The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

Investment / Alternatives Summit - March / Oct / Nov

Investment Day - March / July / Sept / Oct / Nov

Private Wealth Summit - April / Oct / Nov

Family Office Summit - April / Oct / Nov

View Events | Register

This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $30 billion.

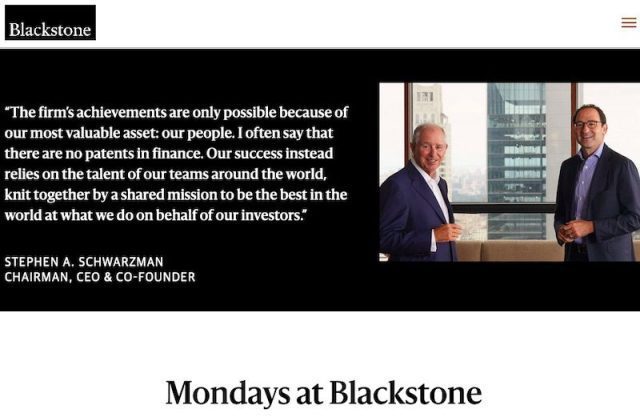

World Largest Private Equity Firm $1.1 Trillion Blackstone Raised $1 Billion from Wealthy Individuals for New Infrastructure Fund Blackstone Infrastructure Strategies (BXINFRA) Led by Blackstone Senior Managing Director of Digital Infrastructure & CEO of BXINFRA Greg Blank, Around 20% of Blackstone $1.1 Trillion AUM are Invested by Individuals & Banks Wealth Management Clients

9th January 2025 | Hong Kong

The world’s largest private equity firm Blackstone ($1.1 trillion AUM) has raised $1 billion from wealthy individuals for the new infrastructure fund Blackstone Infrastructure Strategies (BXINFRA), led by Blackstone Senior Managing Director of Digital Infrastructure & CEO of BXINFRA Greg Blank. BXINFRA seeks to provide qualified individual investors access to Blackstone’s premier infrastructure platform. Of Blackstone $1.1 trillion AUM, around 20% are invested by individuals & banks’ wealth management clients. Greg Blank is the Chief Executive Officer of Blackstone Infrastructure Strategies (BXINFRA) and a Senior Managing Director in the Infrastructure Group where he focuses on investments in the Digital Infrastructure sector. Since joining Blackstone, Mr. Blank has worked in both the New York and Hong Kong offices in the Private Equity and Infrastructure groups; and has been involved in the execution of numerous Blackstone investments, including QTS Realty Trust, Signature Aviation, the data center joint venture with Digital Realty, Phoenix Tower International, Hotwire Communications, NCR, Kronos, Paysafe, Blue Yonder, Ipreo, and Optiv. In 2024 November, Blackstone & Hong Kong Private Wealth Management Association (PWMA) have announced to launch a Private Market Fundamentals Certified Educational Program half-day sessions for wealth management professionals in 2025 February.

“ World Largest Private Equity Firm $1.1 Trillion Blackstone Raised $1 Billion from Wealthy Individuals for New Infrastructure Fund Blackstone Infrastructure Strategies (BXINFRA) Led by Blackstone Senior Managing Director of Digital Infrastructure & CEO of BXINFRA Greg Blank, Around 20% of Blackstone $1.1 Trillion AUM are Invested by Individuals & Banks Wealth Management Clients “

Caproasia Access | Events | Summits | Register Events | The Financial Centre

The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

Basic Member: $5 Monthly | $60 Yearly

Newsletter Daily 2 pm (Promo): $20 Monthly | $180 Yearly (FP: $680)

Hong Kong | Singapore

March / July / Sept / Oct / Nov

Private Equity, Hedge Funds, Boutique Funds, Private Markets & more. Join 20+ CIOs & Senior investment team, with > 60% single family offices with $300 million AUM. Taking place in Hong Kong and in Singapore. Every March, July, Sept, Oct & Nov.

Visit | Register here

10th April & 16th Oct Hong Kong Ritz Carlton | 24th April & 6th Nov Singapore Amara Sanctuary Resort

Join 80 single family offices & family office professionals in Hong Kong & Singapore

Links: 2025 Family Office Summit | Register here

March / Oct / Nov in Hong Kong & Singapore

Join leading asset managers, hedge funds, boutique funds, private equity, venture capital & real estate firms in Hong Kong, Singapore & Asia-Pacific at the Investment / Alternatives Summit. Join as delegate, speaker, presenter, partner & sponsor.

Visit | Register here

April / Oct / Nov in Hong Kong & Singapore

Join CEOs, CIOs, Head of Private Banking, Head of Family Offices & Product Heads at The Private Wealth Summit. Join as delegate, speaker, presenter, partner & sponsor.

Visit | Register here

$1.1 Trillion Private Equity Blackstone & Hong Kong Private Wealth Management Association to Launch Private Market Fundamentals Certified Educational Program Half-Day Sessions for Wealth Management Professionals in 2025 February

22nd November 2024 – Leading private equity firm Blackstone ($1.1 trillion AUM) & Hong Kong Private Wealth Management Association (PWMA) have announced to launch a Private Market Fundamentals Certified Educational Program half-day sessions for wealth management professionals in 2025 February. Announcement (21/11/24): “Blackstone and the Private Wealth Management Association (PWMA) have announced their partnership to launch a first-of-its-kind certified educational programme for wealth management professionals to gain a deeper understanding of private market fundamentals. The programme draws on Blackstone’s expertise and insights as the world’s largest alternative asset manager to equip Hong Kong’s wealth management professionals with the knowledge and resources to support individual investors who are increasingly looking to diversify their portfolios and allocate into private markets. As part of Blackstone’s commitment to support continued education of Hong Kong’s private wealth management professionals, Ed Huang, Head of Asia Pacific for Blackstone Private Wealth Solutions, will join the PWMA Advisory Council. The Council, comprising senior representatives of PWMA member firms, reviews the work of the Association and offers advice to the PWMA Executive Committee. The programme, available from February 2025, will be a series of half-day in-person sessions in Hong Kong, open to all PWMA members. Upon completion, participants are eligible to receive On-going Professional Training (OPT) hours or other professional training credits as per their employers’ guidelines. For more information, visit the PWMA website at pwma.org.hk.”

Amy Lo, Chairman, PWMA Executive Committee: “Hong Kong has emerged as an important wealth management hub, and more individual investors are seeking access to private markets to enhance their portfolios. We are pleased to partner with an industry leader like Blackstone, who shares our commitment of fostering the growth and development of Hong Kong’s private wealth management industry, to support wealth practitioners who are helping to manage and grow assets for our valued clients.”

Ed Huang, Head of Asia Pacific for Blackstone Private Wealth Solutions: “Providing high-quality education on private markets is an important cornerstone of our private wealth platform. While there’s momentum in the adoption of private markets, individual investors remain under-allocated. We believe allocation will continue to rise as wealth management professionals and individual investors seek portfolio diversification and attractive risk-adjusted performance. We launched our core educational program, Blackstone University, in 2011, and are thrilled to partner with PWMA to support the growing interest in private markets.”

PWMA – Established in 2013, the Private Wealth Management Association (PWMA) is an industry association, whose mission is to foster the growth and development of the private wealth management (PWM) industry in Hong Kong. PMWA aims to strengthen the position of Hong Kong as the leading PWM hub by promoting proper conduct and integrity as well as setting standards for professional competence on the part of PWM practitioners; providing professional training and development opportunities to maintain the enhanced levels of competence expected of PWM practitioners; building a PWM community through industry events, forums and committees; establishing a platform for members to address and work collaboratively on industry wide challenges; providing a unified industry voice and representation on PWM related matters; and establishing an effective channel to maintain ongoing dialogue with government officials, regulators, trade bodies, industry associations and other stakeholders.

Blackstone – Blackstone (NYSE: BX) is the world’s largest alternative asset manager. We seek to deliver compelling returns for institutional and individual investors by strengthening the companies in which we invest. Our more than $1.1 trillion in assets under management include global investment strategies focused on real estate, private equity, infrastructure, life sciences, growth equity, credit, real assets, secondaries and hedge funds. Further information is available at www.blackstone.com.

$1.1 Trillion Private Equity Blackstone & Hong Kong Private Wealth Management Association to Launch Private Market Fundamentals Certified Educational Program Half-Day Sessions for Wealth Management Professionals in 2025 February

For Investment Managers, Hedge Funds, Boutique Funds, Private Equity, Venture Capital, Professional Investors, Family Offices, Private Bankers & Advisors, sign up today. Subscribe to Caproasia and receive the latest news, data, insights & reports, events & programs daily at 2 pm.

Join Events & Find Services

Join Investments, Private Wealth, Family Office events in Hong Kong, Singapore, Asia-wide. Find hard-to-find $3 million to $300 million financial & investment services at The Financial Centre | TFC. Find financial, investment, private wealth, family office, real estate, luxury investments, citizenship, law firms & more. List hard-to-find financial & private wealth services.

Have a product launch? Promote a product or service? List your service at The Financial Centre | TFC. Join interviews & editorial and be featured on Caproasia.com or join Investments, Private Wealth, Family Office events. Contact us at angel@caproasia.com or mail@caproasia.com

Caproasia.com | The leading source of data, research, information & resource for financial professionals, investment managers, professional investors, family offices & advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets?

The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

2020 List of Private Banks in Hong Kong

2020 List of Private Banks in Singapore

2020 Top 10 Largest Family Office

2020 Top 10 Largest Multi-Family Offices

2020 Report: Hong Kong Private Banks & Asset Mgmt - $4.49 Trillion

2020 Report: Singapore Asset Mgmt - $3.48 Trillion AUM

For Investors | Professionals | Executives

Latest data, reports, insights, news, events & programs

Everyday at 2 pm

Direct to your inbox

Save 2 to 8 hours per week. Organised for success

Register Below

Get Ahead in 60 Seconds. Join 10,000 +

Save 2 to 8 hours weekly. Organised for Success.

Sign Up / Register

Please click on desktop.

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit

Contact Us

For Enquiries, Membershipmail@caproasia.com, angel@caproasia.com

For Listing, Subscription

mail@caproasia.com, claire@caproasia.com

For Press Release, send to:

press@caproasia.com

For Events & Webinars

events@caproasia.com

For Media Kit, Advertising, Sponsorships, Partnerships

angel@caproasia.com

For Research, Data, Surveys, Reports

research@caproasia.com

For General Enquiries

mail@caproasia.com

a financial information technology co.

since 2014