Hong Kong Billionaire & King of Oyster Sauce Lee Man Tat Died at Age 91, 6th Richest with $17 Billion Fortune

29th July 2021 | Hong Kong

Hong Kong billionaire & King of Oyster Sauce Lee Man Tat has died at the age of 91, on the 26th of July 2021. Lee Man Tat is the 3rd generation Chairman of Lee Kum Kee Group, the largest global producer of oyster sauce founded in 1888, and is the 6th richest man in Hong Kong with more than $17 billion fortune. His son Charlie Lee, is the 4th generation Chairman of Lee Kum Kee Group.

“ Hong Kong Billionaire & King of Oyster Sauce Lee Man Tat Died at Age 91, 6th Richest with $17 Billion Fortune “

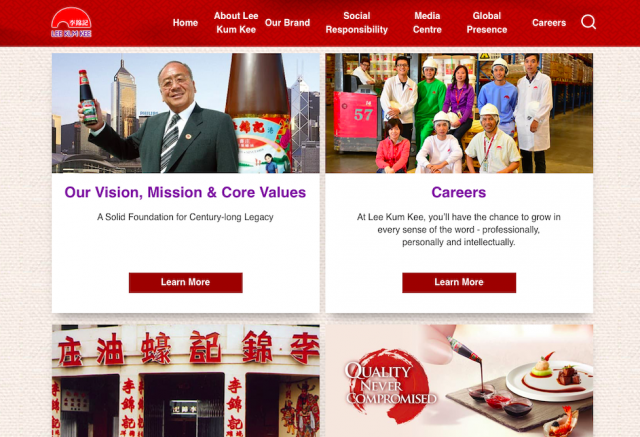

Hong Kong Billionaire Lee Man Tat, 3rd Generation Chairman of Lee Kum Kee (1888)

Lee Man Tat is the 3rd generation Chairman of Lee Kum Kee Group, founded by his grandfather Lee Kum Sheung in 1888. In 1972, he became the Chairman taking over from his father Lee Shiu-nan, and over the last 50 years, grew Lee Kum Kee Group into a global producer and distributor of sauce & condiments.

Today, Lee Kum Kee Group has 100+ products, 200+ sauces & condiments, 6,000+ employees and global distribution network in over 100 countries globally. In 2017, Lee Kum Kee Group acquired London’s landmark building Walkie-Talkie Skyscraper for £1.3 billion, a record price for a single building transaction.

Despite being the 6th richest man in Hong Kong with more than $17 billion fortune and one of the most successful companies in Hong Kong, Lee Man Tat had kept Lee Kum Kee Group as a private company, with no plans for a public listing.

Caproasia financial media extends our well-wishes to the family.

Video: Lee Kum Kee: Across Three Centuries Serving People with Passion to Enhance Taste

Corporate Video 2020 History, Achievements, Outlook – Lee Kum Kee Excels Beyond Millennium

The History Of Oyster Sauce with Lee Kum Kee

Billionaires:

- Billionaires Richard Branson and Jeff Bezos with $216 Billion Combined Wealth Starts Spaceflight Tourism

- Xiaomi Founder &

- Billionaire Lei Jun Donates $2.2 Billion of Shares to Charity

- UK Largest Divorce Payout from Russian Billionaire Farkhad Akhmedov, Settles at $186 Million from Original $620 Million

- British Fintech Wise IPO Creates 2 New Billionaires with $3.55 Billion

- China Premium Tea Nayuki IPO in Hong Kong, Creates 2 New Billionaires with $1.1 Billion Each

- Didi Global IPO Creates 2 New Self-Made Billionaires, Founder Will Cheng Wei with $4.4 Billion

- Billionaire Warren Buffett Resigns from Bill and Melinda Gates Foundation, $49 Billion Endowment

- United States Billionaires Tax Leak, Top 25 Pays 3.4% in Tax Rate from $401 Billion Fortune

- Didi Chuxing IPO Creates 2 New Self-Made Billionaires, Founder Will Cheng Wei with $7 Billion

- Billionaires Bill Gates & Melinda Divorce, $150 Billion Assets

- Billionaire James Dyson Switches Residency Back to UK from Singapore

- South Korean Billionaire & Chairman of Kakao Kim Beom-Su to Give More than Half His $10 Billion Fortune Away

- Billionaire & Google co-Founder Sergey Brin Setup Family Office in Singapore

- Macau Billionaire and Casino Tycoon Stanley Ho Died at Age 98

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit