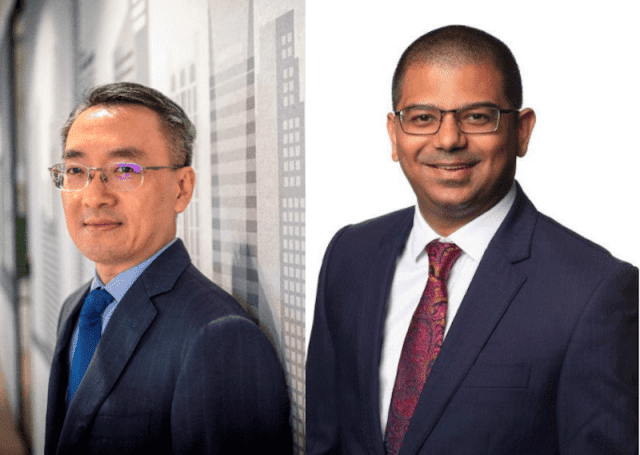

ING Bank Appoints Westpac Singapore CEO Anand Sachdev as Country Manager Singapore, Erwin Maspolim Appointed as Head of Southeast Asia

17th June 2022 | Singapore

ING Bank has appointed former Westpac Singapore CEO Anand Sachdev as the new ING Country Manager of Singapore succeeding Erwin Maspolim who is appointed as the Head of Southeast Asia, Representative Offices. Both appointments are effective from 21st June 2022, and reporting to Anju Abrol (Head of Wholesale Banking APAC). Anand Sachdev joins from Westpac Banking Corporation, where he last held the role of CEO Singapore & COO Asia, and had been with Westpac since 2005 (Senior roles across Asia, Australia and the Pacific Islands). Anju Abrol ING Bank Head of Wholesale Banking APAC: ”Anand’s solid experience and track record will strengthen our capabilities and support for our APAC growth strategy.” Erwin Maspolim (ING Head of Southeast Asia, Representative Offices) will focus on Vietnam & Indonesia, and Southeast Asian markets. Erwin has over 25 years of experience in front office leading corporate and project finance covering multiple sectors such as power, utilities, renewables, water, waste, technology, media & telecommunications, healthcare and infrastructure across APAC.

“ ING Bank Appoints Westpac Singapore CEO Anand Sachdev as Country Manager Singapore, Erwin Maspolim Appointed as Head of Southeast Asia “

ING Bank

Singapore is the Asia Pacific headquarters for ING and the branch has about 600 employees. In the Asia Pacific, ING offers wholesale banking across 11 markets, namely Australia, China, Hong Kong SAR, India, Indonesia, Japan, the Philippines, Singapore, South Korea, Taiwan and Vietnam.

About ING

ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is empowering people to stay a step ahead in life and in business. ING Bank’s more than 57,000 employees offer retail and wholesale banking services to customers in over 40 countries. ING Group shares are listed on the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and on the New York Stock Exchange (ADRs: ING US, ING.N). When it comes to sustainability, we facilitate and finance society’s shift to a low-carbon future and pioneer innovative forms of finance to support a better world. As such, we’re ranked first in the banks industry group by Sustainalytics and have an ‘AA’ rating in MSCI’s ratings universe. ING Group shares are included in major sustainability and Environmental, Social and Governance (ESG) index products of leading providers STOXX, Morningstar and FTSE Russell.

ING in Asia Pacific

In Asia Pacific, ING offers wholesale banking across 11 markets, namely Australia, China, Hong Kong SAR, India, Indonesia, Japan, the Philippines, Singapore, South Korea, Taiwan and Vietnam. ING offers both retail and wholesale banking services in Australia. The bank also started its digital banking platform in the Philippines in 2018. ING’s regional presence includes a 13% stake in Bank of Beijing, China and a 23% stake in TTB (TMBThanachart Bank), Thailand.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit