMCI) is a global leader in Application-Optimized Total IT Solutions. Founded and operating in San Jose, California, Supermicro is committed to delivering first-to-market innovation for Enterprise, Cloud, AI, and 5G Telco/Edge IT Infrastructure. We are transforming into a Total IT Solutions provider with server, AI, storage, IoT, and switch systems, software, and services while delivering advanced high-volume motherboard, power, and chassis products. The products are designed and manufactured in-house (in the US, Taiwan, and the Netherlands), leveraging global operations for scale and efficiency and optimized to improve TCO and reduce environmental impact (Green Computing). The award-winning portfolio of Server Building Block Solutions® allows customers to optimize for their exact workload and application by selecting from a broad family of systems built from our flexible and reusable building blocks that support a comprehensive set of form factors, processors, memory, GPUs, storage, networking, power, and cooling solutions (air-conditioned, free air cooling or liquid cooling).

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit