Southeast Asia Gaming & E-Commerce Giant Sea Billionaire Founder Forrest Li Wife Ma Li Qian Buys Singapore Good Class Bungalow on Gallop Road for $31 Million, Forrest Li Owns Adjacent Good Class Bungalow Bought in 2019

27th April 2024 | Hong Kong

Southeast Asia gaming & E-commerce giant Sea Limitedbillionaire founder Forrest Li wife Ma Li Qian has paid an option (April 2024) to buy a Singapore Good Class Bungalow (GCB) on Gallop Road for $31 million (S$42.5 million), with Forrest Li owning the adjacent Good Class Bungalow (Bought in 2019). Both the Singapore Good Class Bungalow on Gallop Road are near UNESCO World Heritage site Singapore’s Botanic Garden. Singapore Good Class Bungalow can only be bought by Singapore citizens (Exceptions had been made to Singapore Permanent Residents who had made exceptional contribution to Singapore). Forrest Li has an estimated personal fortune of around $4.5 billion to $5 billion. In 2022, Sea Limited founder Forrest Li & top management announced to forgo salaries, and implementing a company-wide business expense limits to economy class travel, travel & meal claims at $30 a day, and hotel at $150 a night. Sea Limited was one the Southeast Asia’s most valuable company with around $200 billion in market capitalisation in 2021, with share price falling more than 80% over the last 12 months to $28 billion market capitalisation. Sea Limited is a leading global consumer internet company founded in Singapore, with Garena, Shopee, and SeaMoney. Garena is a leading global online games developer and publisher. Shopee is the largest pan-regional e-commerce platform in Southeast Asia and Taiwan. SeaMoney is a leading digital payments and financial services provider in Southeast Asia.

” Southeast Asia Gaming & E-Commerce Giant Sea Billionaire Founder Forrest Li Wife Ma Li Qian Buys Singapore Good Class Bungalow on Gallop Road for $31 Million, Forrest Li Owns Adjacent Good Class Bungalow Bought in 2019 “

Southeast Asia Gaming & E-Commerce Giant Sea Billionaire Founder Forrest Li & Top Management to Forgo Salaries, Business Expense Limits to Economy Class, Travel & Meal $30 a Day, Hotel $150 a Night

15th September 2022 – Southeast Asia gaming & E-commerce giant Sea Limited billionaire founder Forrest Li & top management have announced to forgo salaries, and implementing a company-wide business expense limits to economy class travel, travel & meal claims at $30 a day, and hotel at $150 a night. Sea Limited was one the Southeast Asia’s most valuable company with around $200 billion in market capitalisation in 2021, with share price falling more than 80% over the last 12 months to $28 billion market capitalisation. Sea Limited is a leading global consumer internet company founded in Singapore, with Garena, Shopee, and SeaMoney. Garena is a leading global online games developer and publisher. Shopee is the largest pan-regional e-commerce platform in Southeast Asia and Taiwan. SeaMoney is a leading digital payments and financial services provider in Southeast Asia.

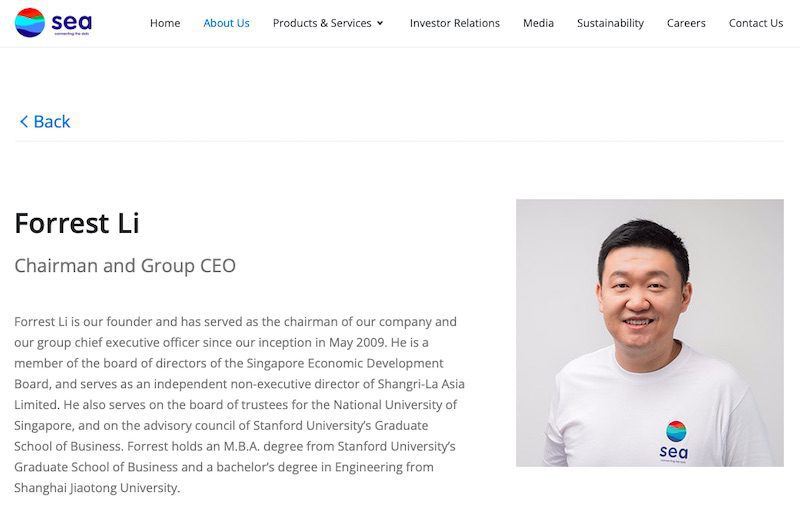

Sea Limited & Forrest Li, Chairman & Group CEO

Sea Limited is a leading global consumer internet company founded in Singapore. Our mission is to better the lives of consumers and small businesses with technology. We operate three core businesses across digital entertainment, e-commerce, as well as digital payments and financial services, known as Garena, Shopee, and SeaMoney, respectively. Garena is a leading global online games developer and publisher. Shopee is the largest pan-regional e-commerce platform in Southeast Asia and Taiwan. SeaMoney is a leading digital payments and financial services provider in Southeast Asia.

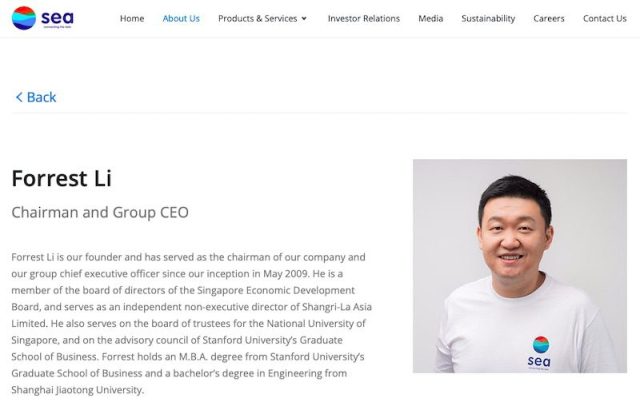

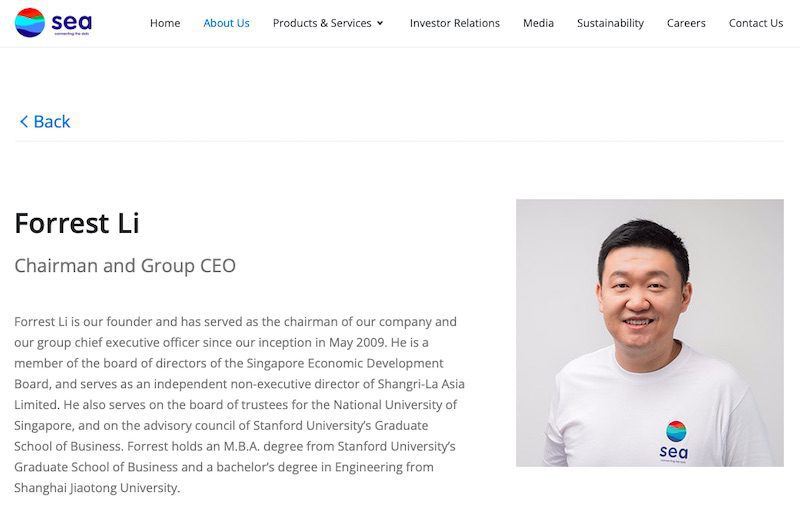

Forrest Li, Chairman & Group CEO

Forrest Li is our founder and has served as the chairman of our company and our group chief executive officer since our inception in May 2009. He is a member of the board of directors of the Singapore Economic Development Board, and serves as an independent non-executive director of Shangri-La Asia Limited. He also serves on the board of trustees for the National University of Singapore, and on the advisory council of Stanford University’s Graduate School of Business. Forrest holds an M.B.A. degree from Stanford University’s Graduate School of Business and a bachelor’s degree in Engineering from Shanghai Jiaotong University.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit