China Largest Lithium Maker $8.7 Billion Tianqi Lithium Founder & Chairman Jiang Weiping Appoints Daughter Jiang Anqi as Chairman, IPO in Hong Kong in 2022 at $28 Billion Value, Billionaire Founder Jiang Weiping & Family Fortune Around $9 Billion in 2022

3rd May 2024 | Hong Kong

China largest lithium maker Tianqi Lithium with $8.7 billion market value (3/5/24) founder & Chairman Jiang Weiping has appointed daughter Jiang Anqi as Chairman. In 2022, Tianqi Lithium (China lithium chemicals supplier for electric car) IPO on Hong Kong Exchange, (13/7/22) closing flat on Day 1 at HKD 82 with market value of around $28 billion and billionaire founder Jiang Weiping & family fortune estimated at around $9 billion. The IPO raised $1.7 billion. Tianqi Group was founded in 2003 by Jiang Weiping, acquiring Shehong Lithium Compounds Factory through Tianqi Group in 2004 and founded Tianqi Lithium. (IPO ~ Initial Public Offering)

“ China Largest Lithium Maker $8.7 Billion Tianqi Lithium Founder & Chairman Jiang Weiping Appoints Daughter Jiang Anqi as Chairman, IPO in Hong Kong in 2022 at $28 Billion Value, Billionaire Founder Jiang Weiping & Family Fortune Around $9 Billion in 2022 “

China Tianqi Lithium IPO in Hong Kong Closes Flat on Day 1 at $28 Billion Value, Billionaire Founder Jiang Weiping & Family Fortune Around $9 Billion

14th July 2022 – Tianqi Lithium (China lithium chemicals supplier for electric car) has IPO on Hong Kong Exchange, (13/7/22) closing flat on Day 1 at HKD 82 with market value of around $28 billion and billionaire founder Jiang Weiping & family fortune estimated at around $9 billion. The IPO raised $1.7 billion. Tianqi Group was founded in 2003 by Jiang Weiping, acquiring Shehong Lithium Compounds Factory through Tianqi Group in 2004 and founded Tianqi Lithium. (IPO ~ Initial Public Offering)

Tianqi Lithium

Listed on the Shenzhen Stock Exchange (stock code: SZ.002466), Tianqi Lithium is a global new energy materials company, with lithium at its core. Tianqi Lithium has world leading positions in its major businesses of lithium resource investment, lithium concentrate extraction and the production of advanced lithium specialty compounds. With resource and production assets located in the pre-eminent lithium regions of Australia, Chile and China, our fully vertical-integrated businesses ensure the Company is optimally positioned to partner with our international customers to support the long-term sustainable development of lithium-ion battery technologies for application in the electric vehicle and energy storage industries.

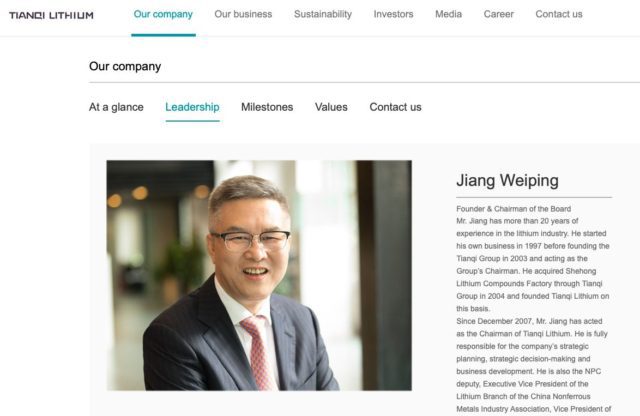

Founder & Chairman of the Board

Mr. Jiang has more than 20 years of experience in the lithium industry. He started his own business in 1997 before founding the Tianqi Group in 2003 and acting as the Group’s Chairman. He acquired Shehong Lithium Compounds Factory through Tianqi Group in 2004 and founded Tianqi Lithium on this basis. Since December 2007, Mr. Jiang has acted as the Chairman of Tianqi Lithium. He is fully responsible for the company’s strategic planning, strategic decision-making and business development. He is also the NPC deputy, Executive Vice President of the Lithium Branch of the China Nonferrous Metals Industry Association, Vice President of The Listed Companies Association of Sichuan, and the economic development consultant of the Suining Municipal Government.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit