Goldman Sachs Asset Management to Invest in World 2nd Largest Ice Cream Maker (Häagen-Dazs & Oreo) UK-Based Froneri at $17 Billion (€15 Billion) Valuation, Froneri Founded in 2016 as Joint Venture Between Switzerland Nestle & R&R Ice Cream (Acquired by France $30 Billion Private Equity Firm PAI Partners in 2013)

3rd August | Hong Kong

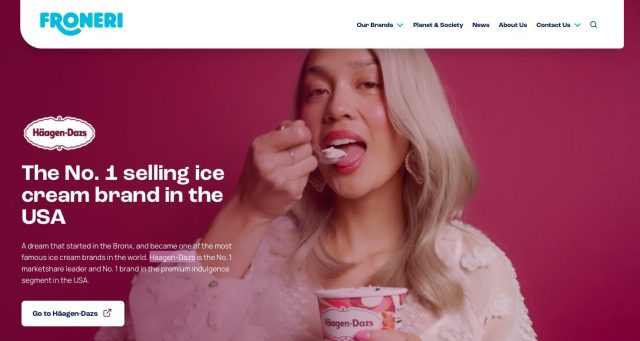

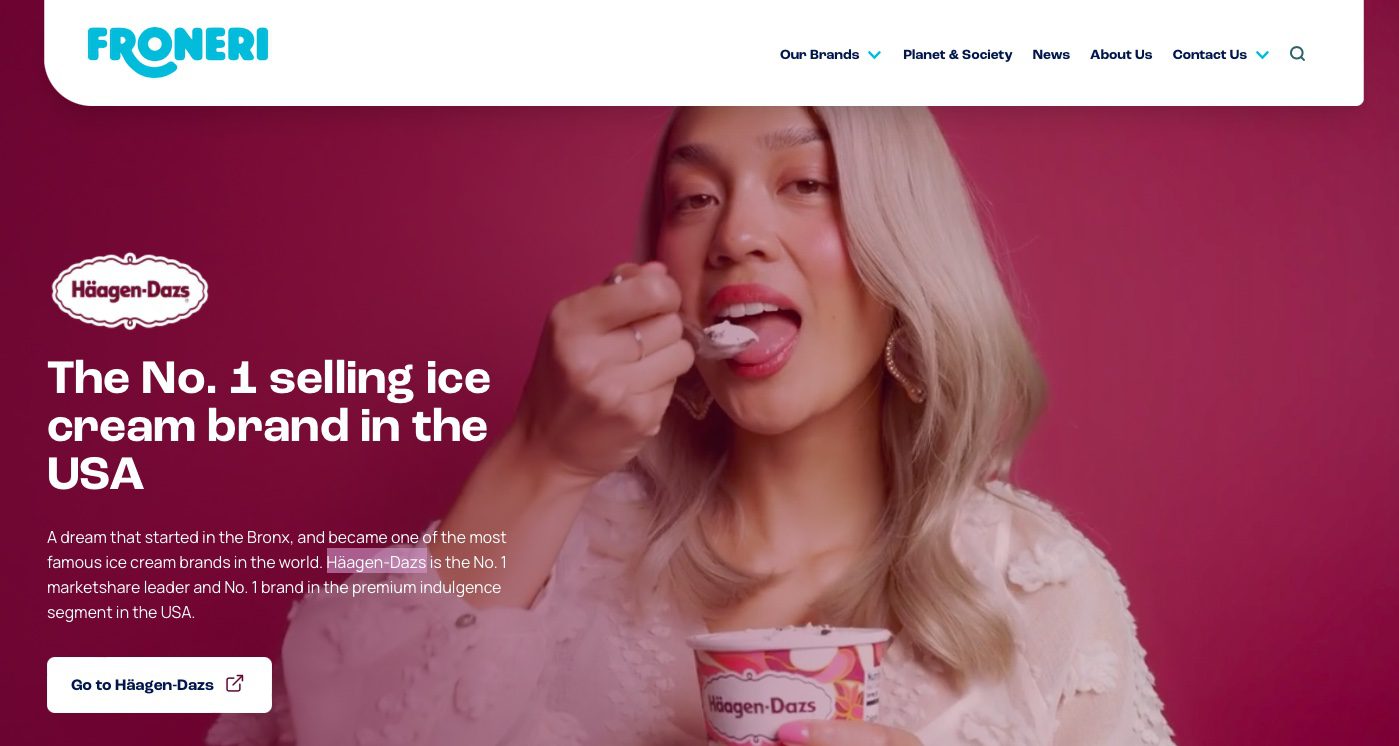

Goldman Sachs Asset Management has been reported to be investing in the world’s 2nd largest ice cream maker (Häagen-Dazs & Oreo) UK-based Froneri at $17 billion (€15 billion) valuation. Froneri was founded in 2016 as a joint venture between Switzerland Nestle & R&R Ice Cream (Acquired by France private equity firm PAI Partners with $30 billion AUM in 2013). Froneri – Created in 2016 as a dynamic joint-venture between R&R and Nestlé, we are the second largest ice cream company in the world and and the number one private label producer worldwide. We are a fast-growth international business with a vision to build the world’s best ice cream company. A passionate challenger brand, we are building the market through sole category focus and delivering value for retailers and consumers. Operating in 23 countries and with approximately 15,000 employees, Froneri is a one-stop shop for all customers looking for ice cream products no matter where you are in the world. R&R Ice Cream – R&R Ice Cream – originally Richmond Ice Cream – started out in 1985 as a North Yorkshire-based own label ice cream manufacturer. In the early years it had five employees and turnover of approximately £250,000. In 1998 the business merged with Treats Group plc – a Leeds based ice lolly manufacturer – followed by the acquisitions of ABF’s ice cream business in 2000 and of Nestlé Ice Cream’s UK business in 2001. The Nestle acquisition allows the company to manufacture, distribute and market top brands such as Fab, Mr Men, Smarties, Rolo and Rowntrees Fruit Pastilles. In 2006, following the Oaktree managed funds’ acquisition of the company; Richmond was merged with German ice cream manufacturer Roncadin GmbH to form R&R Ice Cream. The expansion programme accelerated with Kelly’s of Cornwall added to the portfolio in 2008 and the French business Rolland joining in 2010. This has been followed by the purchase of Pilpa in France, the German ice cream company Durigon and Italy’s largest own label ice cream manufacturer Eskigel. In 2011, R&R announced a licensing agreement with Mondelez International to manufacture and distribute an ice cream range of Mondelez International (formerly Kraft Foods) brands including Milka, Toblerone, Daim, Oreo and Philadelphia in 10 countries across mainland Europe. Most recently, R&R has acquired YooMoo, the leading UK frozen yogurt business, and Fredericks Dairies. PAI Partners – We are a pre-eminent private equity firm, investing in market-leading companies across the globe. Our unique perspective in realising opportunities and forging dynamic partnerships is at the foundation of PAI. Unrivalled longevity in our core sectors provides the highest levels of knowledge and experience – supported by our influential local and international networks. Our teams look to build not only bigger businesses – but better businesses. Sector-leading companies creating sustainable value for all.

“ Goldman Sachs Asset Management to Invest in World 2nd Largest Ice Cream Maker (Häagen-Dazs & Oreo) UK-Based Froneri at $17 Billion (€15 Billion) Valuation, Froneri Founded in 2016 as Joint Venture Between Switzerland Nestle & R&R Ice Cream (Acquired by France $30 Billion Private Equity Firm PAI Partners in 2013) “

Goldman Sachs Asset Management to Invest in World 2nd Largest Ice Cream Maker (Häagen-Dazs & Oreo) UK-Based Froneri at $17 Billion (€15 Billion) Valuation, Froneri Founded in 2016 as Joint Venture Between Switzerland Nestle & R&R Ice Cream (Acquired by France $30 Billion Private Equity Firm PAI Partners in 2013)

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit