India $5.4 Billion IDFC FIRST Bank Issues $878 Million in Preferred Shares to Private Equity Group Warburg Pincus & Abu Dhabi Investment Authority (ADIA), Warburg Pincus (Currant Sea Investments) to Invest $571 Million & ADIA (Platinum Invictus B 2025 RSC) to Invest $307 Million, IDFC FIRST Bank is India 9th Largest Non-Government Bank, IDFC FIRST Bank is Merger of IDFC Bank & Capital First in 2024

20th April 2025 | Hong Kong

India IDFC FIRST Bank ($5.4 billion market value) board has approved the issuance of $878 million in preferred shares to private equity group Warburg Pincus & Abu Dhabi Investment Authority (ADIA), with Warburg Pincus (Currant Sea Investments) to invest $571 million & ADIA (Platinum Invictus B 2025 RSC) to invest $307 million. IDFC FIRST Bank is India 9th largest non-government bank. IDFC FIRST Bank was formed with the merger of IDFC Bank & Capital First in 2024. Announcement (17/4/25): “The Board of Directors of IDFC FIRST Bank, at its meeting held today, approved a preferential issue of equity capital (CCPS) amounting to approximately ₹4,876 crore to Currant Sea Investments B.V., an affiliate company of global growth investor Warburg Pincus LLC and approximately ₹2,624 crore to Platinum Invictus B 2025 RSC Limited, a wholly owned subsidiary of the Abu Dhabi Investment Authority (ADIA) managed by its Private Equities Department. The proposed issues are subject to shareholder and regulatory approvals. Over the last six years, IDFC FIRST Bank has undergone a successful transformation from its legacy as an infrastructure-focused DFI to becoming a modern, technology-driven, pan-India, universal bank. In the process, it has made significant investments in distribution, technology, and talent to become a leading private sector bank in India. During this time, deposits grew 6x, loans and advances doubled, and CASA ratio has significantly improved from 8.7% to 47.7%. PAT rose from a loss of ₹1,944 crore in FY19 to a profit of ₹2,957 crore in FY24. However, profitability dipped in 9M FY25 due to industry wide challenges in microfinance, which the bank has navigated well. With this fund raise, the overall capital adequacy will increase from 16.1% to 18.9%, (CET-1 ratio at ~16.5%, calculated on the capital position of the Bank as of December 31, 2024), strengthening the Bank’s balance sheet and positioning it for strong and self-sustaining profitable growth.”

“ India $5.4 Billion IDFC FIRST Bank Issues $878 Million in Preferred Shares to Private Equity Group Warburg Pincus & Abu Dhabi Investment Authority (ADIA), Warburg Pincus (Currant Sea Investments) to Invest $571 Million & ADIA (Platinum Invictus B 2025 RSC) to Invest $307 Million, IDFC FIRST Bank is India 9th Largest Non-Government Bank, IDFC FIRST Bank is Merger of IDFC Bank & Capital First in 2024 “

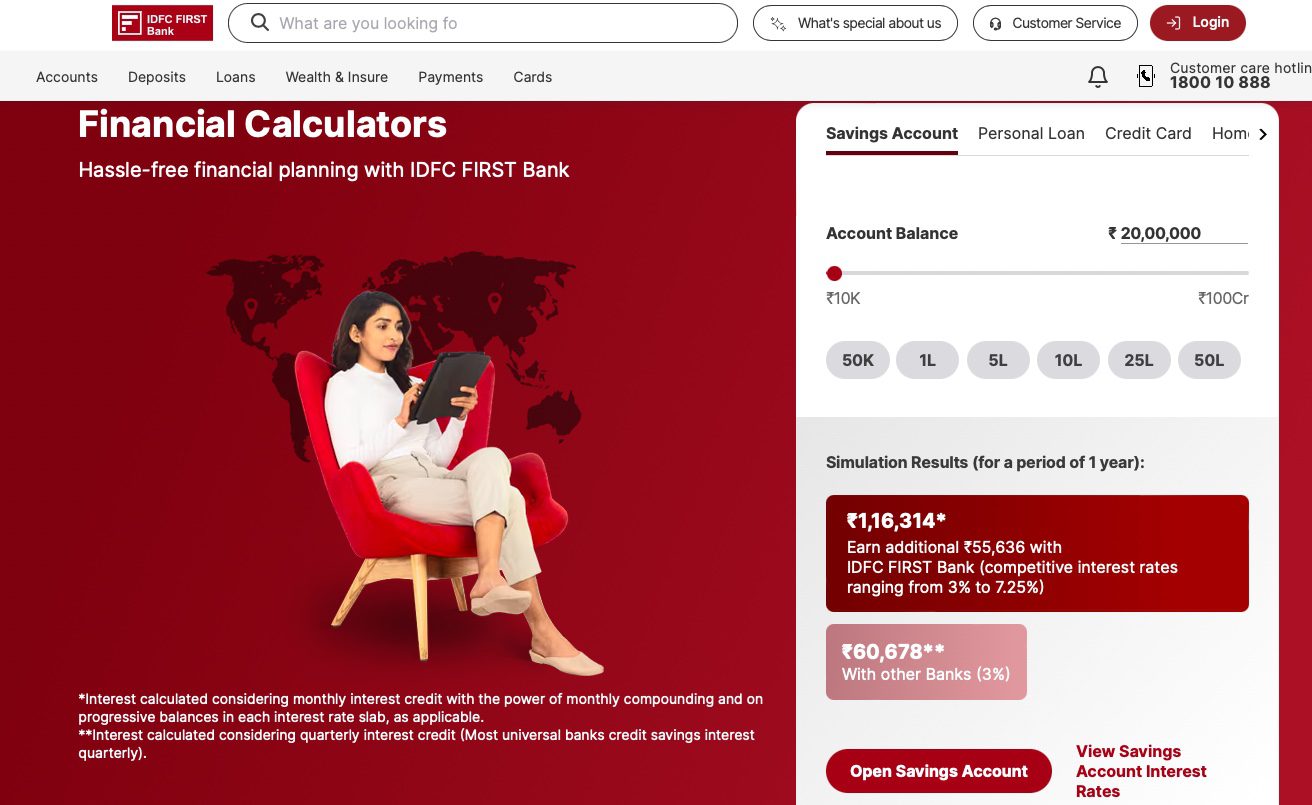

IDFC FIRST Bank – IDFC FIRST Bank is a new-age private bank in India, with a vision to create a world class bank in India, focused on Ethical, Digital, and Social Good Banking. It operates 971 branches spread over 60,000 locations including cities, towns, and villages across India. While it has a physical network, it is built as a digital first Bank in approach, scale and scope. It is a full suite Universal Bank offering services across Retail, MSME, rural, corporate, wealth management, private banking, Fastag, cash management, NRI and treasury solutions. The Bank’s customer deposits are growing at 25.2% YoY and Loans & Advances growing by 20.3% YoY (as of March 31, 2025 as per provisional disclosure) based on friendly user digital interface, ethical approach, and a strong brand. Bank’s mobile banking app was rated #1 in India and #4 globally by Forrester in Digital Experience: Indian Mobile Banking Applications, Q3 2024 and Digital Experience ReviewTM: Global Mobile Banking Apps, Q4 2024. Its employees believe that to create a world class bank in India is an incredible opportunity of their lifetimes.

Warburg Pincus – Warburg Pincus LLC is the pioneer of private equity global growth investing. A private partnership since 1966, the firm has the flexibility and experience to focus on helping investors and management teams achieve enduring success across market cycles. Today, the firm has more than $87 billion in assets under management, and more than 220 companies in their active portfolio, diversified across stages, sectors, and geographies. Warburg Pincus has invested in more than 1,000 companies across its private equity, real estate, and capital solutions strategies. The firm is headquartered in New York with ojices in Amsterdam, Beijing, Berlin, Hong Kong, Houston, London, Luxembourg, Mumbai, Mauritius, San Francisco, São Paulo, Shanghai, and Singapore.

Abu Dhabi Investment Authority (ADIA) – Established in 1976, the Abu Dhabi Investment Authority (“ADIA”) is a globally diversified investment institution that prudently invests funds on behalf of the Government of Abu Dhabi through a strategy focused on long-term value creation.

India $5.4 Billion IDFC FIRST Bank Issues $878 Million in Preferred Shares to Private Equity Group Warburg Pincus & Abu Dhabi Investment Authority (ADIA), Warburg Pincus (Currant Sea Investments) to Invest $571 Million & ADIA (Platinum Invictus B 2025 RSC) to Invest $307 Million, IDFC FIRST Bank is India 9th Largest Non-Government Bank, IDFC FIRST Bank is Merger of IDFC Bank & Capital First in 2024

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit