India Fintech Merchant Payment Platform Pine Labs Files for India IPO to Raise $304 Million at $6 Billion Valuation, Founded in 1998 by Lokvir Kapoor, Rajul Garg & Tarun Upadhyay, Investors Include Sequoia India (Peak XV Partners), Actis Capital, Temasek, PayPal, Mastercard, Lone Pine Capital, Vitruvian Partners, Sunley House Capital, Baron Capital Group, Duro Capital, Marshall Wace, Moore Strategic Ventures & Ward Ferry Management

27th June | Hong Kong

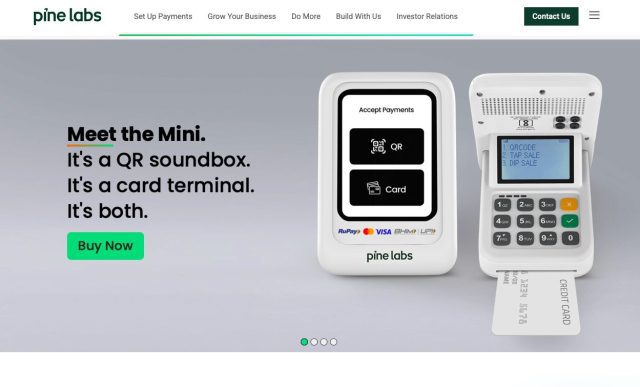

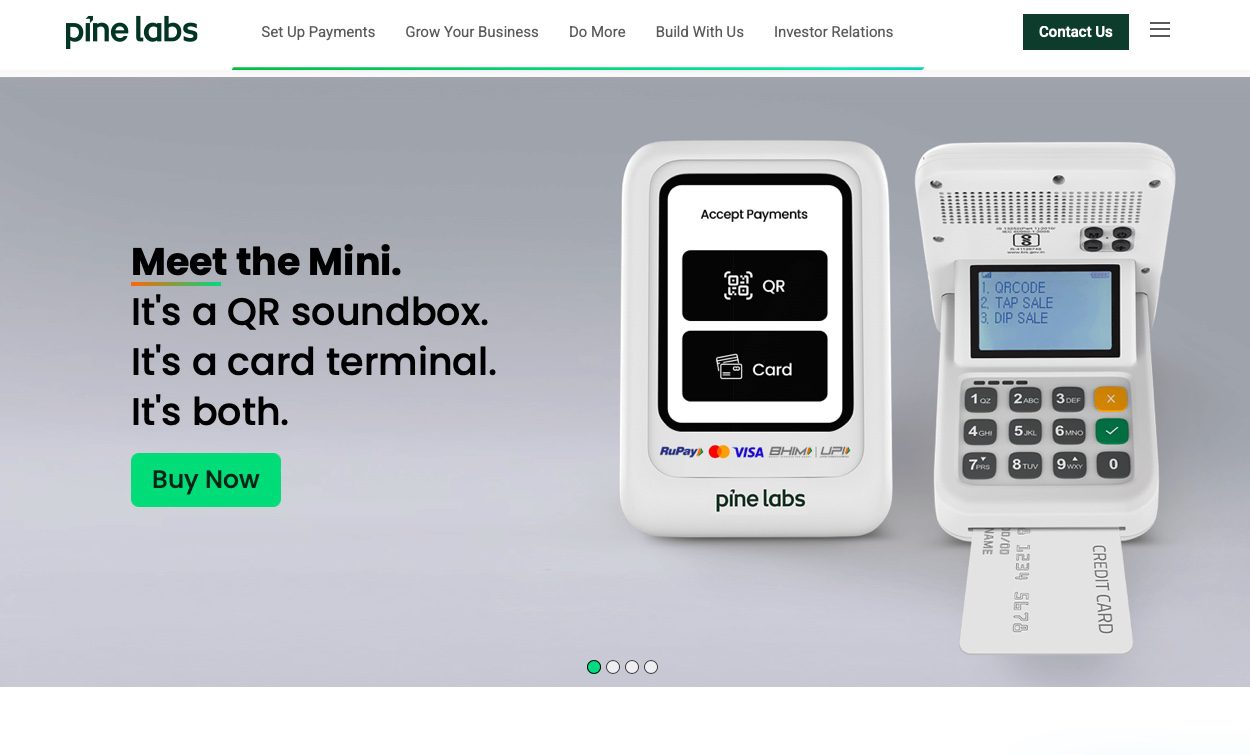

India fintech merchant payment platform Pine Labs has filed for India IPO to raise $304 million at $6 billion valuation. Pine Labs was founded in 1998 by Lokvir Kapoor, Rajul Garg & Tarun Upadhyay. Pine Labs investors include Sequoia India (Peak XV Partners), Actis Capital, Temasek, PayPal, Mastercard, Lone Pine Capital, Vitruvian Partners, Sunley House Capital, Baron Capital Group, Duro Capital, Marshall Wace, Moore Strategic Ventures & Ward Ferry Management. Pine Labs – At Pine Labs is a technology company digitising commerce, through a suite of digital payments and issuing solutions in India and across the globe. We have built an advanced technology infrastructure to accelerate the digitisation journey of merchants, consumer brands, enterprises, and financial institutions. We operate in India and a growing number of international markets including Malaysia, UAE, Singapore, Australia, USA, and Africa. Pine Labs’ tech-first approach to digital payments and focus on simplification at the front end aims to help businesses embrace fintech products at scale. Our digital payments business represents a one-stop payments destination across channels, including online payments designed to deliver secure and smooth online payment experiences to the end user, powered by a tech stack that can augment an existing online business or build an all-new e-commerce payment setup from the ground up. We also provide integrated Affordability Solutions for merchants and consumer brands and enterprises, and Fintech infrastructure solutions for financial institutions. Our Issuing business offers a full-stack, end-to-end technology service solution in the Prepaid Transaction Management, Gift Cards, and Sales/ Distribution Space, with a presence in multiple countries and live service engagements with brands and customers from the Retail, Hospitality and Airline Industries. We offer prepaid instruments primarily in India, Southeast Asia, Australia and the United States and we presently offer Credit Processing in India, Africa, and Southeast Asia.

“ India Fintech Merchant Payment Platform Pine Labs Files for India IPO to Raise $304 Million at $6 Billion Valuation, Founded in 1998 by Lokvir Kapoor, Rajul Garg & Tarun Upadhyay, Investors Include Sequoia India (Peak XV Partners), Actis Capital, Temasek, PayPal, Mastercard, Lone Pine Capital, Vitruvian Partners, Sunley House Capital, Baron Capital Group, Duro Capital, Marshall Wace, Moore Strategic Ventures & Ward Ferry Management “

India Fintech Merchant Payment Platform Pine Labs Files for India IPO to Raise $304 Million at $6 Billion Valuation, Founded in 1998 by Lokvir Kapoor, Rajul Garg & Tarun Upadhyay, Investors Include Sequoia India (Peak XV Partners), Actis Capital, Temasek, PayPal, Mastercard, Lone Pine Capital, Vitruvian Partners, Sunley House Capital, Baron Capital Group, Duro Capital, Marshall Wace, Moore Strategic Ventures & Ward Ferry Management

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit