Harvard University $53 Billion Endowment Harvard Management Company Reviewing to Sell $6 Billion Private Equity Portfolio Including $1 Billion to Franklin Templeton Private Equity Secondaries Specialist Lexington Partners, Founded in 1974 & Invests in More than 14,000 Individual Funds, One of Earliest Institutional Investors in Venture Capital, First & Largest Investors in Timberland Assets, Portfolio Outperforms Typical 60/40 Stock & Bond Portfolio and Average Endowment Portfolio, Contributes to 1/3 of Harvard University Operating Budget & Distributed More than $43 Billion to Harvard University

29th April 2025 | Hong Kong

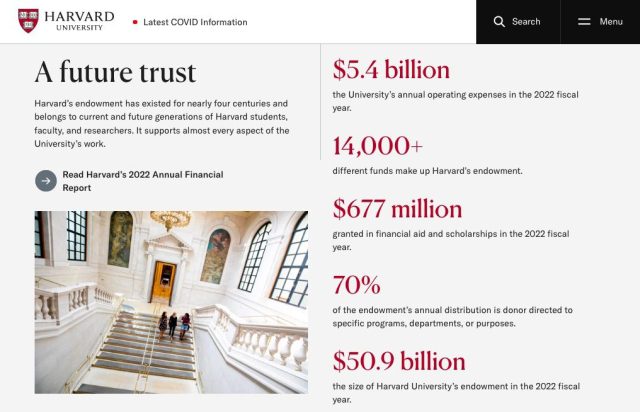

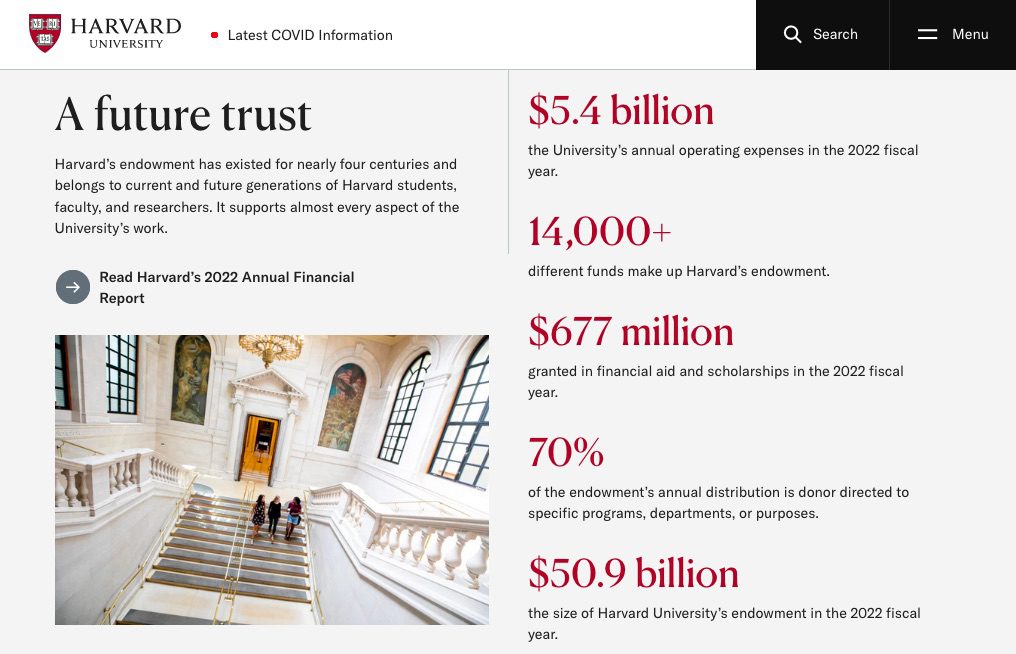

Harvard University endowment Harvard Management Company ($53 billion AUM) has been reported to be reviewing to sell $6 billion of private equity portfolio including $1 billion to Franklin Templeton private equity secondaries specialist Lexington Partners. Harvard Management Company was founded in 1974, and invests in more than 14,000 individual funds. Harvard Management Company is one of the earliest institutional investors in venture capital, first & largest investors in timberland assets, with portfolio outperforming typical 60/40 stock & bond portfolio and average endowment portfolio. Harvard Management Company contributes to 1/3 of Harvard University operating budget, and had distributed more than $43 billion to Harvard University since 1974 inception. Harvard Management Company – Harvard’s endowment is a dedicated and permanent source of funding that maintains the teaching and research mission of the University. Established in 1974, Harvard Management Company invests these funds as a single entity, the revenue from which contributes more than one-third of the University’s annual operating budget. Made up of more than 14,000 individual funds invested as a single entity, the endowment’s returns have enabled leading financial aid programs, groundbreaking discoveries in scientific research, and hundreds of professorships across a wide range of academic fields. Since HMC was founded in 1974, annual distributions from the endowment to Harvard University have grown significantly and now account for more than one-third of the University’s annual operating budget. In total, HMC has distributed more than $43 billion to Harvard. The need to generate this critical funding, while managing the endowment for the long term, underscores the importance of delivering strong investment returns, maintaining sufficient liquidity, and exercising good risk management. History – Formed in 1974, HMC manages Harvard University’s endowment and related financial assets. Our mission is to help ensure Harvard University has the financial resources to confidently maintain and expand its leadership in education and research for future generations. Since its inception, HMC has been tasked with the singular mission to generate strong long-term results to support the educational and research goals of Harvard University. This long-term focus has given us an edge in many facets of investment management. We were among the earliest institutional investors in venture capital, one of the first and largest investors in timberland assets, and a leading investor in some of the most successful absolute return and direct investment strategies. Being an early entrant and bringing long-term focus has often allowed us to establish unique investment positions in less crowded areas. As a result, our portfolio has significantly outperformed a typical 60/40 stock/bond portfolio and the average endowment portfolio. This outperformance has contributed billions of dollars to Harvard University.

“ Harvard University $53 Billion Endowment Harvard Management Company Reviewing to Sell $6 Billion Private Equity Portfolio Including $1 Billion to Franklin Templeton Private Equity Secondaries Specialist Lexington Partners, Founded in 1974 & Invests in More than 14,000 Individual Funds, One of Earliest Institutional Investors in Venture Capital, First & Largest Investors in Timberland Assets, Portfolio Outperforms Typical 60/40 Stock & Bond Portfolio and Average Endowment Portfolio, Contributes to 1/3 of Harvard University Operating Budget & Distributed More than $43 Billion to Harvard University “

Harvard University $53 Billion Endowment Harvard Management Company Reviewing to Sell $6 Billion Private Equity Portfolio Including $1 Billion to Franklin Templeton Private Equity Secondaries Specialist Lexington Partners, Founded in 1974 & Invests in More than 14,000 Individual Funds, One of Earliest Institutional Investors in Venture Capital, First & Largest Investors in Timberland Assets, Portfolio Outperforms Typical 60/40 Stock & Bond Portfolio and Average Endowment Portfolio, Contributes to 1/3 of Harvard University Operating Budget & Distributed More than $43 Billion to Harvard University

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit