Microsoft Co-Founder Paul Allen Art Collection Fetches Record $1.62 Billion at Christie’s Auction in New York, Estate Will Donate All Proceeds to Philanthropy

11th November 2022 | Hong Kong

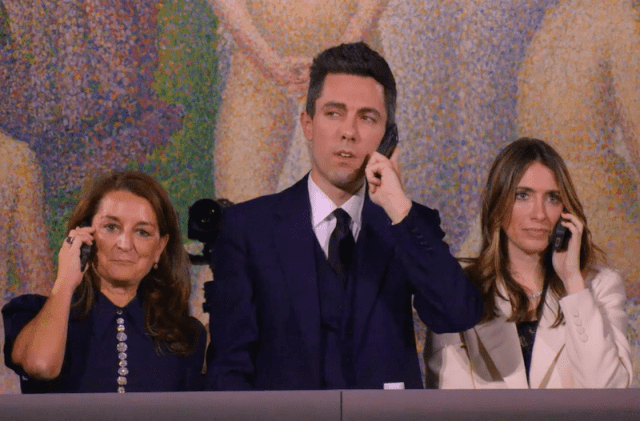

The late Microsoft co-founder Paul Allen’s art collection has fetched a record $1.62 billion at the Christie’s auction in New York, with the late Paul Allen’s estate to donate all proceeds to philanthropy. The collection is titled Visionary by Paul G. Allen Collection. On 9th November 2022, 60 art collection achieved a total of $1.5 billion, and 5 paintings were sold at more than $100 million. On 10th November, 95 art collection were sold for $115 million, with a total of $1.62 billion over the 2 days of auction. The Paul Allen’s art collection became the most valuable art collection of all time, with the oldest collection dating back to 500 years ago. Christie’s: “The top lot of the collection was Les Poseuses, Ensemble (Petite version) by Georges Seurat, which sold for $149 million. The sale of the painting marks the highest price ever achieved for any Impressionist or Post-Impressionist work of art.” Max Carter, Vice Chairman, 20th & 21st Century Art: “Never before have more than two paintings exceeded $100 million in a single sale, but tonight we saw 5. 4 were masterpieces from the fathers of modernism — Cezanne, Seurat, Van Gogh and Gauguin.”

“ Microsoft Co-Founder Paul Allen Art Collection Fetches Record $1.62 Billion at Christie’s Auction in New York, Estate Will Donate All Proceeds to Philanthropy “

The late Paul Allen has no spouse or children, and had passed his estimated $26 billion fortune (2018) to his sister Jody Allen. Paul Allen is the co-founder of Microsoft (1975), which is the largest personal computer software company in the world. His personal fortune (estate) is estimated at more than $75 billion (2020). Vulcan Inc is the family office of the late Paul Allen (1953 – 2018), co-founder of Microsoft and Jody Allen (sister).

Microsoft co-founder Paul Allen $10 Billion Family Office Vulcan Capital, Creates $8 Billion Investment Firm Cercano Management

Vulcan Capital, the venture investment arm of the family office of Microsoft co-founder Paul Allen with $26 billion fortune and managing $10 billion of investments, has created an independent investment firm Cercano Management following his death in 2018. The transition of Cercano Management to manage the investment assets of the Paul G. Allen estate and Paul G. Allen Family Foundation had started in early 2021. Cercano Management LLC and Cercano Management Holdings L.P. were officially established in September 2021. The late Paul Allen has no spouse or children, and had passed his estimated $26 billion fortune (2018) to his sister Jody Allen.

Paul Allen (1953 – 2018)

The late Paul Allen has no spouse or children, and had passed his estimated $26 billion fortune (2018) to his sister Jody Allen. Paul Allen is the co-founder of Microsoft (1975), which is the largest personal computer software company in the world. His personal fortune (estate) is estimated at more than $75 billion (2020). Vulcan Inc is the family office of the late Paul Allen (1953 – 2018), co-founder of Microsoft and Jody Allen (sister).

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit