China Bottled Water Giant Nongfu Spring Founder Zhong Shanshan Remains as China Richest in 2023 for 4th Straight Year with $62 Billion Fortune & Ranked 21st Richest in the World, 814 Billionaires in China in 2023, 800 Billionaires in United States, Total of 3,729 Billionaires in the World with Combined $15 Trillion Wealth in 2023

30th March 2024 | Hong Kong

China bottled water giant Nongfu Spring founder Zhong Shanshan has remained as China richest in 2023 for 4th straight year with $62 billion fortune, and is ranked 21st richest in the world. There are 814 billionaires in China in 2023, 800 billionaires in United States, and total of 3,729 billionaires in the world with combined $15 trillion wealth in 2023. Founded in 1996, Nongfu Spring is China’s largest packaging water supplier, holding the number one spot for market share and is one of the top 20 beverage companies in China.

“ China Bottled Water Giant Nongfu Spring Founder Zhong Shanshan Remains as China Richest in 2023 for 4th Straight Year with $62 Billion Fortune & Ranked 21st Richest in the World, 814 Billionaires in China in 2023, 800 Billionaires in United States, Total of 3,729 Billionaires in the World with Combined $15 Trillion Wealth in 2023 “

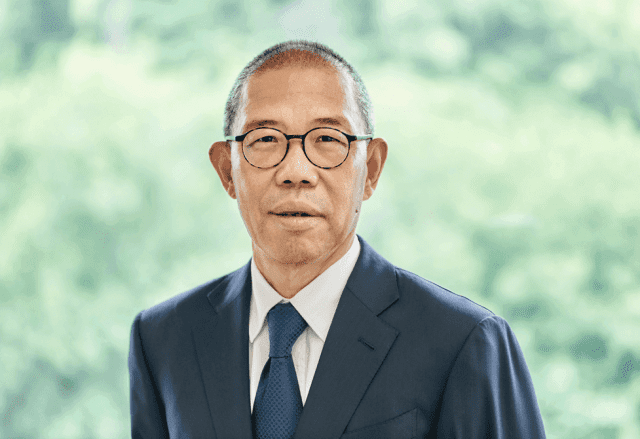

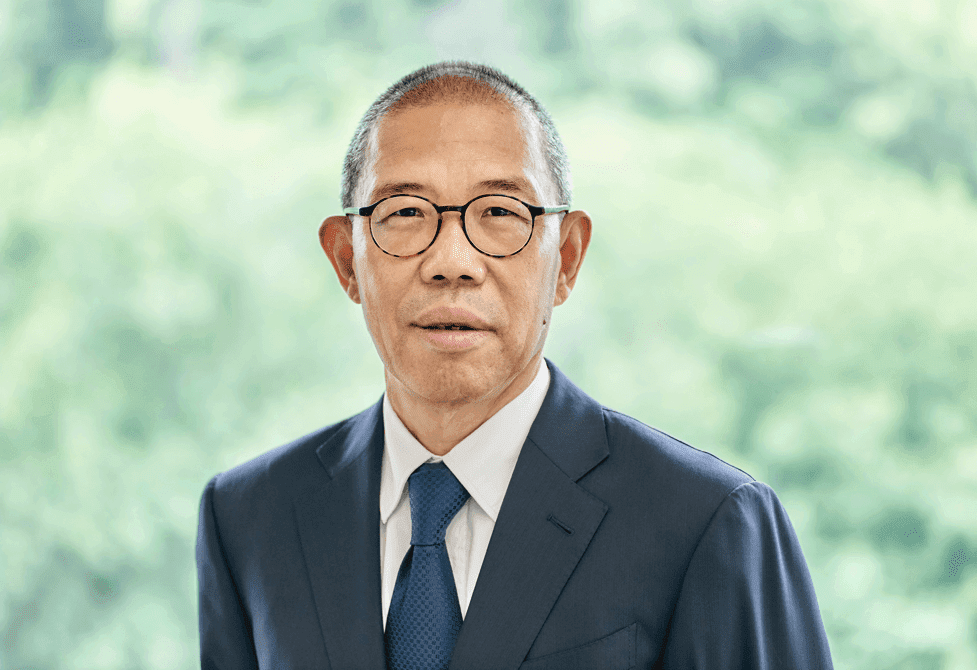

Zhong Shanshan, Founder, Chairman of the Board, General Manager

Mr. Zhong Shanshan was born in 1954. He founded Nongfu Spring in September 1996, acts as the Chairman of the Board, Executive Director and General Manager of the Company, as well as the Chairman of the Nomination Committee and a member of the Remuneration Committee of the Board of the Company. Mr. Zhong Shanshan is responsible for overall development strategies, business plans and major operational decisions of the Company and direct management of brands and human resources, etc. Prior to the establishment of the Company, Mr. Zhong Shanshan founded Yangshengtang in March 1993 and currently acts as the Chairman of Yangshengtang. Mr. Zhong Shanshan has nearly 30 years of extensive experience in the food and soft beverage industry.

China Bottled Water Giant Nongfu Spring Founder Zhong Shanshan Remains as China Richest in 2023 for 4th Straight Year with $62 Billion Fortune & Ranked 21st Richest in the World, 814 Billionaires in China in 2023, 800 Billionaires in United States, Total of 3,729 Billionaires in the World with Combined $15 Trillion Wealth in 2023

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit