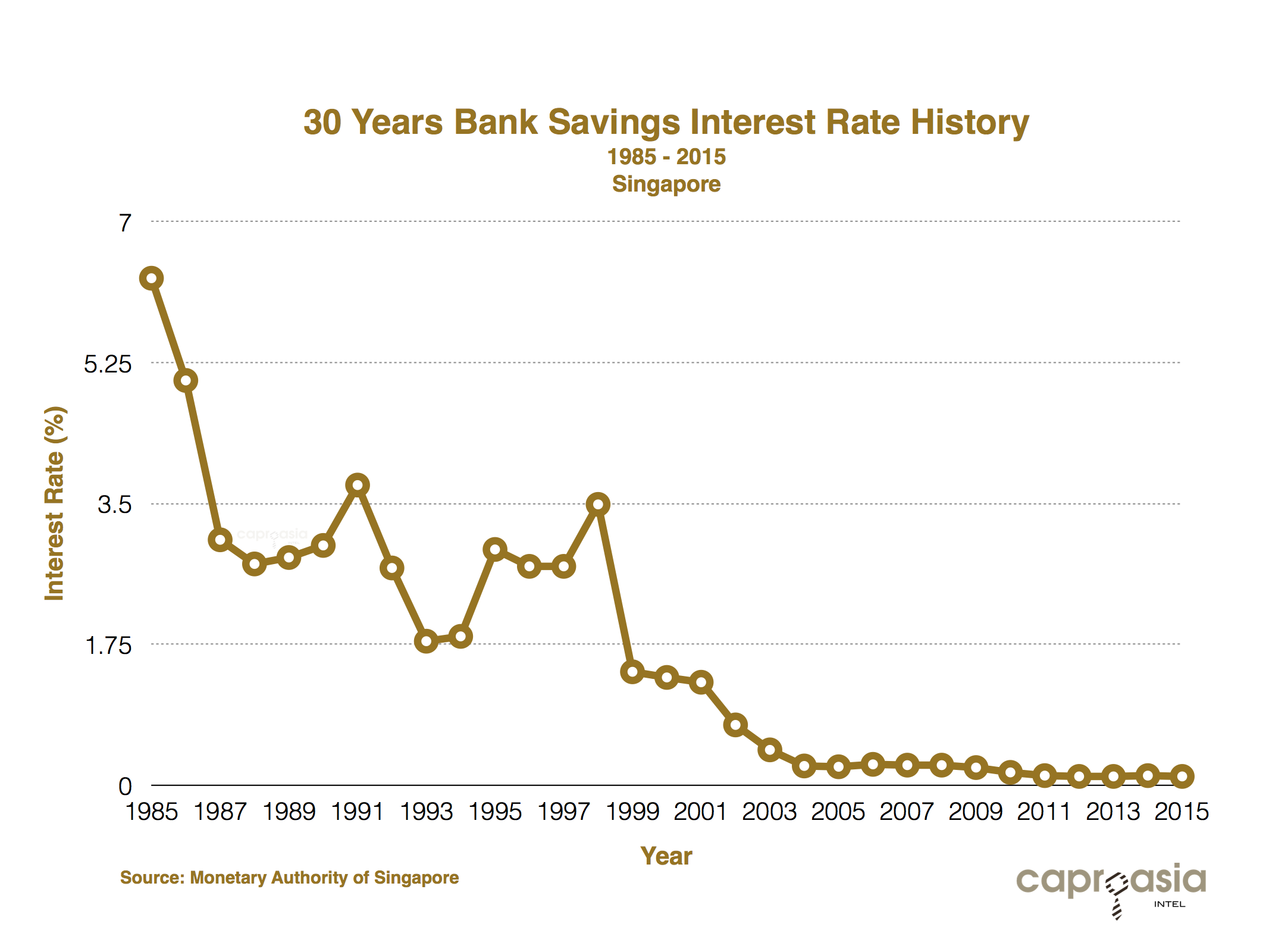

Singapore Bank Savings Interest Rate 30 Years History

Period: 1985 – 2015

Key Observations:

1985 – 1990: Similar to most developing countries, Singapore had a high interest rate environment during the period. Savings interest rates in banks was 6.3% in 1985 and ended at 2.98% in 1990. Depositors earned a high savings rate during the period.

In 1985, Savings Account Pays 6.3% p.a.

1991 – 1996: As Singapore approached developed nation status, savings interest rates ranged lower: 2.72% – 3.73%.

1997 – 1998: Asia was severely affected by the Asian Financial Crisis in 1997 and interest rate spiked up to 3.49% in 1998.

1999 – 2002: The recovery was short-lived as the dot-com bust in 2000 followed by terrorist bombing of World Trade Centre in United States affected global economic growth. Bank’s savings interest rates fell to 1.41%, 1.34% and 1.28% respectively for the period.

2002 – 2015: Bank savings rate stayed the lowest ever in the history of Singapore as savings interest rates fell to 0.75% and in 2015, 0.11%.

Many countries including Singapore had referenced monetary policies after the United States monetary policies. Post-2001, US Federal Reserve was on an ultra-low interest rate policies till 2006. The Federal Reserve Chairman was Alan Greenspan from 1987 – 2006.

As Singapore embarked on a journey to turn Singapore into a financial & wealth management hub, there was huge influx of funds into Singapore banks, keeping banks savings interest rate low for the entire period.

- 1985: 6.3%

- 1995: 2.93%

- 2005: 0.23%

- 2010: 0.16%

- 2015: 0.11%

Bank Savings Interest Rates Data 1985 – 2015

| 1985 | 6.3 | 1995 | 2.93 | 2005 | 0.23 |

| 1986 | 5.03 | 1996 | 2.72 | 2006 | 0.26 |

| 1987 | 3.05 | 1997 | 2.72 | 2007 | 0.25 |

| 1988 | 2.75 | 1998 | 3.49 | 2008 | 0.25 |

| 1989 | 2.83 | 1999 | 1.41 | 2009 | 0.22 |

| 1990 | 2.98 | 2000 | 1.34 | 2010 | 0.16 |

| 1991 | 3.73 | 2001 | 1.28 | 2011 | 0.12 |

| 1992 | 2.7 | 2002 | 0.75 | 2012 | 0.11 |

| 1993 | 1.79 | 2003 | 0.44 | 2013 | 0.11 |

| 1994 | 1.85 | 2004 | 0.24 | 2014 | 0.12 |

| 2015 | 0.11 |

Source:

- Monetary Authority of Singapore 2015

- Leading 10 Banks & Finance Co. in Singapore

- Average Interest Rates in All January

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit