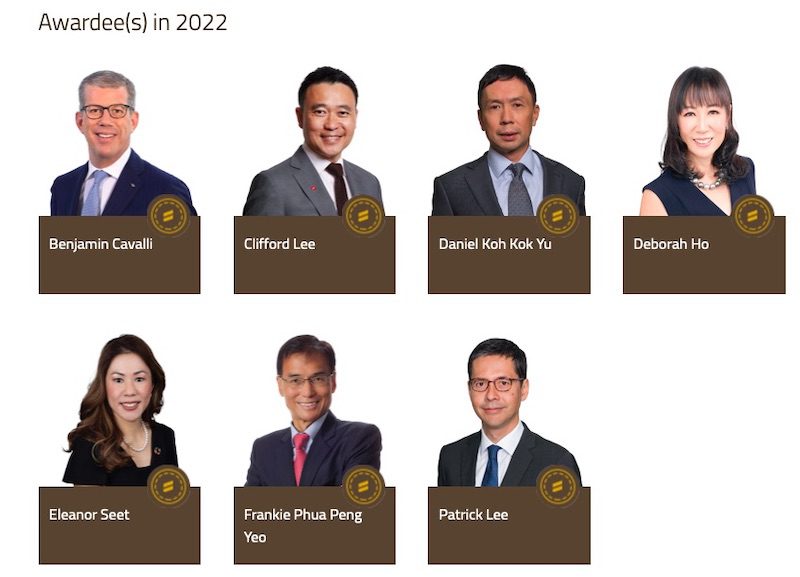

Singapore Confers 7 Industry Leaders with IBF Distinguished Fellow in 2022: Deborah Ho, Eleanor Seet, Patrick Lee, Daniel Koh, Clifford Lee, Benjamin Cavalli & Frankie Phua

13th October 2022 | Singapore

The Singapore Institute of Banking & Finance has conferred 7 financial industry leaders with the IBF Distinguished Fellow in 2022, Deborah Ho (BlackRock), Eleanor Seet (Nikko Asset Management), Patrick Lee (Standard Chartered Bank), Daniel Koh (Standard Chartered Bank), Clifford Lee (DBS Bank), Benjamin Cavalli (Credit Suisse) and Frankie Phua (UOB). The “IBF Distinguished Fellow” title is a prestigious title conferred upon industry captains and leaders who are the epitome of professional stature, integrity, and achievement. The Distinguished Fellows serve as a beacon of excellence for the industry. The awards were handed out by Singapore Minister for Trade and Industry Gan Kim Yong and Managing Director of the Monetary Authority of Singapore (MAS) / & Chairman of the Institute of Banking and Finance Singapore (IBF) Ravi Menon. 20 financial industry leaders were conferred the “IBF Fellow” award. The 2022 IBF Award recipients were recognised at the IBF Distinction Evening on 6 October 2022.

” Singapore Confers 7 Industry Leaders with IBF Distinguished Fellow in 2022: Deborah Ho, Eleanor Seet, Patrick Lee, Daniel Koh, Clifford Lee, Benjamin Cavalli & Frankie Phua “

IBF Distinguished Fellow in 2022

The IBF Distinguished Fellows of 2022 are:

- Asset Management: Deborah Ho, Country Head of Singapore & Head of Southeast Asia, Blackrock

- Asset Management: Eleanor Seet, President & Head of Asia, ex-Japan, Nikko Asset Management Asia

- Corporate Banking: Patrick Lee, Cluster CEO, Singapore & ASEAN Markets, Standard Chartered Bank (Singapore)

- Financial Markets: Daniel Koh, Global Head of Treasury Markets, Standard Chartered Bank (Singapore)

- Financial Markets: Clifford Lee, Managing Director, Group Head of Fixed Income, DBS Bank

- Private Banking & Wealth Management: Benjamin Cavalli, Managing Director, Chief Executive Officer Hong Kong, Head of Wealth Management Asia Pacific and APAC Sustainability Leader, Credit Suisse, Singapore Branch

- Risk Management: Frankie Phua, Managing Director, Head of Group Risk Management, United Overseas Bank (UOB)

The “IBF Distinguished Fellow” title is a prestigious title conferred upon industry captains and leaders who are the epitome of professional stature, integrity, and achievement. The Distinguished Fellows serve as a beacon of excellence for the industry.

Criteria

- C-Suite Senior Management (e.g. CEO, CFO, COO etc); or

- Member of a Financial Institution’s Group Executive Committee or equivalent; or

- Office-holder of an Industry Association or Industry Committee (e.g. Chairman, President)

- At least 15 years of financial industry experience or equivalent

- Demonstrated outstanding leadership capabilities

- Significant contribution to the industry

- Display professional ethics and integrity

IBF Distinguished Fellows of 2022 – Quotes

To maintain Singapore’s attractiveness as a global financial hub, it is crucial that we have a future-ready, skilled workforce so that firms can access the talent they need to grow. ~ Deborah Ho, Country Head of Singapore & Head of Southeast Asia, Blackrock

We cannot succeed in our role as stewards of capital, to continue to be part of steering risk & reward conversations and outcomes, if we do not push and partner in this upskilling and workforce transformation agenda to match the transformation that ESG and digitalisation herald. ~ Eleanor Seet, President & Head of Asia, ex-Japan, Nikko Asset Management Asia

The development of talent in a period of rapid change and transformation is at the heart of a successful financial services industry. A bank is nothing without its people, and its people must always be equipped with the relevant skills to address the needs of the customers. ~ Patrick Lee, Cluster CEO, Singapore & ASEAN Markets, Standard Chartered Bank (Singapore)

To keep ourselves and Singapore ahead of the curve in the financial industry, we must embrace a growth mindset and inculcate lifelong learning habits. ~ Daniel Koh, Global Head of Treasury Markets, Standard Chartered Bank (Singapore)

Singapore’s continued relevance as a major financial centre is dependent on our ability to upskill and transform to meet challenges from evolving digitalisation trends and greater accountability on ESG fronts. ~ Clifford Lee, Managing Director, Group Head of Fixed Income, DBS Bank

As the saying goes “It is better to disrupt yourself”, it is critical that we provide consistent structured cross-lateral trainings so that we can help our clients and employees navigate and manage the uncertainties and key trends that would shape our future e.g. technology, sustainability and next generation. ~ Benjamin Cavalli, Managing Director, Chief Executive Officer Hong Kong, Head of Wealth Management Asia Pacific and APAC Sustainability Leader, Credit Suisse, Singapore Branch

New risks cannot be managed with old tools. Risk management practices have to constantly evolve to keep pace with business model changes, new products and new technologies. ~ Frankie Phua, Managing Director, Head of Group Risk Management, United Overseas Bank (UOB)

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit