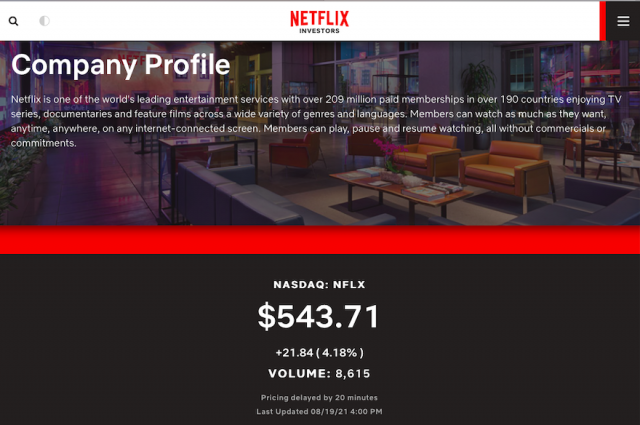

United States SEC Charges Netflix Insider Trading Ring, $3 Million Total Profit

19th August 2021 | Hong Kong

The United States Securities and Exchange Commission (SEC) have filed insider trading charges against 3 former Netflix software engineers and 2 close associates who generated over $3 million in total profit by trading on confidential information about Netflix’s subscriber growth.

“ United States SEC Charges Netflix Insider Trading Ring, $3 Million Total Profits “

Netflix Insider Trading Ring

According to the SEC’s complaint, Sung Mo “Jay” Jun was at the center of a long-running scheme to illegally trade on non-public information concerning the growth in Netflix’s subscriber base, a key metric Netflix reported in its quarterly earnings announcements. The complaint alleges that Sung Mo Jun, while employed at Netflix in 2016 and 2017, repeatedly tipped this information to his brother, Joon Mo Jun, and his close friend, Junwoo Chon, who both used it to trade in advance of multiple Netflix earnings announcements.

The SEC’s complaint further alleges that after Sung Mo Jun left Netflix in 2017, he obtained confidential Netflix subscriber growth information from another Netflix insider, Ayden Lee. Sung Mo Jun allegedly traded himself and tipped Joon Jun and Chon in advance of Netflix earnings announcements from 2017 to 2019. The SEC alleges that Sung Mo Jun’s former Netflix colleague Jae Hyeon Bae, another Netflix engineer, tipped Joon Jun based on Netflix’s subscriber growth information in advance of Netflix’s July 2019 earnings announcement. Sung Mo Jun, Joon Jun, and Chon allegedly used encrypted messaging applications to discuss their trading in an attempt to evade detection. According to the complaint, Sung Mo Jun, Joon Jun, and Chon made approximately $3 million in total profits from the illegal scheme. The SEC Market Abuse Unit’s Analysis and Detection Center uncovered the trading ring by using data analysis tools to identify the traders’ improbably successful trading over time.

The SEC’s complaint, filed in federal court in Seattle, charges Sung Mo Jun, Joon Jun, Chon, Lee, and Bae with violating the antifraud provisions of Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder. Sung Mo Jun, Joon Jun, Chon, and Lee have consented to the entry of judgments which, if approved by the court, would permanently enjoin each from violating the charged provisions, with civil penalties, if any, to be decided later by the court. Sung Mo Jun also agreed to an officer and director bar. Bae consented to the entry of a final judgment, also subject to court approval, permanently enjoining him from violating Section 10(b) of the Exchange Act and Rule 10b-5 and imposing a civil penalty of $72,875.

In a parallel action, the U.S. Attorney’s Office for the Western District of Washington filed a criminal information against Sung Mo Jun, Joon Jun, Chon, and Lee.

The SEC’s investigation was conducted by Rahul Kolhatkar of the San Francisco Regional Office and Jonathan Warner of the Market Abuse Unit, with assistance from John Rymas, Hugh Beck, and Darren Boerner of the Market Abuse Unit’s Analysis and Detection Center and Rachita Gullapalli and Erin Smith of the SEC’s Division of Economic and Risk Analysis. The case was supervised by Jennifer J. Lee and Monique C. Winkler of the San Francisco Regional Office, and Steven Buchholz and Mr. Sansone of the Market Abuse Unit. The litigation will be led by Marc Katz, Mr. Kolhatkar, and Mr. Warner.

Erin E. Schneider, Director of the SEC’s San Francisco Regional Office:

“We allege that a Netflix employee and his close associates engaged in a long-running, multimillion dollar scheme to profit from valuable, misappropriated company information. The charges announced today hold each of the participants accountable for their roles in the scheme.”

Joseph Sansone, Chief of the SEC’s Market Abuse Unit:

“The defendants allegedly tried to evade detection by using encrypted messaging applications and paying cash kickbacks. This case reflects our continued use of sophisticated analytical tools to detect, unravel and halt pernicious insider trading schemes that involve multiple tippers, traders, and market events.”

Related:

- Hong Kong SFC & ICAC Arrests Former Senior Executive of Listed Company for Suspicious Loan Activities

- China Sentenced Former Head of ICBC Shanghai to Lifetime Imprisonment for Receiving $21 Million in Bribes

- China Crackdown Intensify, Changes to Tech Companies & Education Sector to Non-Profit with Share Prices Dropping 40% to 80%

- China Regulators Fine Tech Giants Alibaba, Tencent, Kuaishou, Weibo, Little Red Book for Content with Soft Pornography Involving Minor

- Hong Kong Exchange Setup China Advisory Group, Ex-Goldman Sachs China Chairman, Hillhouse Group, PAG Group

- Didi App Download Suspended in China, Faces Lawsuit for Misleading Investor

- China Increased Scrutiny on Foreign IPOs & Tech Giants, Requires Pre-Approval for Offshore IPOs

- Donald Trump Files Class Action Lawsuits Against Tech Giants and CEOs of Facebook, Twitter and Google

- China Regulator Issues Warning on Stock Market Manipulation, Crackdown on Bitcoin

- Alibaba First Quarterly Loss with $1.17 Billion Since IPO, Hit by Anti-Monopoly Fine of $2.78 Billion

- Alibaba Fined $2.78 Billion by China State Regulator for Anti-Monopoly Practices

- Ant Group $300 Billion Record IPO Suspended in both Shanghai and Hong Kong Exchange

- 150 Stocks Suspended Trading on Hong Kong Stock Exchange for Missing Filing Deadline

- Hong Kong SFC: Police Arrested 12 People Suspected of Ramp & Dump Manipulation Schemes

- Hong Kong SFC Issues Restriction Notices to 13 Brokers for 54 Accounts Related to Social Media Scam

- Hong Kong & Singapore Regulators Warn Investors of Increased Trading Risks Triggered by Social Media & Online Forums

- Hong Kong SFC Warns of Investment Scams on Social Media Platforms

- Singapore Exchange Issues Alert on Stocks Trading Scam in Chat Groups

Fines:

- Nomura, UBS and Unicredit Fined $451 Million for Rigging European Bond Prices

- United States SEC Gives Record $114 million to a Single Whistleblower

- Ant Group $300 Billion Record IPO Suspended in both Shanghai and Hong Kong Exchange

- United States SEC Fines Under Armour $9 Million for Misleading Investors on Revenue Growth in 2015

- Alibaba Fined $2.78 Billion by China State Regulator for Anti-Monopoly Practices

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit