IMF World Economic Outlook 2025: Global GDP to Grow +2.8% with +4.3% Inflation in 2025, United States +1.5%, UK +1.7%, China +4%, India +6.2% & Japan +0.6% in 2025, 4 Growth Upside – Next-Generation Trade Agreements, Mitigation of Conflicts, Structural Reform Momentum, Growth Engine Powered by Artificial Intelligence (AI), 5 Downside Risks – Escalating Trade Measures & Prolonged Trade Policy Uncertainty, Rising Long-Term Interest Rates, Rising Social Discontent, Increasing Challenges to International Cooperation, Labor Supply Gaps

8th May 2025 | Hong Kong

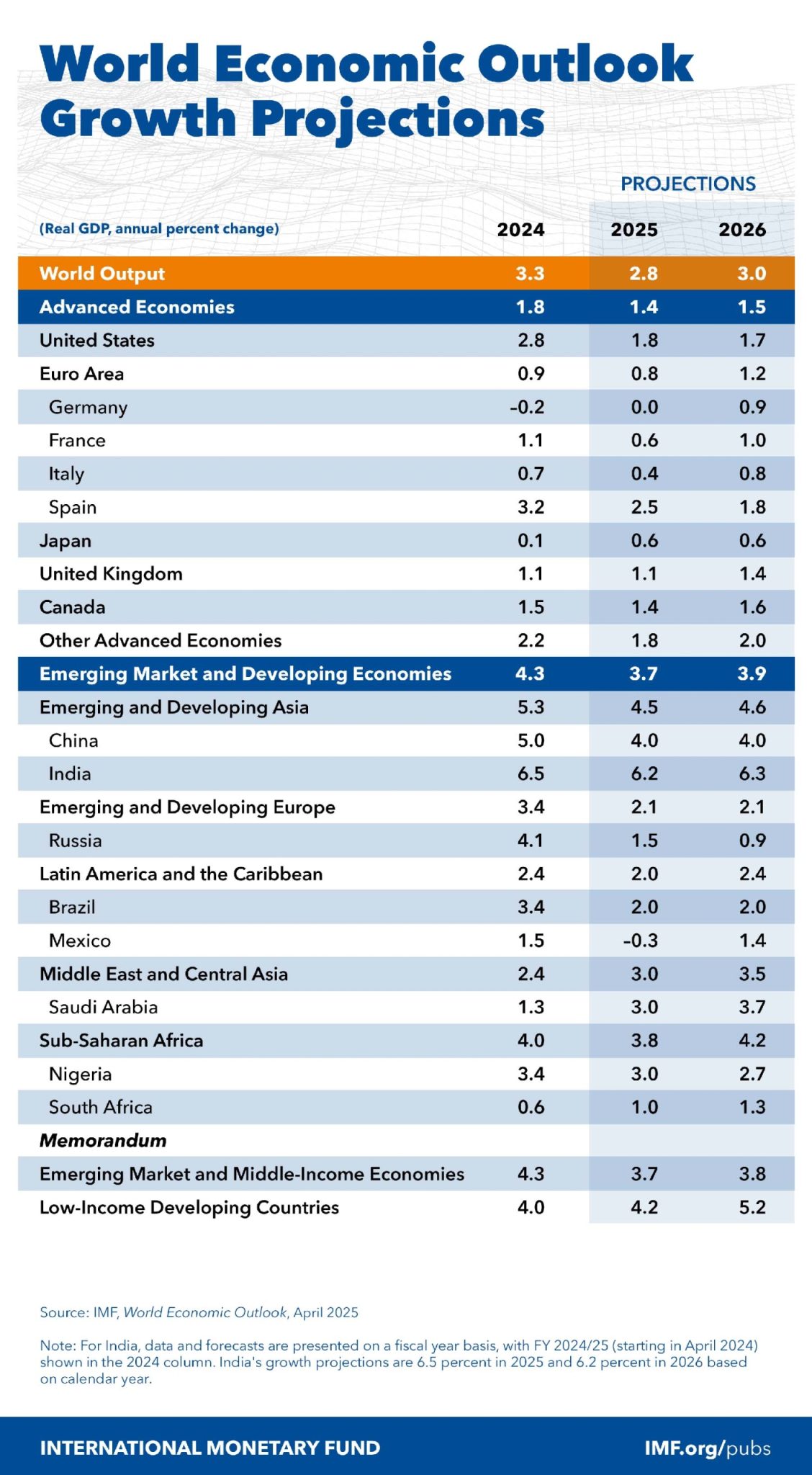

The International Monetary Fund (IMF) has released the IMF World Economic Outlook 2025 (April Update), providing key insights into global economy & GDP growth in 2025 & 2026. Global GDP is expected to grow +2.8% in 2025 and +3% in 2026, with global inflation forecast at +4.3% in 2025 and +3.6% in 2026. United States GDP growth forecast in 2025 / 2026 +1.5% / +1.7%, United Kingdom (UK) +1.7% / +0.9%, China +4% / +4%, India +6.2% / +6.3%. 4 Growth Upside – Next-generation trade agreements, Mitigation of conflicts, Structural reform momentum, Growth engine powered by artificial intelligence (AI). 5 Downside Risks – Escalating trade measures & prolonged trade policy uncertainty, Rising long-term interest rates, Rising social discontent, Increasing challenges to international cooperation, Labor supply gaps. 10 Central Bank policies recommendations / priorities – Delivering a stable and predictable trade environment, Preserve international cooperation, Calibrate monetary policy amid two-sided risk, Safeguard financial stability through prudential policy, Devise adjustment plans to restore fiscal sustainability, Enact targeted fiscal reforms, Protect growth & the vulnerable, Use timely, targeted, temporary support where essential, in a responsible way, Enact structural reforms for medium-term growth, Make progress on climate policies. 2025 Global Outlook – Global economy at critical juncture, Major policy shifts are resetting the global trade system and giving rise to uncertainty, United States tariffs against trading partners which have invoked countermeasures, Signs of stabilization were emerging through much of 2024 after a prolonged and challenging period of unprecedented shocks, Inflation down from multi-decade highs followed a gradual though bumpy decline toward central bank targets, Labor markets normalized with unemployment and vacancy rates returning to pre-pandemic levels, Growth hovered around 3% in the past few years and global output came close to potential. See below for key findings & summary | View report

“ IMF World Economic Outlook 2025: Global GDP to Grow +2.8% with +4.3% Inflation in 2025, United States +1.5%, UK +1.7%, China +4%, India +6.2% & Japan +0.6% in 2025, 4 Growth Upside – Next-Generation Trade Agreements, Mitigation of Conflicts, Structural Reform Momentum, Growth Engine Powered by Artificial Intelligence (AI), 5 Downside Risks – Escalating Trade Measures & Prolonged Trade Policy Uncertainty, Rising Long-Term Interest Rates, Rising Social Discontent, Increasing Challenges to International Cooperation, Labor Supply Gaps “

IMF World Economic Outlook 2025: Global GDP to Grow +2.8% with +4.3% Inflation in 2025, United States +1.5%, UK +1.7%, China +4%, India +6.2% & Japan +0.6% in 2025, 4 Growth Upside – Next-Generation Trade Agreements, Mitigation of Conflicts, Structural Reform Momentum, Growth Engine Powered by Artificial Intelligence (AI), 5 Downside Risks – Escalating Trade Measures & Prolonged Trade Policy Uncertainty, Rising Long-Term Interest Rates, Rising Social Discontent, Increasing Challenges to International Cooperation, Labor Supply Gaps

The International Monetary Fund (IMF) has released the IMF World Economic Outlook 2025 (April Update), providing key insights into global economy & GDP growth in 2025 & 2026. See below for key findings & summary | View report

IMF World Economic Outlook 2025

1) GDP Forecast:

GDP Growth Forecast (2025 / 2026):

- Global: +2.8% / +3%

- Advanced Economies: +1.4% / +1.5%

- Emerging Market and Developing Economies: +3.7% / +3.9%

Global Inflation Forecast (2025 / 2026): +4.3% / +3.6%

2025 / 2026 GDP Growth forecast in Americas:

- United States: +1.5% / +1.7%

- Canada: +0.6 / +2.2%

- Brazil: +2% / +2.2%

- Mexico: -0.2% / +2%

2025 / 2026 GDP Growth forecast in Europe:

- United Kingdom: +1.7% / +0.9%

- Germany: +0.3% / +1%

- France: +0.8% / +1%

- Italy: +0.4% / +0.8%

- Spain: +2.5% / +1.8%

- Netherlands: +1.4% / +1.4%

- Switzerland: +0.9% / +1.6%

- Russia: +1.5% / +0.9%

2025 / 2026 GDP Growth Forecast in APAC:

- China: +4% / +4%

- India: +6.2% / +6.3%

- Japan: +0.6% / +0.6%

- South Korea: +1% / +1.4%

- Taiwan: +2.9% / +2.5%

- Hong Kong: +1.5% / +1.9%

- Singapore: +2% / +1.9%

- Indonesia: +4.7% / +4.7%

- Malaysia: +4.1% / +3.8%

- Thailand: +1.8% / +1.6%

- Philippines: +5.5% / +5.8%

- Vietnam: +5.2% / +4%

- Australia: +1.6% / +2.1%

- New Zealand: +1.4% / +2.7%

2025 / 2026 GDP Growth Forecast in Middle East:

- UAE: +4% / +5%

- Saudi Arabia: +3% / +3.7%

- Israel: +3.2% / +3.6%

- Egypt: +3.8% / +4.3%

- Iran: +0.3% / +1.1%

- Iraq: -1.5% / +1.4%

- Qatar: +2.4% / +5.6%

- Kuwait: +1.9% / +3.1%

Top 10 Economies in the World (GDP):

- United States – $27.7 trillion

- China – $17.7 trillion

- Germany – $4.5 trillion

- Japan – $4.2 trillion

- India – $3.5 trillion

- United Kingdom – $3.3 trillion

- France – $3 trillion

- Italy – $2.3 trillion

- Brazil – $2.1 trilion

- Canada – $2.1 trillion

Top 15 Economies in Asia-Pacific (GDP):

- China – $17.7 trillion

- Japan – $4.2 trillion

- India – $3.5 trillion

- Australia – $1.7 trillion

- South Korea – $1.7 trillion

- Indonesia – $1.3 trillion

- Taiwan – $755 billion

- Thailand – $514 billion

- Singapore – $501 billion

- Bangladesh – $437 billion

- Philippines – $437 billion

- Vietnam – $429 billion

- Malaysia – $399 billion

- Hong Kong – $380 billion

- Pakistan – $337 billion

Source (GDP): World Bank

2) 2025 Global Economy

- Global GDP – To increase to +2.8% in 2025, and +3% in 2026

- Global inflation – To decrease to +4.3% in 2025, and +3.6% in 2026

3) 2025 Global Outlook

- Global economy at critical juncture

- Major policy shifts are resetting the global trade system and giving rise to uncertainty

- United States tariffs against trading partners which have invoked countermeasures.

- Signs of stabilization were emerging through much of 2024 after a prolonged and challenging period of unprecedented shocks

- Inflation down from multi-decade highs followed a gradual though bumpy decline toward central bank targets

- Labor markets normalized with unemployment and vacancy rates returning to pre-pandemic levels

- Growth hovered around 3% in the past few years and global output came close to potential

- Diminished Policy Space – Much of the available policy space has already been exhausted in many countries, limiting how much support policymakers can give economies in case of new negative shocks or a pronounced downturn. Many countries passed large fiscal support packages, first during the pandemic and then as energy and food prices spiked at the onset of Russia’s invasion of Ukraine.

- High Public Debt amid Elevated Interest Rates – Fiscal space is now much tighter than a decade ago, and the fiscal adjustment required to stabilize debt ratios is at a historic high. At the same time, debt service as a fraction of fiscal revenue is rising Servicing costs remain below pandemic levels in countries where debt was incurred under favorable conditions during COVID-19, effective rates are likely to surpass prepandemic levels as debt rolls over, notably those for low-income countries and some emerging market and developing economies.

- Global Imbalances Arising from Domestic Imbalances – Rising geopolitical tensions and widening domestic imbalances, in particular, weak demand in China and strong demand in the United States – have renewed concerns about global imbalances. Since 2016–17, China and the United States have diversified their bases of trading partners, decoupling from each other in terms of export and import linkages

Assumptions:

- Monetary policy – In the United States, the federal funds rate is projected to be down to 4% at the end of 2025 and reach its long-term equilibrium of 2.9% at the end of 2028. In the euro area, 100 basis points in cuts are expected in 2025 (with three cuts having already occurred this year), representing two more 25 basis point cuts than in the assumptions underlying the October 2024 WEO, bringing the policy rate to 2% by the middle of the year. In Japan, policy rates are expected to be lifted at a similar pace as assumed in October 2024, gradually rising over the medium term toward a neutral setting of about 1.5%

- Fiscal policy – Governments in advanced economies on average are expected to tighten fiscal policy in 2025, 2026 and, to a lesser extent, in 2027.

- Commodity price – Prices of fuel commodities are projected to decrease in 2025 by 7.9%, with a 15.5% decline in oil prices and a 15.8% drop in coal prices offset by a 22.8% increase in natural gas prices

4) 4 Growth Upside

- Next-generation trade agreements

- Mitigation of conflicts

- Structural reform momentum

- Growth engine powered by artificial intelligence (AI)

5) 5 Downside Risks

- Escalating trade measures & prolonged trade policy uncertainty

- Rising long-term interest rates

- Rising social discontent

- Increasing challenges to international cooperation

- Labor supply gaps

6) 10 Central Bank policies recommendations / priorities:

- Delivering a stable and predictable trade environment

- Preserve international cooperation

- Calibrate monetary policy amid two-sided risk

- Safeguard financial stability through prudential policy

- Devise adjustment plans to restore fiscal sustainability

- Enact targeted fiscal reforms

- Protect growth & the vulnerable

- Use timely, targeted, temporary support where essential, in a responsible way

- Enact structural reforms for medium-term growth

- Make progress on climate policies

7) IMF World Economic Outlook 2025 Forecast – April Update

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit