United States Grocery Delivery Instacart Files for IPO on Nasdaq with Reported Valuation of Around $12 Billion to $18 Billion, Founded in 2012 by Apoorva Mehta

25th August 2023 | Hong Kong

United States grocery delivery Instacart has filed for IPO (Initial Public Offering) on Nasdaq with reported valuation of around $12 billion to $18 billion. Instacart is founded in 2012 by Apoorva Mehta, and will transition to be off the Board after the IPO. Sequoia Capital and D1 Capital Partners owns more than 5% of Instacart.

“ United States Grocery Delivery Instacart Files for IPO on Nasdaq with Reported Valuation of Around $12 Billion to $18 Billion, Founded in 2012 by Apoorva Mehta “

United States Grocery Delivery Instacart Files for IPO on Nasdaq with Reported Valuation of Around $12 Billion to $18 Billion

25th August 2023 – Maplebear Inc. d/b/a “Instacart” today announced that it has filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission related to a proposed initial public offering of its common stock. The number of shares to be offered and the price range for the proposed offering have not yet been determined. Instacart intends to list its common stock on the Nasdaq Global Select Market under the symbol “CART.”

Goldman Sachs & Co. LLC and J.P. Morgan will act as lead book-running managers for the proposed offering. BofA Securities, Barclays, and Citigroup will act as additional book-running managers, Baird, JMP Securities, A Citizens Company, LionTree, Oppenheimer & Co., Piper Sandler, SoFi, Stifel, Blaylock Van, LLC, Drexel Hamilton, Loop Capital Markets, R. Seelaus & Co., LLC, Ramirez & Co., Inc., Stern, and Tigress Financial Partners will act as co-managers for the proposed offering.

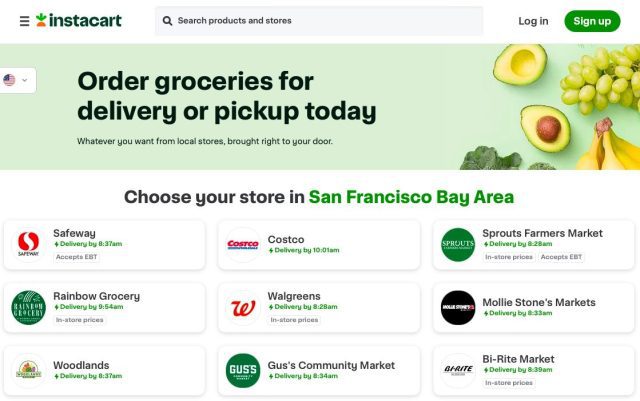

Instacart, the leading grocery technology company in North America, works with grocers and retailers to transform how people shop. The company partners with more than 1,400 national, regional, and local retail banners to facilitate online shopping, delivery and pickup services from more than 80,000 stores across North America on the Instacart Marketplace. Instacart makes it possible for millions of people to get the groceries they need from the retailers they love, and for approximately 600,000 Instacart shoppers to earn by picking, packing and delivering orders on their own flexible schedule. The Instacart Platform offers retailers a suite of enterprise-grade technology products and services to power their e-commerce experiences, fulfill orders, digitize brick-and-mortar stores, provide advertising services, and glean insights. With Instacart Ads, thousands of CPG brands – from category leaders to emerging brands – partner with the company to connect directly with consumers online, right at the point of purchase. With Instacart Health, the company is providing tools to increase nutrition security, make healthy choices easier for consumers, and expand the role that food can play in improving health outcomes.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit