United States Healthcare & Coronary Artery Disease (CAD) Company Heartflow Nasdaq IPO to Raise $212 Million at $1.3 Billion Valuation, Founded in 2007 by Charles Taylor & Christopher Zarins, Investors Include Bain Capital, Hayfin, Wellington, Janus Henderson Investors, US Venture Partners (USVP), HealthCor, Capricorn Investment Group & Martis Capital

3rd August | Hong Kong

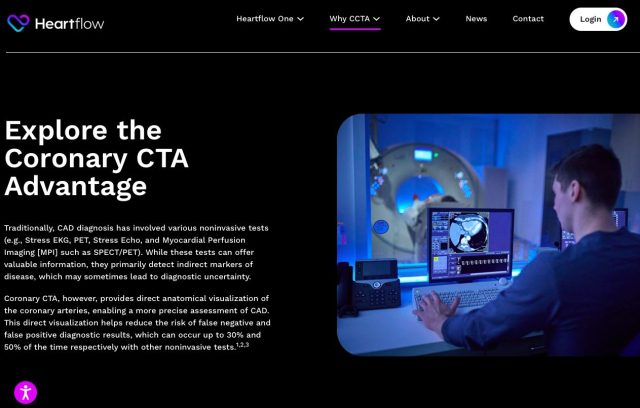

United States healthcare & coronary artery disease (CAD) company Heartflow Nasdaq IPO is raising $212 million at $1.3 billion valuation. Heartflow was founded in 2007 by Charles Taylor & Christopher Zarins. Heartflow investors include Bain Capital, Hayfin, Wellington, Janus Henderson Investors, US Venture Partners (USVP), HealthCor, Capricorn Investment Group & Martis Capital. Heartflow – Heartflow is the global leader in AI-driven coronary artery disease (CAD) management, transforming how CAD — the world’s leading cause of death — is diagnosed and treated. Our advanced technology generates personalized, precision 3D heart models from a single CT scan, providing clinicians with the clarity and confidence to deliver earlier, more effective treatments — transforming CAD into a disease that can be managed for life. Heartflow One is the only complete, non-invasive, precision coronary care platform providing patient insights throughout the guideline-directed CCTA pathway. The AI-driven platform — including Roadmap™ Analysis, FFRCT Analysis and Plaque Analysis — is supported by the ACC/AHA Chest Pain Guideline and backed by more than 600 peer-reviewed publications. With over 400,000 patients treated, more than 1,400 leading institutions adopting our solution, and 99.5% of U.S. lives covered — Heartflow is redefining the standard of coronary care. We’re a global company, with employees across the United States, Europe and Japan. Our headquarters are in Mountain View, California, with additional offices in California, Texas, the UK and Japan. We believe CAD shouldn’t be a silent threat. We’re changing the story of CAD by making it screenable, diagnosable, and manageable — empowering clinicians to save lives and giving patients more time for what matters most.

“ United States Healthcare & Coronary Artery Disease (CAD) Company Heartflow Nasdaq IPO to Raise $212 Million at $1.3 Billion Valuation, Founded in 2007 by Charles Taylor & Christopher Zarins, Investors Include Bain Capital, Hayfin, Wellington, Janus Henderson Investors, US Venture Partners (USVP), HealthCor, Capricorn Investment Group & Martis Capital “

United States Healthcare & Coronary Artery Disease (CAD) Company Heartflow Nasdaq IPO to Raise $212 Million at $1.3 Billion Valuation, Founded in 2007 by Charles Taylor & Christopher Zarins, Investors Include Bain Capital, Hayfin, Wellington, Janus Henderson Investors, US Venture Partners (USVP), HealthCor, Capricorn Investment Group & Martis Capital

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit