Thailand Billionaire Charoen Sirivadhanabhakdi $2.4 Billion Frasers Property Offers to Buyout Frasers Hospitality Trust at $1 Billion Valuation ($0.71 Per Share) Representing +11.1% Premium Over Net Asset Value (NAV), Failed in Buyout Offer in 2022 at $0.70 Per Share with Only 0.12% Shareholders Votes Short (74.88% Approved, Requirement 75%)

15th May 2025 | Hong Kong

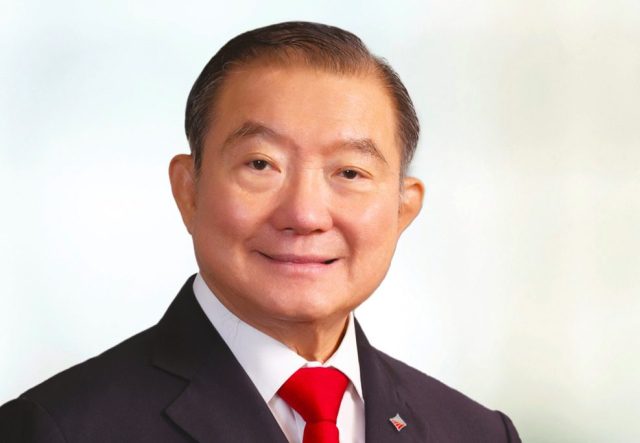

Thailand billionaire Charoen Sirivadhanabhakdi (Age 81) with $12 billion Singapore-listed Frasers Property ($2.4 billion market value) has made an offer to buyout Singapore-listed Frasers Hospitality Trust at $1 billion valuation ($0.71 per share), representing +11.1% premium over net asset value (NAV). In 2022, Frasers Property failed in buyout offer at $0.70 per share with only 0.12% shareholders votes short (74.88% approved, requirement 75%). Frasers Hospitality Trust – FHT is the first global hotel and serviced residence trust to be listed in Singapore. It is established with the principal strategy of investing globally in income-producing real estate assets used primarily for hospitality purposes. In 2025 February, Charoen Sirivadhanabhakdi retired as Chairman of Frasers Property (7/2/25) & appointed as Chairman Emeritus with Chumpol NaLamlieng succeeding as Chairman. Frasers Property has a market value of around $2.4 billion. In 2025 January, Charoen Sirivadhanabhakdi announced to retire as Fraser & Neave (F&N) Chairman on 16th January 2025 & appointed as Chairman Emeritus, with Koh Poh Tiong appointed as Chairman and CEO Thapana Sirivadhanabhakdi (Son of Charoen Sirivadhanabhakdi) appointed as Vice-Chairman. F&N is listed on Singapore Exchange (SGX) with current market value of around $1 billion. Charoen Sirivadhanabhakdi is the founder of Thai Beverage, and has key shareholdings in TCC Group, F&N., Fraser Property, Oishi Group, Berli Jucker, Big C Supercenter & Asset World Corporation. In 1995, Charoen Sirivadhanabhakdi (Thai Beverage) created Chang beer. Charoen Sirivadhanabhakd late wife is Khunying Wanna (Wanna Sirivadhanabhakdi), and they have 5 children (Atinant Bijananda, Wallapa Traisorat, Thapana Sirivadhanabhakdi, Thapanee Techajareonvikul & Panote Sirivadhanabhakdi). In 2024 July, Thai Beverage (ThaiBev, $9.2 billion market value) has proposed a share swap between subsidiary InterBev Investment & Thailand billionaire Charoen Sirivadhanabhakdi investment holding company TCC Assets, with InterBev Investment to transfer all 28.78% of Frasers Property to TCC Assets and TCC Assets to transfer 41.3% of F&N to InterBev Investment. Thai Beverage (ThaiBev) CEO is Thapana Sirivadhanabhakdi, who is the son of Charoen Sirivadhanabhakdi. Thailand billionaire Charoen Sirivadhanabhakdi personal fortune is at $11 billion. Profile – Frasers Property Limited is a multinational investor-developer-manager of real estate products and services across the property value chain. The Group is listed on the Main Board of the Singapore Exchange Securities Trading Limited (“SGX-ST”) and headquartered in Singapore. Frasers Property’s multinational businesses operate across five asset classes, namely, commercial & business parks, hospitality, industrial & logistics, residential and retail. We have businesses in Southeast Asia, Australia, Europe and China, and our well-established hospitality business owns and/or operates serviced apartments and hotels in over 20 countries and more than 70 cities across Asia, Australia, Europe, the Middle East and Africa. Frasers Property is also the sponsor of two real estate investment trusts (“REITs”) and one stapled trust listed on the SGX-ST. Frasers Centrepoint Trust and Frasers Logistics & Commercial Trust are focused on retail, and industrial & commercial properties, respectively. Frasers Hospitality Trust (comprising Frasers Hospitality Real Estate Investment Trust and Frasers Hospitality Business Trust) is a stapled trust focused on hospitality properties. In addition, the Group has two REITs listed on the Stock Exchange of Thailand. Frasers Property (Thailand) Public Company Limited is the sponsor of Frasers Property Thailand Industrial Freehold & Leasehold REIT, which is focused on industrial & logistics properties in Thailand, and Golden Ventures Leasehold Real Estate Investment Trust, which is focused on commercial properties.

“ Thailand Billionaire Charoen Sirivadhanabhakdi $2.4 Billion Frasers Property Offers to Buyout Frasers Hospitality Trust at $1 Billion Valuation ($0.71 Per Share) Representing +11.1% Premium Over Net Asset Value (NAV), Failed in Buyout Offer in 2022 at $0.70 Per Share with Only 0.12% Shareholders Votes Short (74.88% Approved, Requirement 75%) “

Thailand Billionaire Charoen Sirivadhanabhakdi Age 80 with $12 Billion Fortune Retires as Chairman of $2.4 Billion Frasers Property (7/2/25) & Appointed as Chairman Emeritus with Chumpol NaLamlieng Succeeding as Chairman, Retired as Fraser & Neave (F&N) Chairman on 16th January 2025 & Appointed as Chairman Emeritus, Koh Poh Tiong Appointed as Chairman and CEO Thapana Sirivadhanabhakdi Who is Son of Charoen Sirivadhanabhakdi is Appointed as Vice-Chairman

8th February 2025 – Thailand billionaire Charoen Sirivadhanabhakdi (Age 80) with $12 billion fortune has retired as Chairman of Frasers Property (7/2/25) & appointed as Chairman Emeritus with Chumpol NaLamlieng succeeding as Chairman. Frasers Property has a market value of around $2.4 billion. In 2025 January, Charoen Sirivadhanabhakdi announced to retire as Fraser & Neave (F&N) Chairman on 16th January 2025 & appointed as Chairman Emeritus, with Koh Poh Tiong appointed as Chairman and CEO Thapana Sirivadhanabhakdi (Son of Charoen Sirivadhanabhakdi) appointed as Vice-Chairman. F&N is listed on Singapore Exchange (SGX) with current market value of around $1 billion. Charoen Sirivadhanabhakdi is the founder of Thai Beverage, and has key shareholdings in TCC Group, F&N., Fraser Property, Oishi Group, Berli Jucker, Big C Supercenter & Asset World Corporation. In 1995, Charoen Sirivadhanabhakdi (Thai Beverage) created Chang beer. Charoen Sirivadhanabhakd late wife is Khunying Wanna (Wanna Sirivadhanabhakdi), and they have 5 children (Atinant Bijananda, Wallapa Traisorat, Thapana Sirivadhanabhakdi, Thapanee Techajareonvikul & Panote Sirivadhanabhakdi). In 2024 July, Thai Beverage (ThaiBev, $9.2 billion market value) has proposed a share swap between subsidiary InterBev Investment & Thailand billionaire Charoen Sirivadhanabhakdi investment holding company TCC Assets, with InterBev Investment to transfer all 28.78% of Frasers Property to TCC Assets and TCC Assets to transfer 41.3% of F&N to InterBev Investment. Thai Beverage (ThaiBev) CEO is Thapana Sirivadhanabhakdi, who is the son of Charoen Sirivadhanabhakdi. Thailand billionaire Charoen Sirivadhanabhakdi personal fortune is at $11 billion. Profile – Frasers Property Limited is a multinational investor-developer-manager of real estate products and services across the property value chain. The Group is listed on the Main Board of the Singapore Exchange Securities Trading Limited (“SGX-ST”) and headquartered in Singapore. Frasers Property’s multinational businesses operate across five asset classes, namely, commercial & business parks, hospitality, industrial & logistics, residential and retail. We have businesses in Southeast Asia, Australia, Europe and China, and our well-established hospitality business owns and/or operates serviced apartments and hotels in over 20 countries and more than 70 cities across Asia, Australia, Europe, the Middle East and Africa. Frasers Property is also the sponsor of two real estate investment trusts (“REITs”) and one stapled trust listed on the SGX-ST. Frasers Centrepoint Trust and Frasers Logistics & Commercial Trust are focused on retail, and industrial & commercial properties, respectively. Frasers Hospitality Trust (comprising Frasers Hospitality Real Estate Investment Trust and Frasers Hospitality Business Trust) is a stapled trust focused on hospitality properties. In addition, the Group has two REITs listed on the Stock Exchange of Thailand. Frasers Property (Thailand) Public Company Limited is the sponsor of Frasers Property Thailand Industrial Freehold & Leasehold REIT, which is focused on industrial & logistics properties in Thailand, and Golden Ventures Leasehold Real Estate Investment Trust, which is focused on commercial properties.

Thailand Billionaire Charoen Sirivadhanabhakdi Age 80 with $12 Billion Fortune to Retire as Fraser & Neave (F&N) Chairman on 16th January 2025 & Appointed as Chairman Emeritus, Koh Poh Tiong Appointed as Chairman and CEO Thapana Sirivadhanabhakdi Who is Son of Charoen Sirivadhanabhakdi is Appointed as Vice-Chairman, F&N Listed on Singapore Exchange with Market Value at $1 Billion

26th December 2024 – Thailand billionaire Charoen Sirivadhanabhakdi (Age 80) with $12 billion fortune has announced to retire as Fraser & Neave (F&N) Chairman on 16th January 2025 & appointed as Chairman Emeritus, with Koh Poh Tiong appointed as Chairman and CEO Thapana Sirivadhanabhakdi (Son of Charoen Sirivadhanabhakdi) appointed as Vice-Chairman. F&N is listed on Singapore Exchange (SGX) with current market value of around $1 billion. Charoen Sirivadhanabhakdi is the founder of Thai Beverage, and has key shareholdings in TCC Group, F&N., Fraser Property, Oishi Group, Berli Jucker, Big C Supercenter & Asset World Corporation. In 1995, Charoen Sirivadhanabhakdi (Thai Beverage) created Chang beer. Charoen Sirivadhanabhakd late wife is Khunying Wanna (Wanna Sirivadhanabhakdi), and they have 5 children (Atinant Bijananda, Wallapa Traisorat, Thapana Sirivadhanabhakdi, Thapanee Techajareonvikul & Panote Sirivadhanabhakdi). In 2024 July, Thai Beverage (ThaiBev, $9.2 billion market value) has proposed a share swap between subsidiary InterBev Investment & Thailand billionaire Charoen Sirivadhanabhakdi investment holding company TCC Assets, with InterBev Investment to transfer all 28.78% of Frasers Property to TCC Assets and TCC Assets to transfer 41.3% of F&N to InterBev Investment. Thai Beverage (ThaiBev) CEO is Thapana Sirivadhanabhakdi, who is the son of Charoen Sirivadhanabhakdi. Thailand billionaire Charoen Sirivadhanabhakdi personal fortune is at $11 billion. Profile – Fraser and Neave, Limited (“F&N” or the “Group“) had its origins more than a century ago, in the spirited decisions of two enterprising young men, John Fraser and David Neave, who diversified from their printing business to pioneer the aerated water business in Southeast Asia in 1883. From a soft drinks base, F&N ventured into the businesses of beer in 1931, dairy in 1959, property development and management in 1990, and publishing & printing in 2000. In 2012, the Group divested a substantial part of its beer business. In 2013, as F&N celebrated its 130th year of operation, it also welcomed its new majority shareholder, the TCC Group, which is engaged in food and beverage, real estate, industrial trading and consumer products, insurance and agriculture. In January 2014, through a distribution in specie and re-listing of Frasers Property Limited by way of introduction on the Singapore stock exchange, the Group demerged its Properties business. Today, F&N is a leading Southeast Asian consumer group with expertise and prominent standing in the Food & Beverage and Publishing & Printing industries. Leveraging its strengths in marketing and distribution, research and development, brands and financial management, as well as years of acquisition experience, the Group provides key resources and sets strategic directions for its subsidiary companies across both industries. Listed on the Singapore Stock Exchange, F&N ranks as one of the most established and successful companies in the region with an impressive array of renowned brands that enjoy strong market leadership. F&N is present in 11 countries spanning Asia Pacific and the Americas, and employs over 7,200 people worldwide.

$9.2 Billion Thai Beverage (ThaiBev) Proposes Share Swap Between Subsidiary InterBev Investment & Thailand Billionaire Charoen Sirivadhanabhakdi Investment Holding Company TCC Assets, InterBev Investment to Transfer All 28.78% of Frasers Property to TCC Assets & TCC Assets to Transfer 41.3% of F&N to InterBev Investment, Thai Beverage (ThaiBev) CEO is Thapana Sirivadhanabhakdi Who is Son of Charoen Sirivadhanabhakdi, Charoen Sirivadhanabhakdi Personal Fortune is at $11 Billion

19th July 2024 – Thai Beverage (ThaiBev, $9.2 billion market value) has proposed a share swap between subsidiary InterBev Investment & Thailand billionaire Charoen Sirivadhanabhakdi investment holding company TCC Assets, with InterBev Investment to transfer all 28.78% of Frasers Property to TCC Assets and TCC Assets to transfer 41.3% of F&N to InterBev Investment. Thai Beverage (ThaiBev) CEO is Thapana Sirivadhanabhakdi, who is the son of Charoen Sirivadhanabhakdi. Thailand billionaire Charoen Sirivadhanabhakdi personal fortune is at $11 billion.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit