Los Angeles Dodgers Japanese Baseball Star Shohei Ohtani Personal Translator Pleads Guilty to Stealing $17 Million in Illegal Bank Transfer from Shohei Ohtani to Pay for Gambling Debts, Ex-Translator Ippei Mizuhara Had Full Access to Bank Accounts & with Phone Records Showing He Lied to Banks Pretending to be Shohei Ohtani, Fraud Discovered During United States Federal Investigation on Illegal Gambling Operations, Shohei Ohtani Has a $700 Million 10-Year Contract with Los Angeles Dodgers

10th May 2024 | Hong Kong

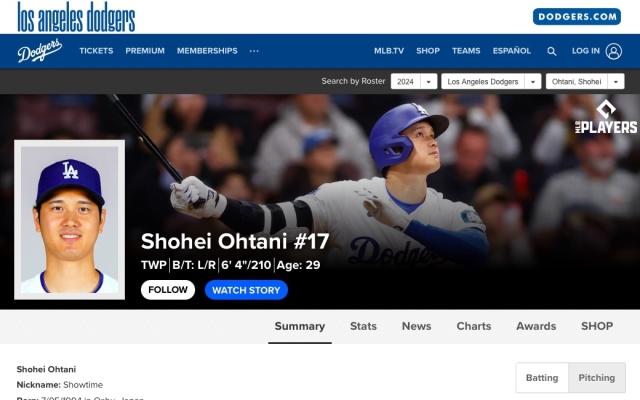

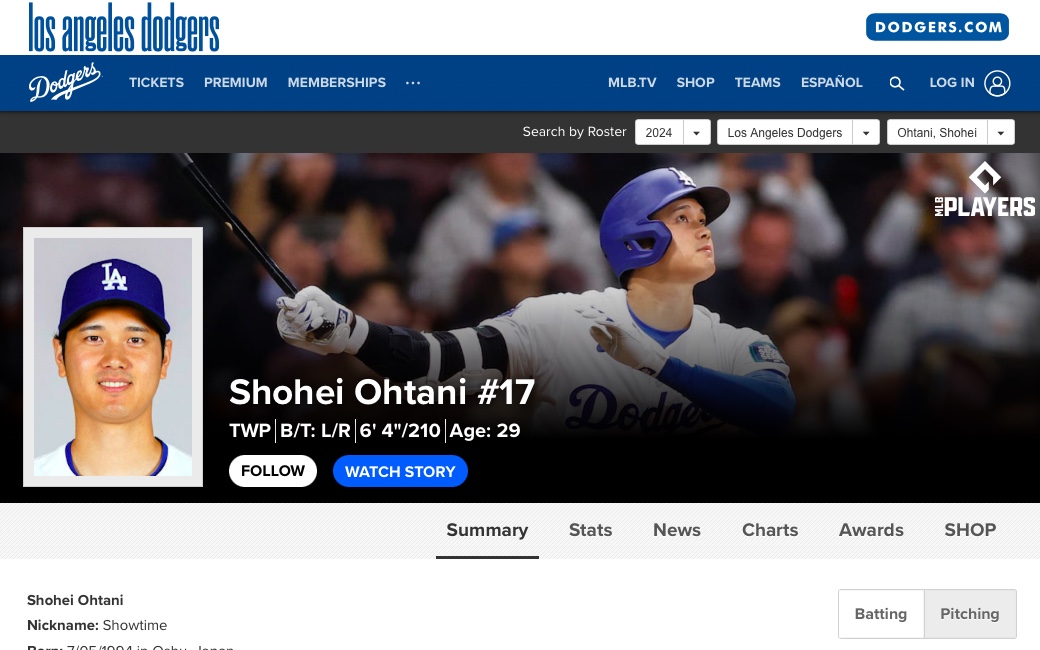

Major League Baseball (MLS) team Los Angeles Dodgers Japanese baseball star Shohei Ohtani (Age 29) personal translator has pleaded guilty to stealing $17 million in illegal bank transfer to pay for his gambling debts, with the ex-translator Ippei Mizuhara having full access to Shohei Ohtani’s bank accounts & phone records showing he lied to banks pretending to be Shohei Ohtani. The fraud was discovered during United States Federal investigation on illegal gambling operations. Shohei Ohtani has a $700 million 10-year contract (announced 9/12/23) with the Los Angeles Dodgers.

“ Los Angeles Dodgers Japanese Baseball Star Shohei Ohtani Personal Translator Pleads Guilty to Stealing $17 Million in Illegal Bank Transfer from Shohei Ohtani to Pay for Gambling Debts, Ex-Translator Ippei Mizuhara Had Full Access to Bank Accounts & with Phone Records Showing He Lied to Banks Pretending to be Shohei Ohtani, Fraud Discovered During United States Federal Investigation on Illegal Gambling Operations, Shohei Ohtani Has a $700 Million 10-Year Contract with Los Angeles Dodgers “

Personal Translator Stole $16 Million from Los Angeles Dodgers Japanese Baseball Star Shohei Ohtani to Pay for Gambling Debts, Ex-Translator Ippei Mizuhara Had Full Access to Bank Accounts & with Phone Records Showing He Lied to Banks Pretending to be Shohei Ohtani, Fraud Discovered During United States Federal Investigation on Illegal Gambling Operations, Shohei Ohtani Has a $700 Million 10-Year Contract with Los Angeles Dodgers

12th April 2024 – The personal translator has stole $16 million from Major League Baseball (MLS) team Los Angeles Dodgers Japanese baseball star Shohei Ohtani (Age 29) to pay for gambling debts, with the ex-translator Ippei Mizuhara having full access to Shohei Ohtani’s bank accounts & phone records showing he lied to banks pretending to be Shohei Ohtani. The fraud was discovered during United States Federal investigation on illegal gambling operations. Shohei Ohtani has a $700 million 10-year contract (announced 9/12/23) with the Los Angeles Dodgers.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit