7th Generation of Rothschild Family and Chairman of Edmond de Rothschild, Benjamin Dies

15th January 2021 | Hong Kong

The 7th generation of the Rothschild family, Benjamin de Rothschild (57) has died from a heart attack at his home in Switzerland on the 15th of January 2021 (Friday). Benjamin de Rothschild is the Chairman of Edmond de Rothschild, a French-Swiss banking group and a descendant of the Rothschild family, one of the most recognised name in the history of banking.

” 7th Generation of Rothschild family, Benjamin de Rothschild Dies at Age 57 “

Edmond de Rothschild, Founded by his Father, 7th Generation of Rothschild

Benjamin de Rothschild (Age 57) is the son of Edmond and Nadine de Rothschild. His father Edmond de Rothschild, founded the banking group “Edmond de Rothschild” named after himself in 1953. In 1997, Benjamin de Rothschild took over leadership at the banking group.

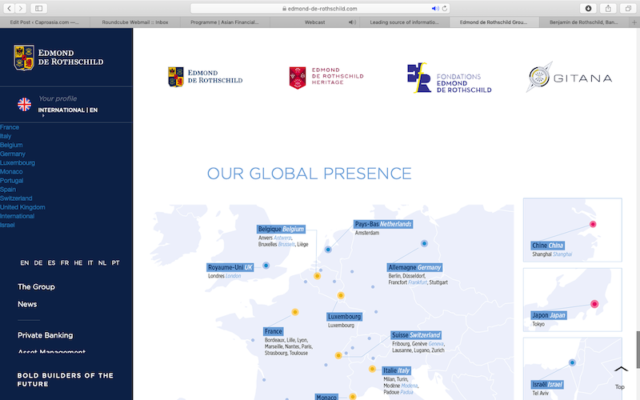

Today, Edmond de Rothschild manages around $193.9 billion of assets (CHF 173 billion). The banking group comprises of businesses in private banking, asset management, private equity, corporate finance, real estate and institution fund & services. In additional, the group also have a business in wine (Edmond de Rothschild Heritage), a foundation (Edmond de Rothschild Foundation) and a competitive sailing team (Gitana Team).

Benjamin de Rothschild is the 7th generation of Mayer Amschel Rothschild (1744 – 1812), who founded the Rothschild banking dynasty and who was referred to as the “founding father of international finance.”

Edmond de Rothschild, Rothschild & Co

In 2019, the Rothschild families settled a dispute in using the Rothschild name. Both Edmond de Rothschild and Rothschild & Co, with also cross-shareholdings, agreed not to use the Rothschild name by itself only.

Benjamin de Rothschild is a billionaire and have an estimated fortune of $1.5 billion. He is not not a successor banker, but also passionate in sailing, automobiles and wine. Benjamin is also an active philanthropist and was involved in developing innovation within the Adolphe de Rothschild Foundation Hospital.

Caproasia financial media extends our well-wishes to the family.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit