Citi Gained $20 Billion Net Inflow into APAC Wealth Management Business

16th December 2020 | Hong Kong

Citi, one of the worlds’ largest bank, has gained net inflow of $20 billion into Citi Wealth Management business in Asia-Pacific (APAC), representing a 10% year-on-year growth with AUM (Assets under Management) growing to $238 billion. The $20 billion net inflow into Citi APAC Wealth Management business came not only from Asia, but also from Europe and Middle-East. Citi wealth business units include its affluent, Citigold and Citi Private Banking businesses.

“ Citi APAC Wealth Management, Gained $20 Billion Net Inflow, $238 billion AUM “

Citi CEO APAC Peter Babej

In 2019, Citi appointed Peter Babej, who was Citi’s Global Head of Financial Institution Group, as CEO of Citi Asia-Pacific. In 2019, Citi’s APAC business contributes around 20% of revenue and nearly 1/3 of Citi’s net income.

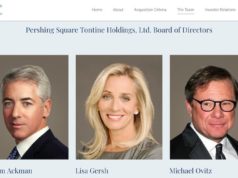

Citi’s wealth management senior leadership team includes Fabio Fontainha who is the Head of Retail Banking for Asia-Pacific and Europe, Middle East and Africa (EMEA), Chan San San who is the Head of Citigold Private Client for Asia, Europe, Middle East and Africa and Steven Lo who is the Regional Head of Citi Private Bank APAC and Lee Lung Nien who is the Chairman of South Asia Citi Private Bank.

Citi APAC Wealth Management Leadership Team

- Peter Babej, CEO of Citi Asia-Pacific

- Fabio Fontainha, Head of Retail Banking for APAC and EMEA

- Chan San San, Head of Citigold Private Client for Asia and EMEA

- Steven Lo, Regional Head of Citi Private Bank APAC

- Lee Lung Nien, Chairman of South Asia Citi Private Bank

Citi Private Bank, Citi Private Capital Group

Citi Private Bank which serves high net worth clients with more than $10 million net worth, manages around $500 billion assets, serves more than 1,400 family offices and private investment companies in more than 80 countries.

In June 2020, Citi Private Bank formed Citi Private Capital Group to provide institutional service to private investment companies, family offices and pools of private capital to opportunities in both the public and private markets. In 2020, Citi Private Bank has received increased client inquiries around what other Single Family Offices are doing, especially regarding commercial real estate and liquidity solutions.

Citi Client Segment:

- Citi Private Bank: $10 million net worth

- Citi Private Client: S$1.5 million / HKD 8 million* (SG / HK)

- Citigold: S$250,000 / HKD 1.5 million* (SG / HK)

* investible assets

Citi Wealth Hub, Citigold

On 14th December 2020 (Monday), Citi officially opened the bank’s largest wealth advisory hub, “Citi Wealth Hub” in Singapore. The hub will be serving Citi customers in Citigold and Citigold Private Client, providing cash and wealth management advisory services.

Citi Client Segment:

- Citi Private Bank: $10 million net worth

- Citi Private Client: S$1.5 million / HKD 8 million* (SG / HK)

- Citigold: S$250,000 / HKD 1.5 million* (SG / HK)

* investible assets

Citigroup

Founded in 1812, Citigroup is one of the world’s largest bank with more than 200 million customer accounts and around 200,000 employees in more than 160 countries and jurisdictions. It is listed on the New York Stock Exchange (NYSE) and has a market capitalization of $124.2 billion (15/12/20). In 2019, Citigroup reported total revenue of $74.2 billion and net profit of $19.4 billion.

Michael Corbat, Citi CEO:

“We continue to navigate the effects of the COVID-19 pandemic extremely well. Credit costs have stabilized; deposits continued to increase; and revenues are up 3% year-to-date. Our Institutional Clients Group again had very strong performance, especially in Markets, Investment Banking and the Private Bank. The backbone of our global network, Treasury and Trade Solutions experienced strong client engagement in the face of low interest rates.

Although Global Consumer Banking revenues remained lower as a result of the pandemic, we did see higher activity in our mortgage and wealth management products.”

Related News:

- Citi Gained $20 Billion Net Inflow into APAC Wealth Management Business

- Citi Private Bank Forms Citi Private Capital Group to Provide Institutional Service to Family Offices, Private Funds and Private Companies

More

- 2020 List of International Private Banks in Hong Kong

- 2020 List of Boutique Private Banks in Hong Kong

- 2020 List of International Private Banks in Singapore

- 2020 List of Boutique Private Banks in Singapore

Related:

- 2020 Top 10 Largest Family Office in the World

- 2020 Top 10 Largest Multi-Family Offices in the World

Reports

- UBS Global Family Report 2020

- Wealth-X Report: The Billionaire Consensus 2020

- Boston Consulting Group Global Wealth Report 2020

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit