Citi International Head of Citigold & Citigold Private Client and Asia South Wealth Head Shyam Sambamurthy Announced to Leave Citi after 36 Years at Citibank Joining Citi in 1988

2nd March 2024 | Hong Kong

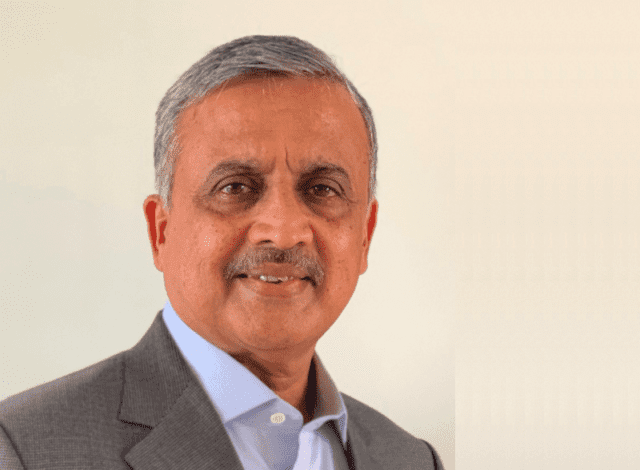

Citi International Head of Citigold & Citigold Private Client and Citi Asia South Wealth Head Shyam Sambamurthy has announced to leave Citi after a 36 years career at Citibank, joining Citi in 1988. In 2022, 34-year Citi veteran C.R. Sambamurthy (Shyam) returned to Citi from his 1-month sabbatical as the new Citi Asia Head of Citigold & Citigold Private Client (1st August 2022) based in Singapore. Shyam Sambamurthy had joined Citi in 1988 and held the role of Citi Global Head of International Personal Banking (IPB) in 2022 July before his sabbatical.

“ Citi International Head of Citigold & Citigold Private Client and Asia South Wealth Head Shyam Sambamurthy Announced to Leave Citi after 36 Years at Citibank Joining Citi in 1988 “

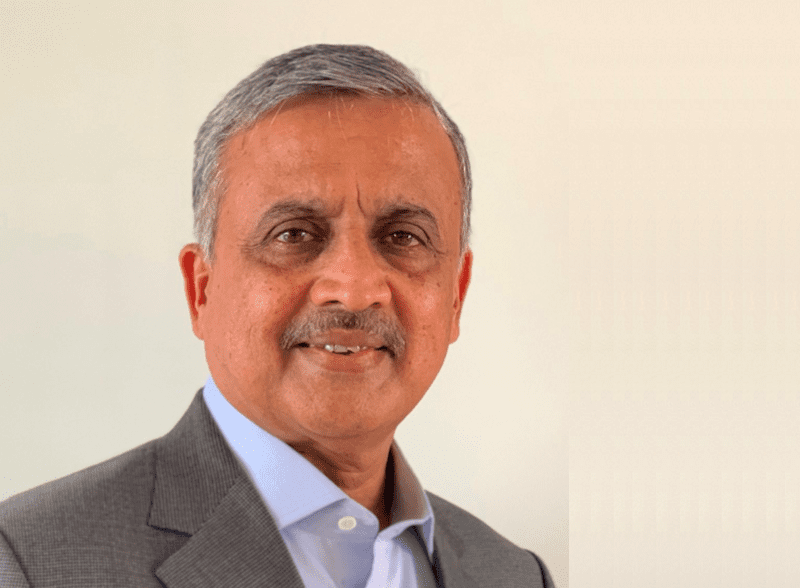

Shyam Sambamurthy at Launch of Citi Wealth Centre in Singapore

(From left to right) Brendan Carney, Citibank Singapore CEO; Andy Sieg, Citi global Head of Wealth; Tibor Pandi, Singapore Citi Country Officer and Banking Head; Shyam Sambamurthy, Citi Asia South Wealth Head.

34-Year Citi Veteran C.R. Sambamurthy Returns from Sabbatical as Citi Asia Head of Citigold & Citigold Private Client, Added 14,000 New Wealth Clients & Hundreds of Private Bankers & Relationship Managers in 2021

28th July 2022 – 34-Year Citi veteran C.R. Sambamurthy (Shyam) has returned to Citi from his sabbatical as the new Citi Asia Head of Citigold & Citigold Private Client (1st August 2022) based in Singapore. Shyam had joined Citi in 1988 and last held the role of Citi Global Head of International Personal Banking (IPB). Shyam will report to Fabio Fontainha (Global Head of Citigold & Citigold Private Client) and Angel Ng (Asia Head of Citi Global Wealth). In 2021, Citi Global Wealth Unit in Hong Kong & Singapore, including Citigold and Citigold Private Client segments, had added 14,000 new wealth clients and hundreds of private bankers & relationships managers. In 2021, Citi announced plans to add 2,300 professionals including 1,100 relationship managers & private bankers across Singapore and Hong Kong, and to acquire $150 billion in AUM (Assets under Management) in the region by 2025. Citi Global Wealth in Asia contributed to more than 30% of the $7.5 billion in Citi Global Wealth global revenues in 2021. Citi Global Wealth unifies the bank’s wealth management teams across the Citi franchise. It is a single, integrated platform serving clients across the wealth continuum, from the affluent segment to ultra-high net worth clients.

C.R. Sambamurthy (Shyam), Citi Asia Head of Citigold & Citigold Private Client

Shyam is a 34-year Citi veteran with significant experience in cross-border wealth management and has managed complex, multi-jurisdictional businesses across Asia and Europe. He was instrumental in the integration of Citi’s Global Non-Resident Indian business with IPB Singapore, helping us become a force to be reckoned with in the Asia Pacific offshore affluent and high-net-worth space. He was also conferred the Institute of Banking and Finance (IBF) Fellow title in 2016, which recognizes financial veterans who have demonstrated mastery of a profession, exemplify thought leadership and have a commitment to industry development.

About Citi Global Wealth:

Citi Global Wealth is an integrated wealth management platform that delivers a total wealth solution to clients across the wealth continuum, with integrated advice and execution across both their assets and liabilities. Citi Global Wealth serves ultra-high-net-worth individuals and family offices through Citi Private Bank, operates in the affluent and high-net worth segments through Citigold® and Citigold Private Client and captures wealth management in the workplace through Global Wealth at Work. Citi Global Wealth provides clients with a leading investment strategies platform, which delivers traditional and alternative investments, managed account strategies, best-in-class research and investment guidance for all clients.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit