$64 Billion Regeneron Pharmaceuticals Buys Bankrupt DNA Testing, Genetics & Biotechnology Company 23andMe for $256 Million in Bankruptcy Auction, Filed for United States Chapter 11 Bankruptcy in 2025 March, Founded in 2006 by Anne Wojcicki, Paul Cusenza & Linda Avey, Nasdaq IPO in 2021 via SPAC Merger with UK Virgin Group Billionaire Richard Branson SPAC (VG Acquisition Corp) & Crossed $6 Billion Market Value after Listing

20th May 2025 | Hong Kong

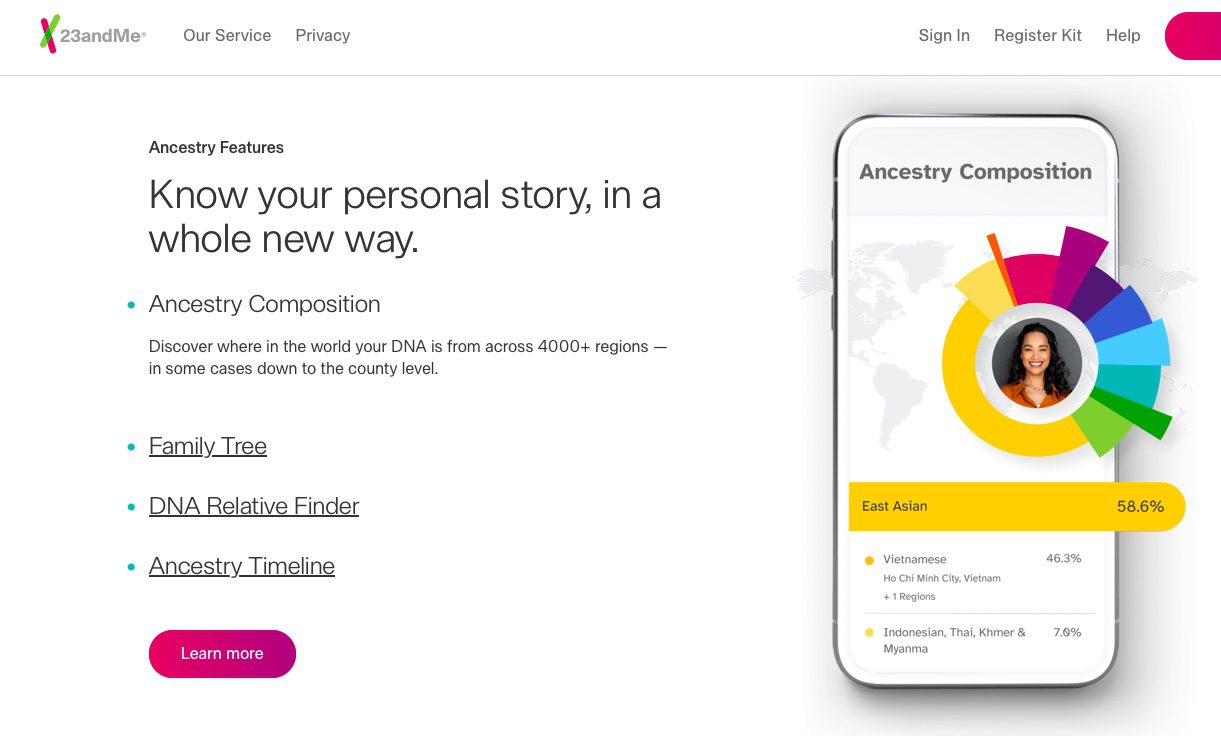

Regeneron Pharmaceuticals ($64 billion market value) has announced to buy bankrupt DNA testing, genetics & biotechnology company 23andMe for $256 million in bankruptcy auction. In 2025 March, $6 billion DNA testing, genetics & biotechnology company 23andMe filed for a United States Chapter 11 Bankruptcy. 23andMe was founded in 2006 by Anne Wojcicki, Paul Cusenza & Linda Avey. 23andMe IPO on Nasdaq in 2021 via SPAC merger with UK Virgin Group billionaire Richard Branson SPAC (VG Acquisition Corp), and crossed $6 billion market value after listing. 23andMe – 23andMe is a genetics-led consumer healthcare and biotechnology company empowering a healthier future. Regeneron – Regeneron (NASDAQ: REGN) is a leading biotechnology company that invents, develops and commercializes life-transforming medicines for people with serious diseases. Founded and led by physician-scientists, its unique ability to repeatedly and consistently translate science into medicine has led to numerous approved treatments and product candidates in development, most of which were homegrown in its laboratories. Regeneron’s medicines and pipeline are designed to help patients with eye diseases, allergic and inflammatory diseases, cancer, cardiovascular and metabolic diseases, neurological diseases, hematologic conditions, infectious diseases, and rare diseases. Regeneron pushes the boundaries of scientific discovery and accelerates drug development using its proprietary technologies, such as VelociSuite®, which produces optimized fully human antibodies and new classes of bispecific antibodies. Regeneron is shaping the next frontier of medicine with data-powered insights from the Regeneron Genetics Center® and pioneering genetic medicine platforms, enabling it to identify innovative targets and complementary approaches to potentially treat or cure diseases.

“ $64 Billion Regeneron Pharmaceuticals Buys Bankrupt DNA Testing, Genetics & Biotechnology Company 23andMe for $256 Million in Bankruptcy Auction, Filed for United States Chapter 11 Bankruptcy in 2025 March, Founded in 2006 by Anne Wojcicki, Paul Cusenza & Linda Avey, Nasdaq IPO in 2021 via SPAC Merger with UK Virgin Group Billionaire Richard Branson SPAC (VG Acquisition Corp) & Crossed $6 Billion Market Value after Listing “

$6 Billion DNA Testing, Genetics & Biotechnology Company 23andMe Files for United States Chapter 11 Bankruptcy, Founded in 2006 by Anne Wojcicki, Paul Cusenza & Linda Avey, Nasdaq IPO in 2021 via SPAC Merger with UK Virgin Group Billionaire Richard Branson SPAC (VG Acquisition Corp) & Crossed $6 Billion Market Value after Listing

25th March 2025 – $6 billion DNA testing, genetics & biotechnology company 23andMe has filed for a United States Chapter 11 Bankruptcy. 23andMe was founded in 2006 by Anne Wojcicki, Paul Cusenza & Linda Avey. 23andMe IPO on Nasdaq in 2021 via SPAC merger with UK Virgin Group billionaire Richard Branson SPAC (VG Acquisition Corp), and crossed $6 billion market value after listing. 23andMe – 23andMe is a genetics-led consumer healthcare and biotechnology company empowering a healthier future.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit