United States Tencent-Backed $14 Billion Brokerage Futu 3rd-Party Software Translator Wrongly Translated Article of Hong Kong Tycoon & Founder of Cheung Kong Holdings Li Ka-shing Death at Age 97 in 2025 March (17/3/25) Instead of Henderson Land Lee Shau Kee(Age 97) Who Died in 2025 March (17/3/25), Li Ka-shing (Then-Age 96) with Then-$30 Billion Fortune Attended Taiwan Rock Band Mayday Concert in 2025 May (10/5/25) at Hong Kong New Kai Tak Stadium for Nearly 2 Hours

6th August | Hong Kong

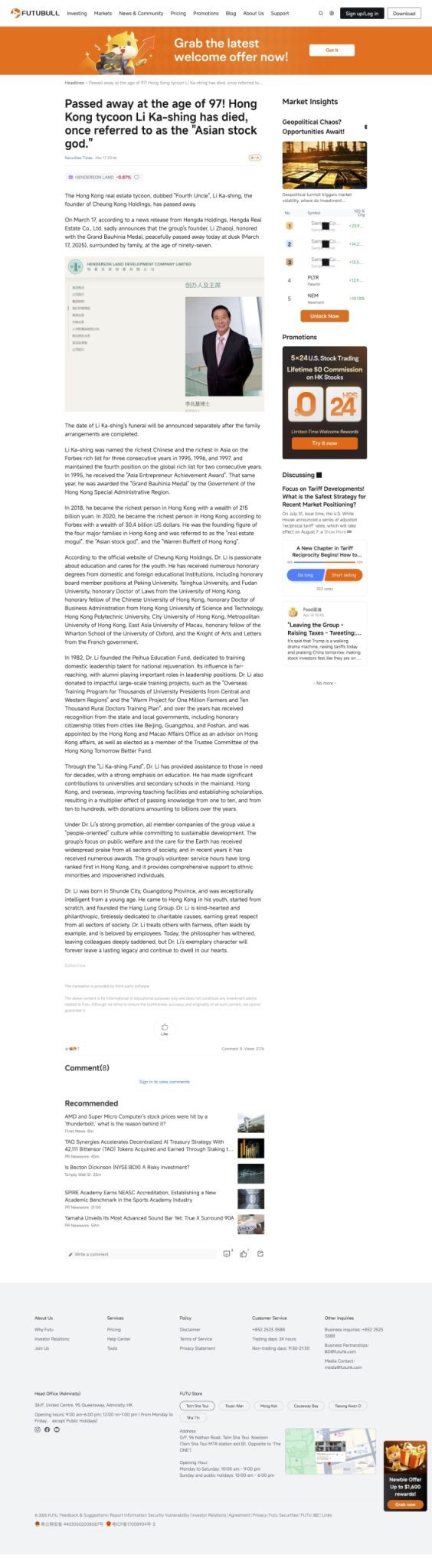

United States Tencent-backed brokerage Futu ($14 billion market value) 3rd-party software translator wrongly translated an article (Chinese to English) of Hong Kong tycoon & founder of Cheung Kong Holdings Li Ka-shing death at age 97 in 2025 March (17/3/25), instead of Henderson Land Lee Shau Kee (Age 97) who died in 2025 March (17/3/25). Futubull (17/3/25): “The Hong Kong real estate tycoon, dubbed “Fourth Uncle”, Li Ka-shing, the founder of Cheung Kong Holdings, has passed away. On March 17, according to a news release from Hengda Holdings, Hengda Real Estate Co., Ltd. sadly announces that the group’s founder, Li Zhaoqi, honored with the Grand Bauhinia Medal, peacefully passed away today at dusk (March 17, 2025), surrounded by family, at the age of ninety-seven. The date of Li Ka-shing’s funeral will be announced separately after the family arrangements are completed … …” Actual Article (17/3/25): “有“四叔”之称的香港地产富豪、恒基兆业地产创始人李兆基去世了。3月17日,据恒基兆业地产官网发布消息称,恒基兆业地产有限公司沉痛宣布集团创办人李兆基大紫荆勋贤,痛于今天黄昏 (公历二零二五年三月十七日),在家人陪伴下安详与世长辞,积闰享寿九十七岁。李兆基出殡仪式的举行日期,一切等家族安排妥当后,将会另行公布。” Google Translate (6/8/25): “Li Shau-kee, the Hong Kong real estate tycoon and founder of Henderson Land Development, known as “Uncle Four,” has passed away. On March 17, Henderson Land Development’s official website announced that Henderson Land Development Co., Ltd. is deeply saddened to announce that its founder, Li Shau-kee, GBM, passed away peacefully this evening (March 17, 2025), surrounded by his family, at the age of 97. The date of Li Shau-kee’s funeral will be announced later, once all arrangements have been finalized by the family.” Original article in Chinese | Futubull article | See below for translated article on Futubull. In 2025 March, Lee Shau Kee with $25 billion fortune died at age 97 (17/3/25). Lee Shau Kee founded Henderson Land in 1976. He was born in China Guangdong Foshan city, and moved to Hong Kong at age 20. In 1962, Lee Shau Kee co-founded Sun Hung Kai , and received HKD 50 million in properties & shares after IPO in 1972. Henderson Land Co-Chairmen are his 2 sons Peter Lee Ka-kit & Martin Lee Ka-shing. Lee Shau Kee key companies include Henderson Land Development, The Hong Kong & China Gas, Towngas Smart Energy, Miramar Hotel & Investment, Hong Kong Ferry (Holdings) & Henderson Investment. Lee Shau Kee has 5 children – Martin Lee Ka-shing, Peter Lee Ka-kit, Pui Yee Lee, Pui Man Lee, Pui Ling Lee, and his & ex-wife is Lau Wai-kuen (Married 1958 to 1985). In 2025 May, Li Ka-shing (then-age 96) attended Taiwan rock band Mayday concert (10/5/25) at Hong Kong new Kai Tak Stadium for nearly 2 hours, and departed in his electric mobility scooter. Li Ka-shing was asked on the $22.8 billion sale of Panama Ports Company to BlackRock, with Li Ka Shing Foundation Director Solina Chau replying Li Ka-shing is retired. Li Ka-shing retired as Chairman of CK Hutchison Holdings & CK Asset Holdings in 2018, and remains as Senior Advisor. In 2025 August, Hong Kong billionaire Li Ka-shing (Age 97) with $35 billion fortune family (Son Victor Li Tzar-kuoi) rejected claim of selling Li Ka-shing 62-year-old Hong Kong family mansion (79 Deep Water Bay Road in Hong Kong Island), bought by Li Ka-shing late wWife Chong Yuet-ming in 1963 for HKD 650,000 ($82,000) from Thomas Le Cheuk-kuen (Then-President Society of Chinese Accountants & Auditors of Hong Kong). The property is registered under Li Ka-shing. Li Ka-shing was born on 29th July 1928.

” United States Tencent-Backed $14 Billion Brokerage Futu 3rd-Party Software Translator Wrongly Translated Article of Hong Kong Tycoon & Founder of Cheung Kong Holdings Li Ka-shing Death at Age 97 in 2025 March (17/3/25) Instead of Henderson Land Lee Shau Kee(Age 97) Who Died in 2025 March (17/3/25), Li Ka-shing (Then-Age 96) with Then-$30 Billion Fortune Attended Taiwan Rock Band Mayday Concert in 2025 May (10/5/25) at Hong Kong New Kai Tak Stadium for Nearly 2 Hours “

Futu Securities International (Hong Kong) Limited – Futu Securities International (Hong Kong) Limited, also known as FUTU HK, is a licensed corporation recognized by the Securities and Futures Commission of Hong Kong. Since its establishment in 2012, FUTU HK has seen remarkable growth, leading the industry with the highest number of downloads for its stock trading app in Hong Kong. Publicly available data indicates that FUTU HK is the top retail brokerage in Hong Kong in terms of trading volume. Based in Hong Kong, FUTU HK is committed to technology-driven innovation, serving the market with fintech solutions and a one-stop online trading investment and wealth management platform. The company’s proprietary Futubull platform delivers real-time market data, financial news, a dedicated community, educational resources, and more to its users. On 8 March 2019, Futu Holdings Limited (Nasdaq: FUTU), the parent company of FUTU HK, was listed on the Nasdaq Stock Exchange. To date, its subsidiaries globally hold over 100 licenses and certifications and operate in Hong Kong, the United States, Singapore, Australia, New Zealand, Canada, Japan, Southeast Asia, etc., serving users across over 200 countries and regions. Looking forward, Futu will continue to prioritize the user experience, continuously enhancing its products and services, collaborating with partners to build a financial ecosystem that amplifies its reach to more markets, channeling global capital, and striving to become an influential global financial services platform.

Translated Article on Futubull (17/3/25):

Original article in Chinese | Futubull article

United States Tencent-Backed $14 Billion Brokerage Futu 3rd-Party Software Translator Wrongly Translated Article of Hong Kong Tycoon & Founder of Cheung Kong Holdings Li Ka-shing Death at Age 97 in 2025 March (17/3/25) Instead of Henderson Land Lee Shau Kee(Age 97) Who Died in 2025 March (17/3/25), Li Ka-shing (Then-Age 96) with Then-$30 Billion Fortune Attended Taiwan Rock Band Mayday Concert in 2025 May (10/5/25) at Hong Kong New Kai Tak Stadium for Nearly 2 Hours

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit