France $1.5 Billion Venture Capital Firm Cathay Innovation Raised $1 Billion for New AI-Dedicated Venture Capital Fund (Cathay Innovation Fund III) Investing in AI Solutions in 4 Key Sectors (Digital Health, Fintech, Consumer & Mobility / Energy) in Europe, United States & Asia, Invests $5 Million to $100 Million in Series A, Series B & Late-Stage Startups

29th May 2025 | Hong Kong

France venture capital firm Cathay Innovation ($1.5 billion AUM) has raised $1 billion for a new AI-dedicated venture capital fund (Cathay Innovation Fund III), investing in AI solutions in 4 key sectors (Digital Health, Fintech, Consumer & Mobility / Energy) in Europe, United States & Asia. Cathay Innovation Fund invests $5 million to $100 million in Series A, Series B & late-stage startups. Announcement (27/5/25): “Cathay Innovation today announced the final close of its latest venture capital fund at $1B, making it the largest AI-dedicated fund out of the European Union. While headquartered in France, the fund invests across Europe, the U.S., and Asia in vertical AI solutions in four key sectors: digital health, fintech, consumer and mobility / energy. The successful close signals a greater shift in AI-era venture capital, where the success of startups and established industry players are increasingly intertwined. Fund III is backed by a diverse base of institutional investors as well as multinational corporations looking to access the latest AI startup technologies key to industry wide transformation. This includes major organizations such as Sanofi, TotalEnergies, Valeo, BNP Paribas Cardif, Groupe SEB and Groupe ADP (Paris Aéroport) since first closing, joined by several international industry players including Vale Ventures, Copec WIND Ventures and more … … Beyond investment, Cathay Innovation’s global platform connects startups with its corporate ecosystem, a broad network of 20+ Fortune 500 corporations to facilitate deeper industry collaboration. This includes strategic partnerships, co-investments or other business development opportunities such as global biopharma Sanofi’s ongoing AI initiatives with Cathay Innovation portfolio companies Owkin, AQEMIA or Inato. This not only helps startups scale earlier and faster, but it helps corporations access cutting-edge technologies at a time when transformation is mission critical. Fund III primarily focuses on startups applying AI deeply tailored to specific sectors. Focusing on Series A, B and late-stage startups, Fund III invests between $5 and $100 million, leading or co-leading rounds and reserving capital for follow-on support. To date, it has invested in 14 startups across the U.S., Europe and Asia including: 1) Healthcare: Nabla (AI co-pilot for physicians), AQEMIA (AI + quantum physics drug discovery), Bioptimus (first universal foundation model for biology), Nelly (European fintech simplifying healthcare payments) 2) Financial Services: Range (AI-driven wealth management), Flowdesk (full-stack market-making for digital assets), Ping++ (Open banking and payment infrastructure) 3) Consumer: Ghost (B2B marketplace for excess inventory), Reebelo (marketplace for refurbished tech devices), Imagino (customer data platform for modern brands), Mogic (genAI-powered short-form video creation), Beatbot (intelligent robotic cleaning systems) 4) Energy: David Energy (next-gen retail energy platform), Entalpic (foundation model-based materials discovery for low-carbon innovations) … … The firm’s geographic diversity is a strategic advantage in today’s fragmented world, helping startups in the U.S., for example, operate successfully in Europe, Latam or other parts of the world and vice versa. Fund III is also classified as an Article 8 fund under the EU’s Sustainable Finance Disclosure Regulation (SFDR), reflecting its commitment to environmental and social impact. It backs high-growth companies where AI is used to advance industries in ways that are locally grounded, globally scalable and socially positive.”

“ France $1.5 Billion Venture Capital Firm Cathay Innovation Raised $1 Billion for New AI-Dedicated Venture Capital Fund (Cathay Innovation Fund III) Investing in AI Solutions in 4 Key Sectors (Digital Health, Fintech, Consumer & Mobility / Energy) in Europe, United States & Asia, Invests $5 Million to $100 Million in Series A, Series B & Late-Stage Startups “

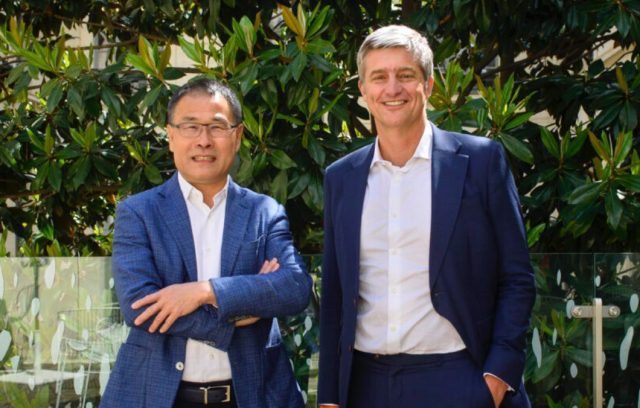

Mingpo Cai, Founder and Chairman of Cathay Capital and Cathay Innovation: “In one of the most challenging fundraising periods the venture industry has seen, Fund III illustrates the power of value-added capital. The benefits of the Cathay platform go far beyond capital, it’s rooted in providing solutions that are useful to our investors, corporate partners and founders. Regardless of macroeconomic uncertainties, the AI-driven transformation of industries will go on. Our mission is to support local champions and create ecosystem synergies that benefit all stakeholders while creating lasting economic and societal impact.”

Denis Barrier, Co-founder of Cathay Innovation: “Fund III represents a new kind of VC fund built for the AI era, with the capital and ecosystem needed for real industrial and societal change. AI is a general-purpose technology—like electricity— not offering incremental improvements, but with the potential to reinvent entire industries. This shift has redefined the role of startups from disruptors to transformation partners, with collaboration now the new currency for success. Over the past decade, we’ve built the world’s largest venture capital platform that can connect startups and corporate innovation under one roof to drive this transformation together.”

Cathay Innovation – Cathay Innovation is a multistage venture capital firm, affiliated to Cathay Capital, investing in founders building transformative businesses across Europe, North America, Asia, Latin America and Africa. Its platform connects founders with investors and its ecosystem of leading Fortune500 corporations to help startups scale and transform industries with consumer to enterprise and AI solutions in commerce, fintech, digital health and mobility / energy. Founded in Paris in 2015, Cathay Innovation now manages over €2.5B AUM with additional offices in San Francisco, Berlin, Madrid, Shanghai and Singapore and has invested in over 120 startups including Chime, Pinduoduo (NASDAQ: PDD), Glovo, Wallbox (NYSE: WBX), Owkin, Getaround, Ledger, ZenBusiness, Alma, Descartes Underwriting and more.

France $1.5 Billion Venture Capital Firm Cathay Innovation Raised $1 Billion for New AI-Dedicated Venture Capital Fund (Cathay Innovation Fund III) Investing in AI Solutions in 4 Key Sectors (Digital Health, Fintech, Consumer & Mobility / Energy) in Europe, United States & Asia, Invests $5 Million to $100 Million in Series A, Series B & Late-Stage Startups

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit