Billionaire Carl Icahn Company Icahn Enterprises Market Value Decreased from $18 Billion to $7.6 Billion Since Released Report by Short-Seller Hindenburg Research & Investigation by Federal Prosectors

27th May 2023 | Hong Kong

Billionaire Carl Icahn company Icahn Enterprises market value has decreased from $18 billion (1/5/23) to $7.6 billion (26/5/23) since the released report by short-seller Hindenburg Research and investigation by United States Federal prosectors. Billionaire Carl Icahn (Icahn Enterprises) had also recently shared in a media coverage that he lost $9 billion on short-trades (short-selling) over 6 years betting on a downturn in the United States economy, and attributing the wrong bets to United States Federal Reserve (FED) injecting trillions into the economy during the COVID-19 Pandemic. More info below.

“ Billionaire Carl Icahn Company Icahn Enterprises Market Value Decreased from $18 Billion to $7.6 Billion Since Released Report by Short-Seller Hindenburg Research & Investigation by Federal Prosectors “

Billionaire Carl Icahn Lost $9 Billion on Short-Trades over 6 Years Betting on a Downturn in United States Economy, Attributed Wrong Bets to United States Fed Injecting Trillions into Economy During COVID-19 Pandemic

20th May 2023 – Billionaire Carl Icahn (Icahn Enterprises) had lost $9 billion on short-trades (short-selling) over 6 years betting on a downturn in the United States economy, and attributing the wrong bets to United States Federal Reserve (FED) injecting trillions into the economy during the COVID-19 Pandemic. Earlier in May 2023, Icahn Enterprises (Market value 1/5/23: $18 billion) was targeted by short-seller Hindenburg Research releasing a negative report on the company on 1st May 2023. More info below.

Icahn Enterprises Official Statement

Icahn Enterprises Official Statement 10/5/23 – Icahn Enterprises L.P. (Nasdaq: IEP) (“IEP” or the “Company”) today issued the following statement in response to a short seller’s misleading and self-serving report published on May 2, 2023:

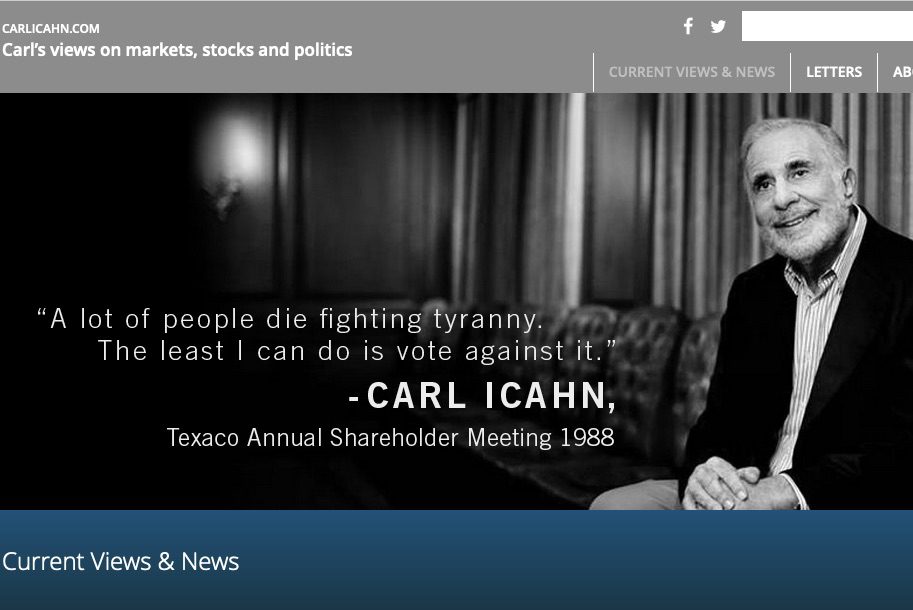

Chairman of the Board, Carl C. Icahn, stated: “Hindenburg Research, founded by Nathan Anderson, would be more aptly named Blitzkrieg Research given its tactics of wantonly destroying property and harming innocent civilians. Mr. Anderson’s modus operandi is to launch disinformation campaigns to distort companies’ images, damage their reputations and bleed the hard-earned savings of individual investors. But, unlike many of its victims, we will not stand by idly. We intend to take all appropriate steps to protect our unitholders and fight back.

“We believe that the greatest paradigm for investment success is activism. We have a long-held belief that at far too many companies today there is no real corporate governance and therefore no accountability and, as a result, companies are not nearly as productive as they should be. The failure of our system presents an opportunity for activists, like us, who are willing to spend the energy, the time and the money to breach the walls that far too many corporations have built to entrench themselves. Over the years, we have generated hundreds of billions of dollars of value for stockholders through activist campaigns where we were able to guide boards and CEOs to take the steps necessary to enhance the value of their companies. Examples of these, to name a few, are Texaco, Reynolds, Netflix, Forest Labs, Apple, CVR Energy, Herbalife, eBay, Tropicana, Cheniere, and Occidental.

“In more recent years the performance of our investment segment has been lower than our historical averages. A key detractor has been our bearish view of the market, causing us to have a large net short position. We recently have taken steps to reduce the short positions in our hedge book and concentrate for the most part on activism, which has served us so well in the past. We believe our existing portfolio has considerable upside potential over the coming years.

“We expect that, over time, IEP’s performance will speak for itself. We have a strong balance sheet, with $1.9 billion of cash and $4 billion of additional liquidity, and stand ready to take advantage of all opportunities. As we consider recent events, we are left asking why Mr. Anderson issued this inflammatory report, doing great harm to retail investors. He has admitted to shorting stock before issuing his report, believing that the stock price would temporarily decline. Was that his only goal? Whatever the motive, IEP intends to vigorously defend itself and its unitholders.”

Mr. Icahn and his affiliates own approximately 84% of the Company’s outstanding units. As a publicly traded limited partnership, IEP offers its unitholders the ability to invest alongside Mr. Icahn as co-owners of IEP and, in so doing, to participate in the Company’s activist strategy. To be clear, Mr. Icahn receives no fees, salary or any other compensation from IEP.

The day after the report was published, IEP’s market capitalization fell by $6.6 billion for our unitholders. As recently as May 4, 2023, the American Bankers Association said that “the harm caused by short selling that runs counter to economic fundamentals ultimately falls on small investors, who see value destroyed by others’ predatory behavior.” The good news for IEP’s investors is that we have Carl, the liquidity, the strategy and the know-how to fight back.

Billionaire Carl Icahn Company $18 Billion Icahn Enterprises Investigated by Federal Prosectors, Current Market Value of $11.2 Billion & Decreased 38% Since Report by Short-Seller Hindenburg Research & Latest Federal Investigation

12th May 2023 – Billionaire Carl Icahn company $18 billion Icahn Enterprises is being investigated by United States Federal prosectors (Filing). Icahn Enterprises current market value is around $11.2 billion and had decreased around 38% since the research report on Icahn Enterprises had been released by short-seller Hindenburg Research and the latest federal investigation. Earlier in May 2023, Icahn Enterprises (Market value 1/5/23: $18 billion) was targeted by short-seller Hindenburg Research releasing a negative report on the company on 1st May 2023. More info below.

Billionaire Carl Icahn Company $18 Billion Icahn Enterprises Targeted by Short-Seller Hindenburg Research, Share Price Decreases by 25% with Current Market Value of $13.4 Billion

6th May 2023 – Billionaire Carl Icahn company Icahn Enterprises (Market value 1/5/23: $18 billion) has been targeted by short-seller Hindenburg Research releasing a negative report on the company on 1st May 2023, with share price decreasing by 25% (6/5/23) and current market value of $13.4 billion. Icahn Enterprises is a diversified holding company engaged in seven primary business segments: Investment, Energy, Automotive, Food Packaging, Real Estate, Home Fashion and Pharma. Carl Icahn & family owns around 85% of Icahn Enterprises. Hindenburg Research: “In brief, Icahn has been using money taken in from new investors to pay out dividends to old investors. Such ponzi-like economic structures are sustainable only to the extent that new money is willing to risk being the last one “holding the bag”. Supporting this structure is Jefferies, the only large investment bank with research coverage on IEP. It has continuously placed a “buy” rating on IEP units. In one of the worst cases of sell-side research malpractice we’ve seen, Jefferies’ research assumes in all cases, even in its bear case, that IEP’s dividend will be safe “into perpetuity”, despite providing no support for that assumption.” Carl Icahn, Chairman of the Board of Icahn Enterprises statement 4/5/23: “We would like to reassure our long-term unitholders that the market disruption caused by the self-serving Hindenburg report does not affect IEP’s liquidity. We would normally wait for the earnings call but, due to the many inquiries we have received, we are announcing now our intention to declare a distribution in the amount of $2.00 per depositary unit for the quarter ended March 31, 2023, with the election to receive either cash or additional depositary units. I as usual will elect to take the distribution in units. The fundamentals of our business, and our belief in the activist paradigm that has served us well for decades, remain unchanged. We obviously disagree with the inflammatory assertions in the Hindenburg report and intend to respond at length – and to vigorously defend IEP and its unitholders. As we stated previously, we believe that IEP’s performance will speak for itself over the long term as it always has … … To receive accurate information about the Company, all investors are encouraged to review materials filed by IEP with the Securities and Exchange Commission and available on its investor relations website.”

Icahn Enterprises

Icahn Enterprises is a diversified holding company engaged in seven primary business segments: Investment, Energy, Automotive, Food Packaging, Real Estate, Home Fashion and Pharma.

Carl C. Icahn, Chairman of the Board

Carl C. Icahn has served as Chairman of the Board of Directors of Icahn Enterprises L.P., a diversified holding company engaged in a variety of businesses, including investment, automotive, energy, food packaging, metals, real estate and home fashion. Since 2007, through his position as Chief Executive Officer of Icahn Capital LP, a wholly owned subsidiary of Icahn Enterprises L.P., and certain related entities, Mr. Icahn’s principal occupation has been managing private investment funds, including Icahn Partners LP and Icahn Partners Master Fund LP. Since 1990, Mr. Icahn has been Chairman of the Board of Directors of Starfire Holding Corporation, a privately-held holding company, and Chairman of the Board of Directors of various subsidiaries of Starfire, since 1984. Mr. Icahn was previously: Chairman of the Board of Directors of Tropicana Entertainment Inc., a company that is primarily engaged in the business of owning and operating casinos and resorts, from 2010 until 2018; Chairman of the Board of Directors of CVR Refining, LP, an independent downstream energy limited partnership, from 2013 to 2018; Chairman of the Board of Directors of CVR Energy, Inc., a diversified holding company primarily engaged in the petroleum refining and nitrogen fertilizer manufacturing industries, from 2012 to 2018; President and a member of the Executive Committee of XO Holdings, a competitive provider of telecom services, from 2011 to 2017, and Chairman of the Board of Directors of its predecessors from 2003 to 2011; director of Federal-Mogul Holdings LLC (formerly known as Federal-Mogul Holdings Corporation), a supplier of automotive powertrain and safety components, from 2007 to 2015, and the non-executive Chairman of the Board of Directors of Federal-Mogul from 2008 to 2015; Chairman of the Board of Directors of American Railcar Industries, Inc., a railcar manufacturing company, from 1994 to 2014; a director of American Railcar Leasing LLC, a lessor and seller of specialized railroad tank and covered hopper railcars, from 2004 to 2013; a director of WestPoint Home LLC, a home textiles manufacturer, from 2005 to 2011; and a director of Cadus Corporation, a company engaged in the acquisition of real estate for renovation or construction and resale, from 1993 to 2010. Mr. Icahn received his B.A. from Princeton University.

Brett Icahn, Director (Son of Carl C. Icahn)

Brett Icahn has been a Portfolio Manager for Icahn Capital LP, a subsidiary of Icahn Enterprises L.P. (a diversified holding company engaged in a variety of businesses, including investment, automotive, energy, food packaging, metals, real estate and home fashion), since October 2020. Mr. Icahn was previously a consultant for Icahn Enterprises L.P., where he exclusively provided investment advice to Carl C. Icahn with respect to the investment strategy for Icahn Enterprises’ Investment segment and with respect to capital allocation across Icahn Enterprises’ various operating subsidiaries from 2017 to 2020. From 2010 to 2017, Mr. Icahn was responsible for co-executing an investment strategy across all industries as a Portfolio Manager of the Sargon Portfolio for Icahn Capital LP, the entity through which Carl C. Icahn manages investment funds. From 2002 to 2010, Mr. Icahn served as an investment analyst for Icahn Capital LP and in a variety of investment advisory roles for Carl C. Icahn. Mr. Icahn joined the Board of Directors of Icahn Enterprises L.P., in October 2020. Mr. Icahn has been a director of Newell Brands Inc., a global marketer of consumer and commercial products, since March 2018. Mr. Icahn was previously a director of: Nuance Communications, Inc., a provider of voice and language solutions, from October 2013 to March 2016; Voltari Corporation, a mobile data services provider, from January 2010 to August 2014; American Railcar Industries, Inc., a railcar manufacturing company, from January 2007 to June 2014; Cadus Corporation, a company engaged in the acquisition of real estate for renovation or construction and resale, from January 2010 to February 2014; Take-Two Interactive Software Inc., a publisher of interactive entertainment products, from April 2010 to November 2013; and The Hain Celestial Group, Inc., a natural and organic products company, from July 2010 to November 2013. American Railcar Industries, Cadus and Voltari were previously indirectly controlled by Carl C. Icahn. Carl C. Icahn also has or previously had non−controlling interests in Newell Brands, Nuance, Hain Celestial and Take-Two through the ownership of securities. Brett Icahn is Carl C. Icahn’s son. Mr. Icahn received a B.A. from Princeton University.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit